Borrowers Alert! You can save big on your home loan EMIs; this is what SBI's Balance Transfer offers you

SBI balance transfer home loan service allows you to transfer your loan from other banks to enjoy low interest rates, zero processing fees and major tenure at this lender.

The State Bank of India (SBI) has been introducing various benefits to its customers in regards to their loans especially home loans. In almost every individuals checklist of dreams, one most likely includes a house of their own.Having a home loan is better because it comes with long tenures exceeding even 10 years. This allows you to make a proper plan for your repayment of debt in an appropriate manner. But did you know this largest lender SBI allows you to save big on your home loans and hence your monthly EMIs. Yes its quite true, there is an SBI balance transfer of home loan service offered by the bank where you can transfer your loan from other banks to enjoy low interest rates, zero processing fees and major tenure at this lender.

SBI offers Balance Transfer of home loan that enables a customer to transfer home loan from Scheduled Commercial Banks (SCBs), Private and Foreign Banks, Housing Finance Companies (HFCs) registered with National Housing Bank (NHB) and Borrower’s employers if they are Central/State Govt or their undertakings or Public Sector Undertaking.

This is subject to condition that the borrower should satisfy the eligibility criteria for availing Home Loan as per the Bank's instruction and has serviced interest and/or installment of the existing loan regularly, as per the original terms of sanction.

The borrower should have valid documents evidencing the title to the house/flat.

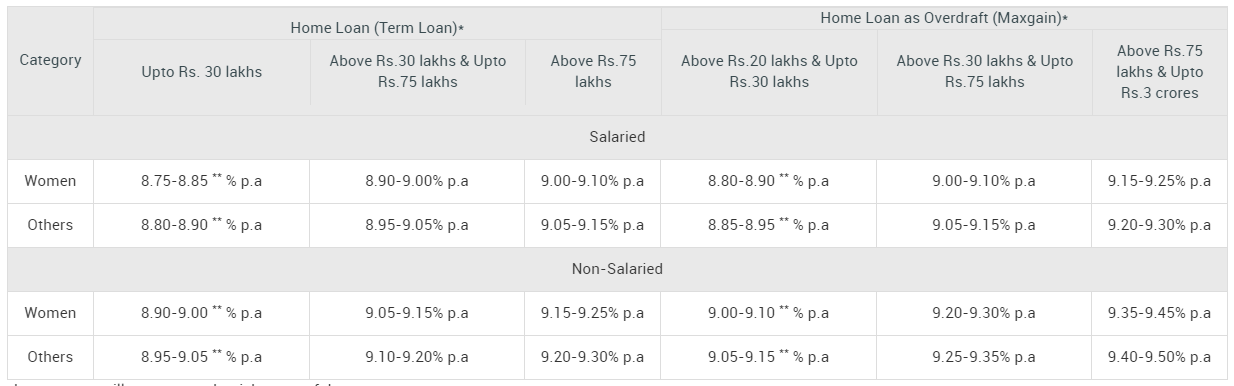

Interest rates offered by SBI to government employees are mentioned below:

Features of SBI Privilege Home loans are:

- Low Interest Rates

- Zero Processing Fee

- No Hidden Charges

- No Pre Payment Penalty

- Interest charges on Daily Reducing Balance

- Repayment up to 30 years

- Interest Concession for Women Borrowers

- Interest Concession in case Check Off is provided

Eligibility:

Resident Type: Resident Indian

Minimum Age: 18 years

Maximum Age: 75 years

Loan Tenure: up to 30 years.

Home loans are given depending upon your age, your salary status, your capability of repayment and background checks of previous loans. If your credit score is very good then getting an home loan is very easy as your bank is assured that you are trustworthy and capable enough to repay your debt.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

IPL Auction 2025 Free Live Streaming: When and where to watch Indian Premier League 2025 mega auction live online, on TV, Mobile Apps, and Laptop?

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

09:07 AM IST

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate  SBI shares in green post Q2 results: most global brokerages raise target price

SBI shares in green post Q2 results: most global brokerages raise target price  SBI Q2 Results: PSU bank's net profit jumps 28% to Rs 18,331 crore, beats Street estimates

SBI Q2 Results: PSU bank's net profit jumps 28% to Rs 18,331 crore, beats Street estimates  Hidden charges on SBI ATM cards: Is your money disappearing quietly?

Hidden charges on SBI ATM cards: Is your money disappearing quietly?