Fixed Depsit Interest Rate: Check latest FD rates of HDFC Bank, SBI, Kotak Mahindra Bank, PNB, ICICI Bank, BoB, IOB, Ujjivan

Fixed Deposit Interest Rate: After the RBI repo rate hike of 50 bps, several public and private banks have increased interest rates on their fixed deposits. Among the top private sectors banks, HDFC Bank, ICICI Bank and and Kotak Mahindra have hiked their term deposit rates. SBI, PNB, BoB are among public lenders

Fixed Deposit Interest Rate: After the Reserve Bank of India’s (RBI) repo rate hike of 50 bps, several public and private banks have increased interest rates on their fixed deposits. Among the private sectors banks, HDFC Bank Limited has increased the rates. While among the public sector banks, state lender State Bank of India (SBI) and Punjab National Bank (PNB).

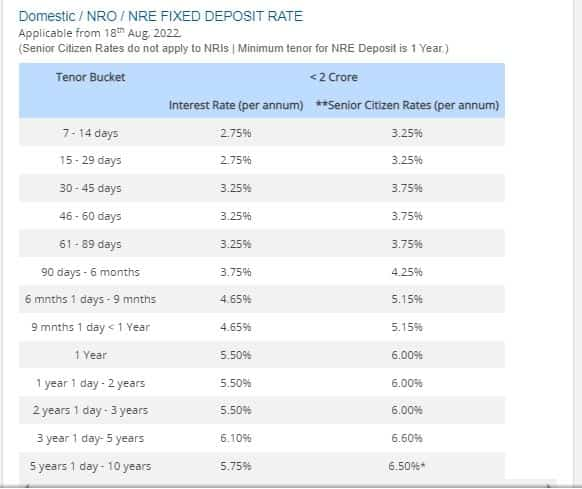

HDFC Bank FD (Fixed Deposit) Rate

As per the information available on the HDFC Bank website, the largest private lender has increased bank fixed deposit rate for all term deposits less than Rs 2 cr. HDFC Bank’s new interest rates come into effect from today, 18 August. The bank has said that the interest rates for fixed deposits have been increased by a maximum amount of 40 bps. The bank is offering fixed deposits for terms spanning from 7 days to 10 years and the customers earn an interest between Rs 2.75 to 6.10 per cent. Senior citizens get a 50 bps higher interest rate.

See Image:

Source: HDFC Bank Website

Source: HDFC Bank Website

SBI:

State Bank of India increased its deposit rate by 15 basis points on deposit maturing between 180 days and 210 days from 4.40 per cent to 4.55 per cent an IANS report said quoting data compiled by CareEdge.

For all other tenures, the SBI FD interest rates have also been hiked by 15 basis points. Bulk deposit rates have been increased by 25-50 basis points for period up to one year. For more than one year, the rates have been hiked by rates ranging from 75-125 basis points, the report further said.

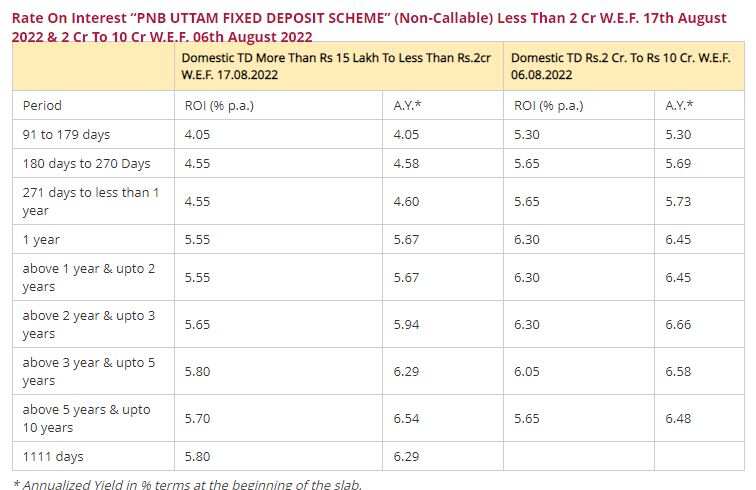

PNB FD Rates

India’s second largest public lender has also increased interest rates on fixed deposits less than Rs 2 cr. As per the information available on the PNB website, the new rates have come into effect from 17 August. The bank is offering term deposits from 7 days to 10 years where customers can earn between 3 per cent to 5.75 per cent interest. Meanwhile, senior citizens get a 0.5 per cent higher interest rate.

