Best mutual funds to invest: Top 10 MF schemes that can save tax for you too!

Best Mutual funds: Equity-Linked Savings Scheme or ELSS are a type of open-ended equity mutual fund.

Best Mutual funds: Equity-Linked Savings Scheme or ELSS is a type of open-ended equity mutual fund. ELSS invests in equity and equity-related securities of companies. What makes an investment in ELSS mutual funds the most attractive is that they are eligible for income tax benefits under Section 80C of the Income Tax Act - apart from growing your money and giving you some of the best returns possible on your investment. In ELSS mutual fund investment, one can claim tax exemption on up to Rs 1.5 lakh annual investments.

However, these mutual funds come with a lock-in period of three years, which means that until that time is over, investors cannot redeem their fund units. Apart from that, an investor who has invested in the ELSS mutual fund will have to pay Long Term Capital Gain (LTCG) Tax at the time of withdrawal of the amount on maturity. However, three years is less than the lock-in duration of many other investment options. You can invest in ELSS via lump sum or SIP mode.

See Zee Business Live TV streaming below:

Speaking on the purpose of investing in ELSS Mutual Funds Harsh Jain, COO & Co-founder at Groww said, "ELSS mutual funds are a smart way to save a significant amount of money that would otherwise go towards taxes. However, ELSS funds being purely equity funds, are dependent on market timings and hence market risks. The risks, therefore, are more than that of PPF and FD, however, potential returns are higher as well."

Elaborating upon the income tax advantages that an ELSS mutual fund investor can avail, Jain said, "For most investors, ELSS investments are a tool to save taxes. ELSS mutual funds help investors to save taxes through tax deductions, tax exemptions, and benefit of indexation. The 1.5 lakh rupees that one invests can be deducted from the taxable income, and returns under Rs 1 lakh are exempted from taxation. This ELSS enables investors to save taxes and build wealth in the process."

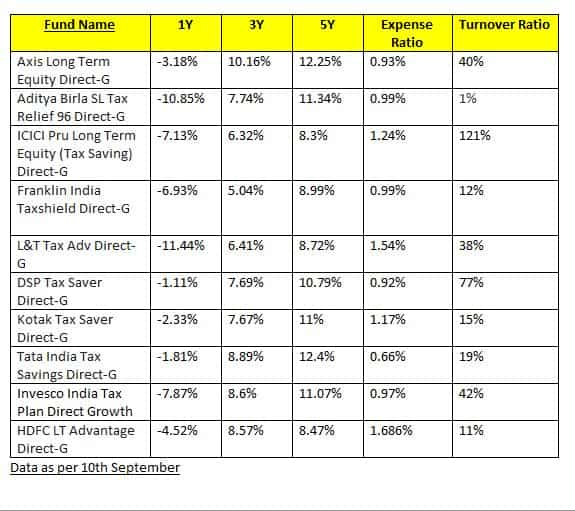

Asked about the top ten ELSS mutual funds that are best mutual funds in the equity mutual fund category, Harsh Jain of Groww said, "Here are some ELSS mutual funds with moderate risk factor involved, which an investor can think of investing." He revealed these names:

1. Axis Long Term Equity Direct-G

2. Aditya Birla SL Tax Relief 96 Direct-G

3. ICICI Pru Long Term Equity (Tax Saving) Direct-G

4. Franklin India Taxshield Direct-G

5. L&T Tax Adv Direct-G, DSP Tax Saver Direct-G

6. Kotak Tax Saver Direct-G

7. Tata India Tax Savings Direct-G

8. Invesco India Tax Plan Direct Growth

9. HDFC LT Advantage Direct-G

10. DSP Tax Saver Direct-G

He said that these funds are expected to outperform other ELSS mutual funds in long-term perspective.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

'Bengaluru, absolute traffic hell...: City's congestion worsens as HSR Layout flyover shuts for metro work, netizens irked

Gratuity Calculation: What will be your gratuity on Rs 40,000 last-drawn basic salary and 5.2 years of service?

8th Pay Commission: Can basic pension cross Rs 3 lakh mark in new pay commission? See calculations to know its possibility?

SBI 444-day FD vs Central Bank of India 444-day FD: Which can provide higher maturity on Rs 5,00,000, Rs 7,00,000 & Rs 10,00,000 deposits?

UPS vs NPS vs OPS: Last drawn basic pay Rs 100,000; pensionable service of 30 years; what can be your monthly pension in each?

03:54 PM IST

Sebi mulls combo product of term life insurance and MFs for investors

Sebi mulls combo product of term life insurance and MFs for investors Mutual fund industry wishlistt from Budget 2025: From reduced taxes on debt funds to higher incentives for ELSS

Mutual fund industry wishlistt from Budget 2025: From reduced taxes on debt funds to higher incentives for ELSS Sebi asks mutual funds to disclose information ratio of schemes

Sebi asks mutual funds to disclose information ratio of schemes HDFC Securities surpasses Rs 25,000-crore in AUM for mutual funds

HDFC Securities surpasses Rs 25,000-crore in AUM for mutual funds Mutual Funds, AUM falls marginally in November after 21 months of rising trend

Mutual Funds, AUM falls marginally in November after 21 months of rising trend