Bank Savings Account vs Liquid mutual funds: Which one is better for you and why? Check what experts say

Bank Savings Account vs Liquid mutual funds: Liquid mutual funds give 5.5 per cent to 6.5 per cent returns while bank deposits give 3.5 per cent to 6.0 per cent return.

Bank Savings Account vs Liquid mutual funds: Those investors who have lower risk appetite generally hesitate to invest in mutual funds. However, they should not do that as, for them, liquid mutual funds can be a great option as they will help get returns in excess of what bank savings accounts and bank deposits offer. According to the tax and investment experts, liquid mutual funds have very little risk involved and give higher returns than bank deposits.

Speaking on bank deposits versus liquid mutual funds, Nikhil Kothari, CFP at Atika Wealth Advisors said, "Liquid mutual funds have all that luxury that a bank deposit gives. Your money invested in the liquid funds will remain liquid and one can fish out your money from the liquid fund at any time. It gives higher returns than the bank deposit also and liquid funds involve very lower risk."

Kothari said that liquid funds' asset managers invest in short-term credit papers, commercial papers, treasury bills and government bonds. In liquid funds, one can have a short-term maturity of up to 91 days.

On how much return one can get from the liquid funds, Khosla said, "In bank deposits, one can expect returns from 3.5 per cent to 6 per cent while in liquid funds, one can get 5.5 per cent to 6.5 per cent. Some of the liquid funds allow money withdrawal on Saturday and Sunday as well. If the investor is using a mobile app, he or she can withdraw up to Rs 50,000 on Saturday or Sunday." He said that one can invest the insurance or bonus money into liquid funds rather than keeping it with banks.

On income tax liability in bank deposits and liquid funds, Khosla said, "In bank deposits, one has to pay income tax if the interest earned is more than Rs 10,000 while in liquid funds, interest earned up to three years are income tax exempted. After three years, one has to pay Long Term Capital Gain (LTCG) tax on earnings in liquid funds. So, it also makes better for an investor to invest in liquid funds than investing in bank deposits."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

09:45 AM IST

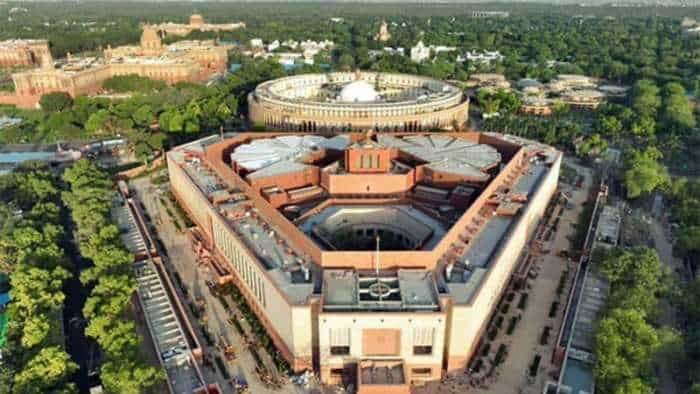

Decline in bank deposits is also because of non-uniform tax treatment on various investment options: SBI

Decline in bank deposits is also because of non-uniform tax treatment on various investment options: SBI Will banks be forced to sharply hike their deposit rates in coming months? Icra Ratings report says this

Will banks be forced to sharply hike their deposit rates in coming months? Icra Ratings report says this Bank deposits rise 12 pc in FY21 on higher CASA growth: RBI data

Bank deposits rise 12 pc in FY21 on higher CASA growth: RBI data Bank Fixed Deposits vs RD vs other deposits! Know these income tax rules that may take away your money

Bank Fixed Deposits vs RD vs other deposits! Know these income tax rules that may take away your money Rich Money Tips! Top 3 ways to become a millionaire with little investment

Rich Money Tips! Top 3 ways to become a millionaire with little investment