From what are flexi-cap mutual funds to why should one opt for it, a complete guide

Flexi-cap mutual funds unlike other equity funds have specific mandates (e.g., large-cap funds invest predominantly in large-cap stocks), flexi-cap funds have no fixed allocation requirements. They can invest dynamically based on market conditions and the fund manager's discretion.

)

Flexi-cap mutual funds are popular today as they allow fund managers to invest across market capitalisations (large-cap, mid-cap, and small-cap) based on market conditions and the fund's investment strategy. Let's deep dive into the mechanism of this investment option in the mutual fund space.

How do Flexi-cap mutual funds work?

Flexi-cap mutual funds unlike other equity funds have specific mandates (e.g., large-cap funds invest predominantly in large-cap stocks), flexi-cap funds have no fixed allocation requirements. They can invest dynamically based on market conditions and the fund manager's discretion.

Should investors opt for flexi-cap mutual funds?

As per a report by Trust Mutual Fund, following are the reasons one can opt for flexi-cap mutual funds:

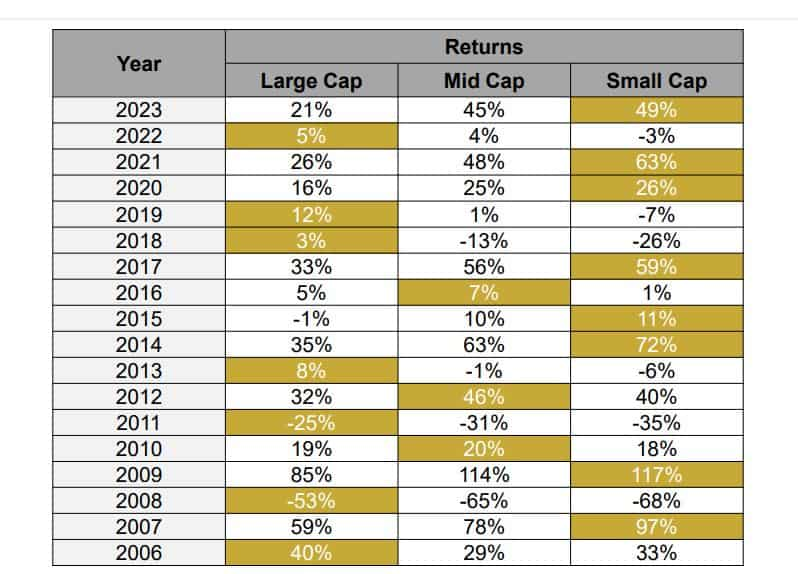

1. Market cap leadership fluctuates every year

Source: ICRA MFI, Bloomberg, Internal Calculation Data as on 31st Dec 2023. Analysis based on calendar year returns of Nifty 100 TRI (for Large Cap), Nifty Mid Cap 150 TRI (for Mid Cap), Nifty Small Cap 250 TRI (Small Cap). Returns are absolute. Past Performance of any segment may or may not be sustained in future.