- Bank of Baroda launches special deposit schemes offering higher interest rates up to 6%

Bank of Baroda has launched a new deposit scheme offering interest rates of up to 6 per cent on domestic retail term deposits.

The 'Baroda Tiranga Deposit Scheme' marks the 75th Independence Day of India, which is a special term deposit scheme offering higher interest rates, the bank said in a release on Tuesday.

The scheme, to be available till December 31, 2022, has two tenor buckets of 444 days and 555 days, offering interest rates of 5.75 per cent per annum and 6 per cent per annum, respectively.

The scheme was launched on Tuesday and is applicable on retail deposits below Rs 2 crore, the bank said.

Senior citizens will get additional interest rates on their deposits under the scheme. (PTI)

- Indian Overseas Bank increased deposit rates by 10 basis points for 444 days and 3 years and above periods for the retail term deposits.

- Indian Bank has also hiked its deposit rates 5-15 basis points.

- ICICI Bank increased interest rates on fixed deposits from Rs 2 crore to Rs 5 crore in August.

- Kotak Mahindra Bank has also increased rates by 15 basis points for select tenures for deposits up to Rs 2 crore in August, CareEdge data showed.

Ujjivan Small Fin Bank raises interest rate on fixed deposits by up to 1.5%

Ujjivan Small Finance Bank has raised interest rate on fixed deposits by up to 1.5 per cent. The new rates have come into effect from August 9, 2022.

The bank said that on the occasion of the 75th year of India's Independence, it has increased the rate on fixed deposits by 30-150 basis points (or 0.3-1.50 per cent) across different tenures.

Introducing tenures of 75 weeks (525 days) and 75 months, Ujjivan SFB said both carry the highest rate of 7.5 per cent per annum.

For an individual, investing Rs 1 lakh for 75 weeks at 7.5 per cent can earn returns up to Rs 1,11,282 at maturity. Likewise, senior citizens for Rs 1 lakh for 75 weeks at 8.25 per cent can earn returns up to Rs 1,12,466 at maturity.

The 990 days tenure too carries the same interest rate, up from 7.20 per cent earlier.

The additional rate for senior citizens is now revised to 0.75 per cent from 0.50 per cent, the bank said.

The new rates are applicable on deposits below Rs 2 crore.

The lender said it will offer monthly, quarterly and at maturity interest pay-out options.

Ujjivan SFB said these new rates are also applicable on tax saver fixed deposits carrying a lock-in period of five years.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

Retirement Planning: Investment Rs 20 lakh, retirement corpus goal Rs 3.40 crore; know how you can achieve it

06:42 PM IST

SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD

SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD SBI FD vs HDFC Bank FD vs ICICI Bank 1-year FD Calculator: What will you get on maturity if you invest Rs 5 lakh in each guaranteed return scheme

SBI FD vs HDFC Bank FD vs ICICI Bank 1-year FD Calculator: What will you get on maturity if you invest Rs 5 lakh in each guaranteed return scheme  Latest FD Interest Rates: SBI, PNB, Canara Bank, HDFC Bank, and ICICI Bank are offering these rates in their popular fixed deposit schemes

Latest FD Interest Rates: SBI, PNB, Canara Bank, HDFC Bank, and ICICI Bank are offering these rates in their popular fixed deposit schemes Post Office FD Interest Rate: See how Rs 1,50,000 investment grows in 1-year, 2-year, 3-year, 5-year deposits (with examples)

Post Office FD Interest Rate: See how Rs 1,50,000 investment grows in 1-year, 2-year, 3-year, 5-year deposits (with examples) Comparing SBI’s 'Amrit Vrishti Scheme' with other bank FDs offering similar interest in fewer days

Comparing SBI’s 'Amrit Vrishti Scheme' with other bank FDs offering similar interest in fewer days