Afraid of investing lump sum? Start STP now to earn returns from market

Liquid funds are short-term debt mutual funds where an investor has the option to park one's fund for few days or months and earn returns for the holding period as per market rates.

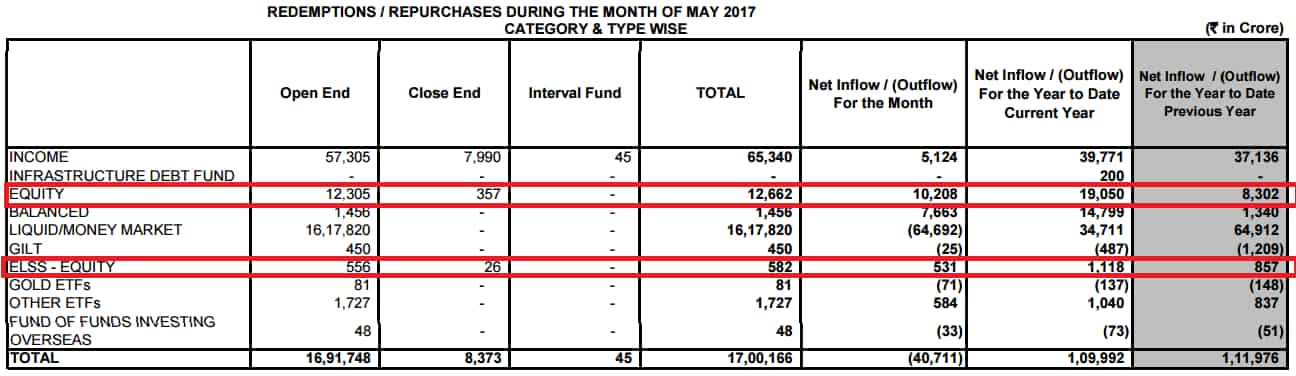

Inflows in Equity mutual funds, including equity linked mutual funds, has jumped to Rs 10,790 crore, nearly two years high in the month of May as against Rs 9429 crore in April, Association of Mutual Fund in India (Amfi) data showed.

As per the data, in June 2015, the inflows from equity funds were Rs 12,273 crore.  The credit for rising inflows goes to market performance. Domestic markets have been performing well post demonetisation period.

The credit for rising inflows goes to market performance. Domestic markets have been performing well post demonetisation period.

Considering, the market performance is subject to volitality, nobody can actually predict when will market fall.

Another fund, which is considered as the safest is Debt (liquid) funds. Liquid funds are short-term debt mutual funds where an investor has the option to park one's fund for few days or months and earn returns for the holding period as per market rates.

ALSO READ: Are liquid funds a good option as bank saving interest rates drop?

Liquid funds are invested in short-term money market instruments such as Government treasury bills, money markets, short term corporate deposits, commercial papers, etc. This makes them very liquid and safe. Moreover, there is no exit load applicable for such a fund.

Now if we compare the two, both are different in terms of giving returns. Anurag Garg of Nivesh.com said, "Liquid funds can never give equities like returns. Purpose of liquid funds is to provide better returns on short term surplus funds in a risk free manner. However, investors can looking to invest in debt funds for more than 3 years can look at corporate debt funds for better returns and tax efficiency compared to bank fixed deposits."

But, what if we say you invest in liquid fund and earn benefit from market volatility.

This could be possible with Systematic Transfer Plan.

What is STP?

Speaking with Zeebiz, Amol Joshi explains it.

Say you have Lumpsum amount to be invested. You intend to invest it in Equity funds. But you are not sure that you want to invest the entire capital at one go and at the same time do not want to miss the bus by not investing and if the markets were to go up. In such a scenario, you invest in Debt (liquid) funds. One can invest today and can redeem in few days or few weeks or any such tenure.

Once your lumpsum is deployed in liquid funds, you can choose to ‘Systematically Transfer’ of small amount in a weekly/monthly frequency.

For instance, Rs 10 lakhs lumpsum, invested in Liquid. Then you choose STP of Rs. 25,000/week from Liquid fund to chosen Equity fund.

Typically over next 40 weeks (~ 9-10 months), Rs. 10 Lakhs would be deployed in equity in systematic manner. In the interim period there is capital gain too in liquid fund, hence STP would ideally run for that much more amount.

ALSO READ: Got an appraisal already? Use that extra income to secure your future

"This systematic exposure / exposure in staggered manner is similar to what happens in Systematic Investment Plan (SIP) way of investing. Only difference being, in SIP cash flow itself is like - monthly salary, hence monthly SIP. In STP cash flow is one time, hence one time STP is ideal to take exposure by way of rupee cost averaging," Joshi said.

So, invest in debt liquid mutual funds and get equity like returns!

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

06:43 PM IST

SIP vs STP: What is the difference between these two mutual fund investments, explained!

SIP vs STP: What is the difference between these two mutual fund investments, explained! How to fund your child’s education using mutual funds; check out here

How to fund your child’s education using mutual funds; check out here Invest in systematic transfer plan for smart investment

Invest in systematic transfer plan for smart investment