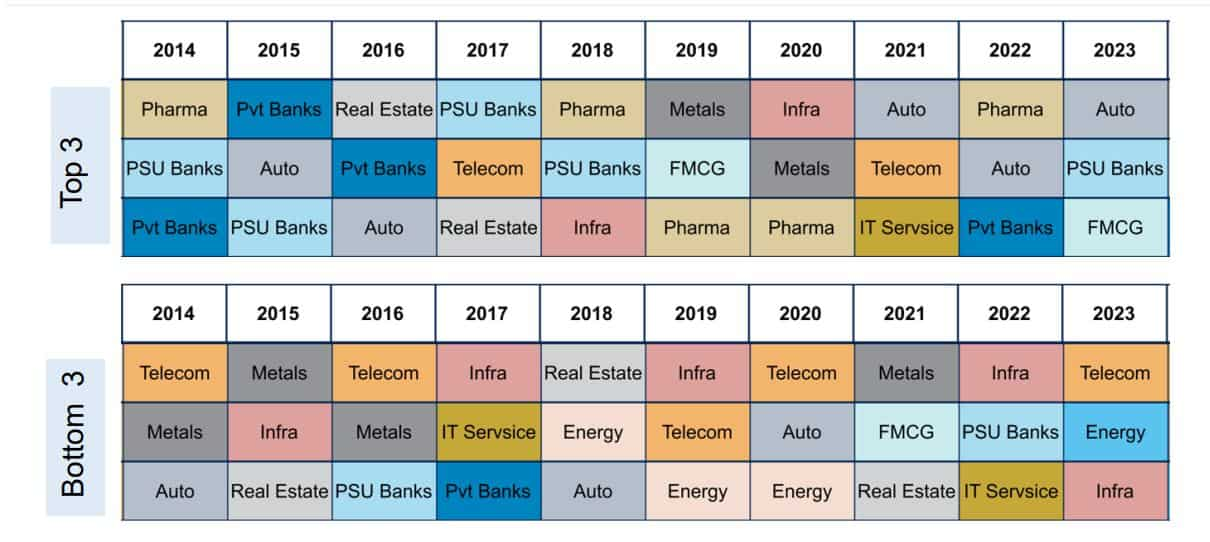

2. Best-performing sectors keep changing

Source: ICRA MFI, Internal Calculation Data as on 31st Dec 2023. Analysis based on calendar year returns of respective indices Returns are absolute. Indices are represented by sectors. For eg: NIFTY Pharma TRI represents Pharma sector. Past Performance of any sector may or may not be sustained in future.

