Explained: Income Tax slabs, benefits for Senior Citizen, Super Senior Citizens

Income Tax: A senior citizen is an individual who is 60 years old but below 80 years while a Super Senior Citizen is those aged above 80.

Income Tax is to be paid by every person who earns more than the exempted limit. Income-tax is levied on the annual income of a person. The year under the Income-tax law is the period starting from 1st April and ending on 31st March of the next calendar year. There are different tax slabs for people with different income and different ages. While those earning higher will have to pay high taxes, those who classify as a senior citizen or super senior citizen have been provided with various tax benefits by the income tax department.

Who are Senior and Super Senior Citizens?

A senior citizen is an individual who is 60 years old but below 80 years while a Super Senior Citizen is those aged above 80.

What is the current tax slab for Senior and Super Senior Citizens?

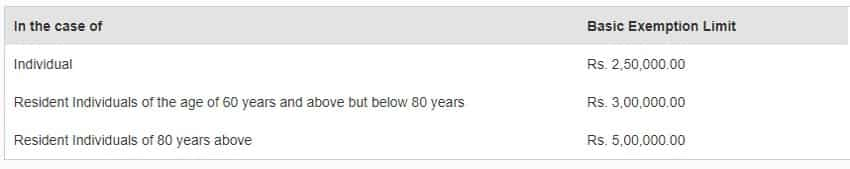

Before the current tax slab, you should know the exemption limit for the Senior and Super Senior Citizens, which is:

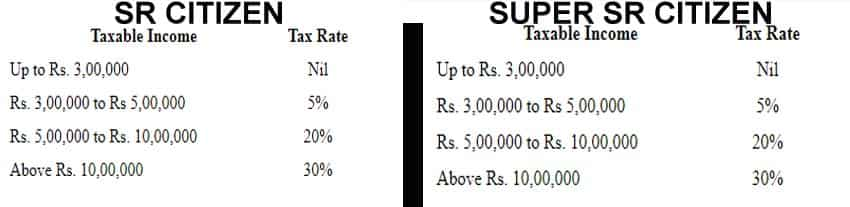

Below are the current tax slabs:

Benefits for the Senior citizen:

A senior citizen is granted a higher exemption limit compared to non-senior citizens. The exemption limit for the financial year 2019-20 available to a resident senior citizen is Rs. 3,00,000. The exemption limit for non-senior citizen is Rs. 2,50,000. Thus, it can be observed that an additional benefit of Rs. 50,000 in the form of higher exemption limit is available to a resident senior citizen as compared to normal tax payers.

Benefits for the Super Senior citizen:

A very senior citizen is granted a higher exemption limit compared to others. The exemption limit for the financial year 2019-20 available to a resident very senior citizen is Rs. 5,00,000. The exemption limit for non-senior citizen is Rs. 2,50,000. Thus, it can be observed that an additional benefit of Rs. 2,50,000 in the form of higher exemption limit is available to a resident very senior citizen as compared to normal tax payers.

As per section 208, every person whose estimated tax liability for the year is Rs. 10,000 or more, shall pay his tax in advance, in the form of "advance tax". However, section 207 gives relief from payment of advance tax to a resident senior citizen. As per section 207 a resident senior citizen (i.e., an individual of the age of 60 years or above during the relevant financial year) not having any income from business or profession, is not liable to pay advance tax.

What are the benefits available in respect of interest on deposits in case of senior citizens?

Section 80TTB of the Income Tax law gives provisions relating to tax benefits available on account of interest income from deposits with banks or post office or co-operative banks of an amount up to Rs. 50,000 earned by the senior citizen (i.e., an individual of the age of 60 years or above). Interest earned on saving deposits and fixed deposit, both shall be eligible for deduction under this provision.

Watch This Zee Business Video

Section 194A of the Income Tax law gives corresponding provisions that no tax shall be deducted at source from payment of interest to a senior citizen up to Rs. 50,000.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

06:46 PM IST

Baijayant Panda to chair Select Committee on Income-Tax Bill

Baijayant Panda to chair Select Committee on Income-Tax Bill Income Tax department activates section wise mapping of I-T Act, Tax bill

Income Tax department activates section wise mapping of I-T Act, Tax bill  New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers

New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers Budget 2025: Middle class is like a hen that lays golden eggs, Centre doesn't keep it happy, says AAP's Raghav Chadha

Budget 2025: Middle class is like a hen that lays golden eggs, Centre doesn't keep it happy, says AAP's Raghav Chadha New Income Tax Bill set to be tabled in Parliament next week

New Income Tax Bill set to be tabled in Parliament next week