Answers to become a crorepati; all you need is Rs 1000 a month, earn Rs 2 crore by this scheme

There is a saying with higher risk comes higher returns and this is surely a true fact when it comes to having an appetite for equities. But not all have massive funds, and not all are capable of taking heavy risk.

We always want to make best of everything. And what would be better if by a little investment we can make sufficient money to last a lifetime that keeps us immersed in a luxurious lifestyle well into old age. However, investment is all about time, discipline, patience and sometimes, luck. But the main job is to find out how much should we invest and in what option. The Indian economy is vast and there are numerous pools of investments, which can confuse the investor about what is the best option for you.

There is a saying with higher risk comes higher returns and this is surely a true fact when it comes to having an appetite for equities. But not all have massive funds, and not all are capable of taking heavy risk.

For these people, Systematic Investment Plan (SIP) comes as best pick. The best way to describe this investment mechanism is - little drops of water make the ocean. SIP is the most basic, flexible and easy way of earning big money for your hard-earned investment.

Mutual Fund SIP is at currently at a booming stage, and is seen as the most convenient, hassle-free and smartest way of investment. One can invest a certain amount in SIP at regular intervals namely weekly, monthly or quarterly.

SIP is an easy step and also ensures discipline in your savings. All you have to do is open an SIP account with a financial institution, and link it with your bank account. Depending upon your investment strategy, money will automatically get deducted from your bank account on weekly, monthly or quarterly basis.

Pros of investing in SIP involves:

The pressure is not on you for speculating or focus on timing the market - such is not the right way for generating returns over long term.

Considering there are intervals of investment like weekly, monthly or quarterly, you tend feel very little impact of market volatility.

It is highly disciplined, passive and automated. Funds get deducted automatically from bank, which makes you more committed to guaranteed saving/investment.

Hassle-free and flexible. Any citizen can create/update/cancel SIP anytime.

Investment amount in SIP starts to as low as Rs 500 per month, which eliminates the burden of managing your overall expenses on monthly basis, as very little is deducted.

There are two methods which greatly help investors earn big through SIPs.

Firstly is rupee-cost averaging. As we are aware that market is sentiment driven and unpredictable, this creates an issue on when is the best time for investment. With rupee-cost averaging, an investor with its invested SIP amount earns more units when the price is low and earns less units when the price is high.

Second would be power of compounding. Every amount you invest, you earn interest on it. This interests get compounded and accumulated over a period of time. The higher the SIP tenure the higher would be your return.

That said, if you are planning to reap benefits of SIP, then this is what you should know.

It is being known that, an SIP invested in large caps, mid caps, small caps, Focused Fund, Multi Cap Funds, ELSS and Thematic/Sector Funds can give you returns ranging from 11% to a massive 27%.

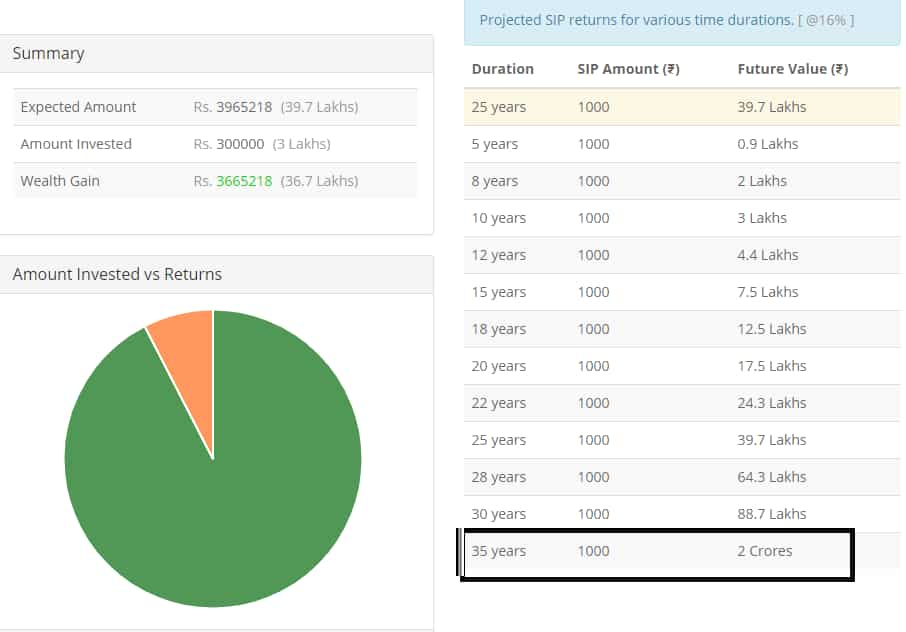

Let’s understand, how much do you earn if you invest Rs 1000 per month.

If you decide to invest about Rs 1000 per month at a projected interest rate 16% then you will gain more than Rs 2 crore in 35 years.

Your investment value would be about Rs 3 lakh for a period of 35 years, and your gains would be 2 crores over the amount invested in SIP.

Hence, SIP can turn your little investment into mammoth gains too. Anything can happen when it comes to market. Although being very volatile, markets are still better placed when it comes to make heavy money. It has always shown a growth every five years and touched new levels. Imagine what level it will be in next 35 years, that definitely would be breathtaking.

Recently, analysts at Karvy Broking Firm said, "We expect some nervousness in markets ahead of the elections. The results of the state elections next month will set the tone though we wouldn’t extrapolate the results to general elections as the Indian electorate can vote differently in state elections and general elections. We believe markets will welcome continuity in the form of a NDA (led by BJP) regaining power at the Centre."

However, Karvy added,"We forecast Sensex to reach 45,000 (14,000 for Nifty) by the end of 2019. If the BJP were to cross the halfway mark on its own, Sensex could reach about 47,000. A loss for NDA and formation of a coalition government which the market reads to be unstable could lead the Sensex to decline to 30,000 (Nifty 9,000) in the immediate aftermath of the elections."

Hence, your gains on investment in SIP is set to make you rich massively. Be wise, Be patient and Make most of Markets.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

Retirement Planning: Investment Rs 20 lakh, retirement corpus goal Rs 3.40 crore; know how you can achieve it

07:51 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples

Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples Unlocking the Power of SIP: From 15x15x15 to 15x5x3 Rule - 5 golden principles for long-term investment success

Unlocking the Power of SIP: From 15x15x15 to 15x5x3 Rule - 5 golden principles for long-term investment success Using 7-5-3-1 rule in mutual fund investment for enhanced wealth creation and improved resilience

Using 7-5-3-1 rule in mutual fund investment for enhanced wealth creation and improved resilience  Exclusive | Soon, SEBI to come up with a consultation paper on Rs 250 SIP

Exclusive | Soon, SEBI to come up with a consultation paper on Rs 250 SIP