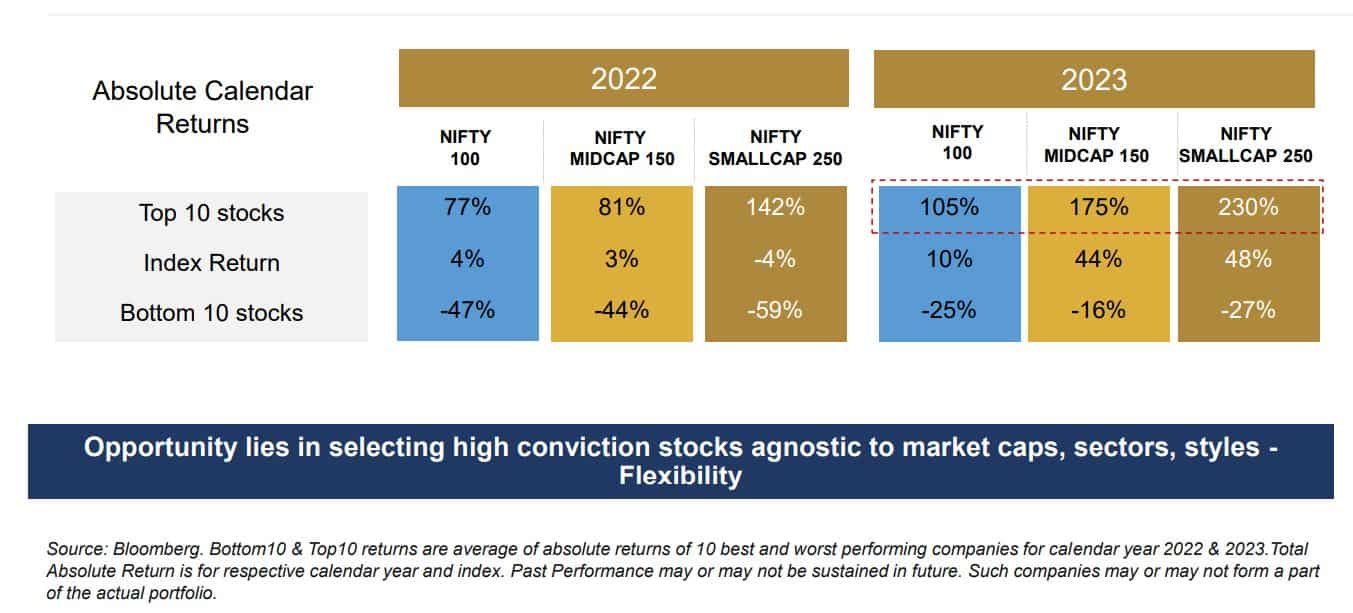

3. Stock picking makes all the difference

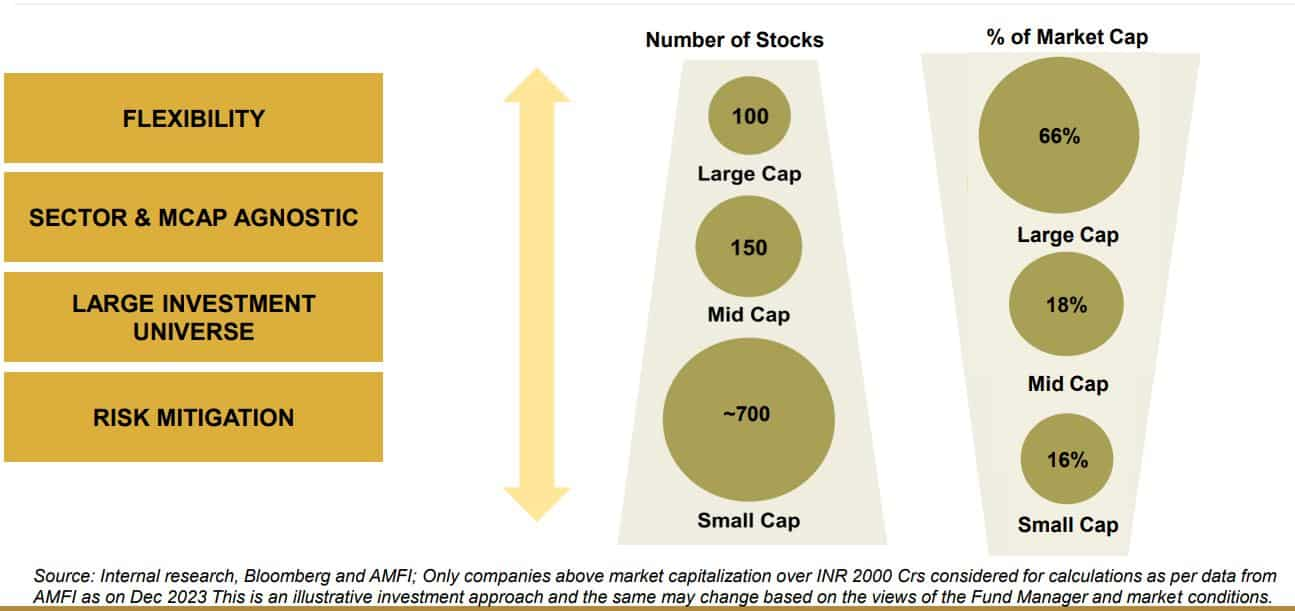

4. It is an all-rounder fund

Risks in Flexi-cap mutual funds

>> Flexi-cap funds are exposed to market risk, meaning the value of investments can fluctuate due to changes in stock prices, economic conditions, and other external factors.

>>Concentration of investments in specific sectors can expose the fund to sectoral risks.

>> Investments in mid-cap and small-cap stocks may pose liquidity risk, especially during volatile market conditions, impacting the fund's ability to buy or sell securities at desired prices.

>> Changes in interest rates can affect the performance of debt securities held by flexi-cap funds, impacting overall returns.

Some things to know about Flexi-cap Mutual Funds:

>>Flexi cap funds provide diversification by investing in stocks from various sectors and market segments.

>> They provide flexibility in choosing investments across market capitalisations.

>>Fund managers actively manage flexi cap funds by making investment decisions based on their assessment of market trends, company fundamentals, and economic outlook. This active management aims to generate superior returns compared to passively managed funds.

>> Flexi cap funds typically have a higher risk-return profile compared to large-cap funds due to their exposure to mid-cap and small-cap stocks.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:59 PM IST

Top flexi-cap SIP mutual funds with up to 40% annual returns: Rs 20,000 monthly SIP in No. 1 fund has turned into Rs 37.67 lakh in 5 years

Top flexi-cap SIP mutual funds with up to 40% annual returns: Rs 20,000 monthly SIP in No. 1 fund has turned into Rs 37.67 lakh in 5 years Your Rs 1 lakh investment would have grown up to Rs 10.80 lakh in these 7 mutual funds in 10 years

Your Rs 1 lakh investment would have grown up to Rs 10.80 lakh in these 7 mutual funds in 10 years