EPFO good news! You can still contribute to your EPF account, if you are heading to a job abroad

EPFO is authorized to issue COC to the employees posted in other countries who have signed the agreement with government.

The Employees' Provident Fund Organisation (EPFO) recently made an announcement for Indian citizens who are working in a foreign country over the issue of how to claim Certificate of Coverage (COC). For the benefit of both the employers and employees, the EPFO has signed an agreement with a host of countries to ensure that the employees of home country do not remit contribution in overseas country. But instead, they can enjoy the benefit of totalisation period such as for deciding the eligibility of pension, or get pension in the way they choose. Employers are also saved from the trouble of making double security contributions for the same set of employees. That said, EPFO is authorized to issue COC to the employees posted in other countries who have signed the agreement with Indian government.

What is COC?

Generally, when an employee decides to work for an employer they are required to make a contribution in the social security scheme of that country where they are working. The social security scheme also can be referred as exactly how an Indian employee has to contribute to EPFO’s employees provident fund (EPF) account. However, if an employee is working for short term in a foreign country, they can be eligible for reaping the benefits of EPF.

This simply means that, an employee will have to opt for claim exemption from a foreign country’s social security, as long as that employee is making contribution to their home social security system in this case EPF. Such option can be chosen by getting a COC from EPFO.

For example, if you are an Indian employee and have been assigned to work on an assignment in let’s say Netherlands. Then you can obtain a COC in India, by agreeing to contribute to home country’s EPF and exempting yourself from Netherland’s social security.

That said, a COC here is most likely referred as detachment certificate, where you are an outbound mobile worker who is posted by their respective employer for working in another country on a specified, short, limited, temporary duration. Hence, you have the liberty to not chose for contributing in the foreign country, but instead enjoy the EPF benefit in home country.

EPFO via its Twitter account on Monday said, “Service for online generation of Certificate of Coverage (CoC) has been introduced for the outgoing Indian International Worker.”

Service for online generation of Certificate of Coverage (CoC) has been introduced for the outgoing Indian International Worker.

Link: https://t.co/QMjT1Rtcgc…/International_workers.php#EPFO #HumHainNa pic.twitter.com/WhrSsoycsk

— EPFO (@socialepfo) June 17, 2019

The regulator also notified that, claims of the international workers are being settled on the last day of their work in India.

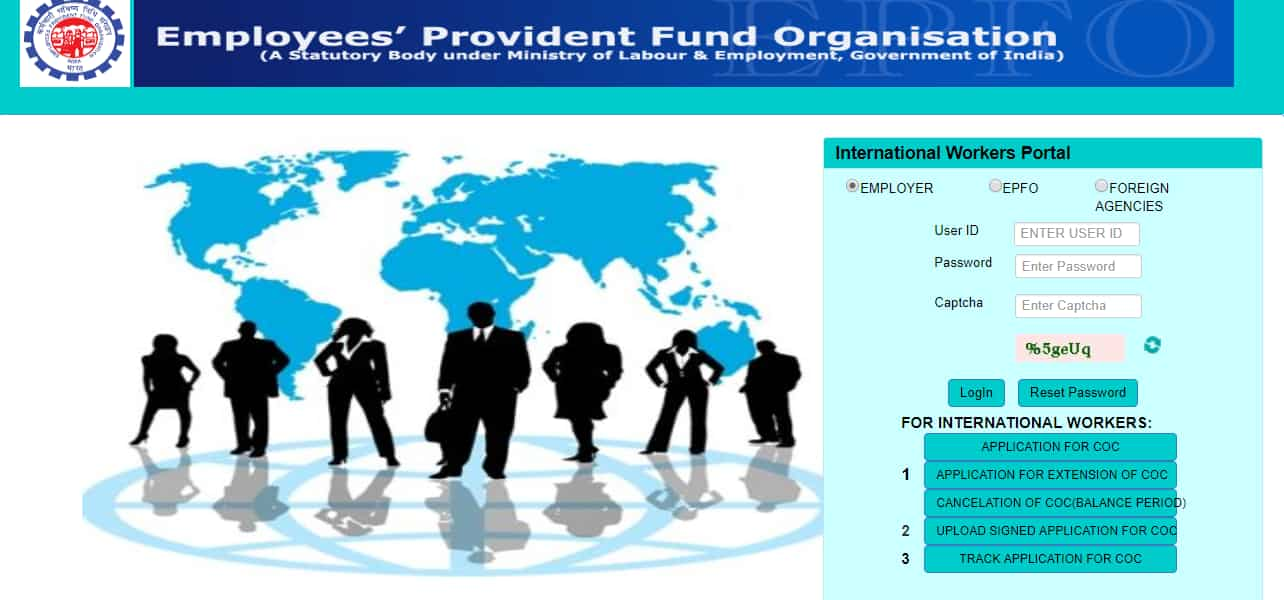

For online generation of COC, you must visit this website - https://iwu.epfindia.gov.in/iwu/

Once visited the page, options such as application for COC, application for extension of COC, cancellation of COC, upload signed application for COC and track application for COC will be given. Select the options as per your requirement. For taking the procedure ahead, take note, you will have to provide in your UAN number.

EPFO has agreement with foreign countries such as Belgium, Germany, Switzerland, Grand Duchy of Luxembourg, France, Denmark, Republic of Korea, Netherlands, Hungary, Finland, Sweden, Czech Republic, Norway, Austria, Canada, Australia, Japan and Portugal.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:14 PM IST

Can I become an EPFO member with a basic salary of Rs 10,000?

Can I become an EPFO member with a basic salary of Rs 10,000? How to check PF balance: A step-by-step guide

How to check PF balance: A step-by-step guide Nominee not mentioned? Here's how to withdraw EPF money after member's death

Nominee not mentioned? Here's how to withdraw EPF money after member's death EPF account: What happens to PF account if you don’t transfer it while switching jobs?

EPF account: What happens to PF account if you don’t transfer it while switching jobs? Employees' Pension Scheme (EPS): Two more days to opt for higher pension

Employees' Pension Scheme (EPS): Two more days to opt for higher pension