A small shift in investment habit can raise your savings by 50%

There are various options like Mutual Funds, pension schemes, Equities, property investment and many others which you can select depending on your need and goals.

Indians are largely well-versed with the idea of saving money for their retirement or other long term purposes.

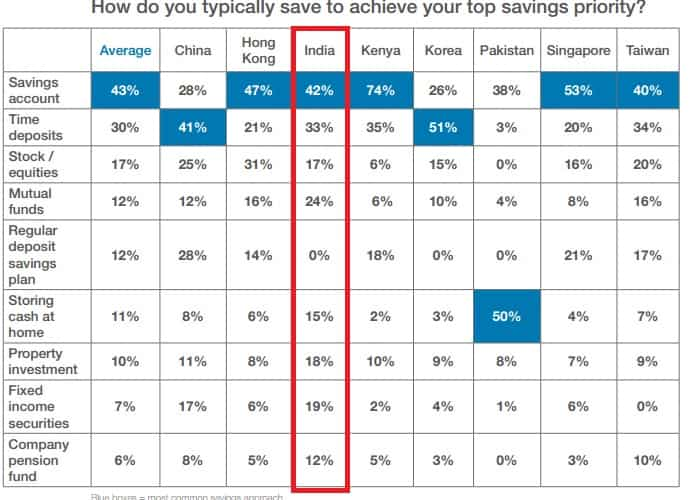

However, as it stands, most still believe in savings as a function of keeping cash at home or basic savings bank accounts followed by fixed deposits or gold.

To bring out the cash sitting in the lockers, the government, financial advisors have been pushing various schemes, financial literacy to encourage investment habit. But, there is hardly any change in the behaviour of people.

There are various options like Mutual Funds, pension schemes, Equities, property investment and many others which you can select depending on your need and goals.

Still, people prefer basic savings account. But, with the little change in the mindset of people can raise India's growth in ten years by 48%.

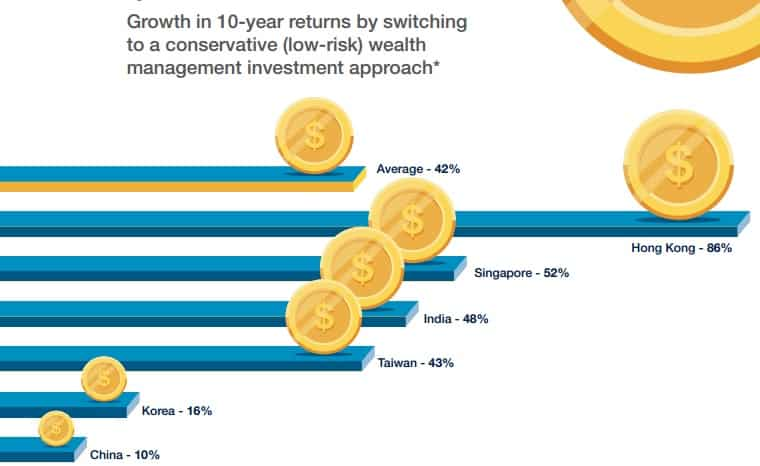

According to a research by Standard Chartered, the emerging affluent in Asia could increase the return on their savings by an average of 42% over a 10-year period, if they switched from a largely basic savings approach to a low risk wealth management investment strategy. This number could reach highs of 48% in case of India.

A switch to a more effective approach could make a huge difference. Consumers in Hong Kong, Singapore, India and Taiwan could increase their savings by as much as 86%, 52%, 48% and 43% respectively over 10 years, the research revealed.

Fernando Morillo, Global Head, Retail Products and Segments, Standard Chartered Bank, said, "The emerging affluent in the markets surveyed are avid savers, setting aside, on average, 27% of their income every month. This well-engrained savings behaviour is the first step towards building financial stability and achieving their savings goals. The next step is to understand and choose the right products that will help them achieve these goals, within the expected timeframe."

Moreover, Morillo said that to achieve the goals sooner, several factors need to be considered including the impact of inflation and individual risk appetite.

A broader approach to savings and investing – which could include a mix of highly liquid products like savings accounts and longer-term investments – could help the emerging affluent.

Around 17% of Emerging affluent consumer respondents in India save money every week for their top savings priority while 60% do it on a monthly basis. The frequent use of digital tools and services is also high among the Indians at 43%, which is lower only to China at 47%. Considering the saving methods used, saving instruments (42% in savings accounts) and advise from friends and family (42%) topping the source of information to help finances.

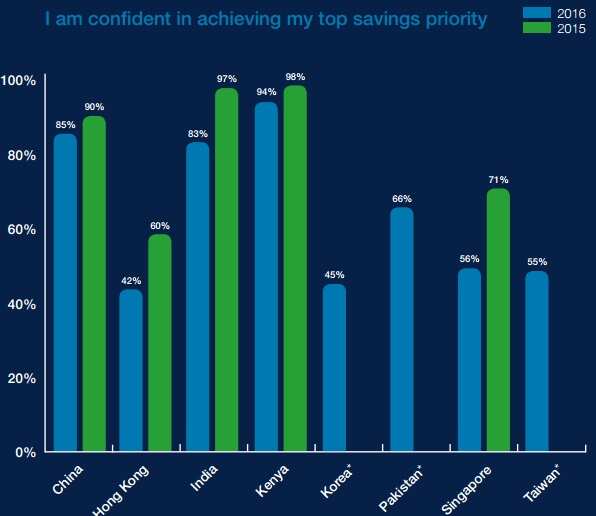

Further, as per the report, people are losing confidence in savings. At the end of 2016, fewer emerging affluent consumers in China, Kenya, Hong Kong, India and Singapore were confident in reaching their savings goals (72%), compared to 2015 (83%).

In India, 97% of population were confident in achieving top savings priority in 2015. However, the confidence slipped to 83%.

So, in order to increase the investment habit, it is important that people do not lose confidence in parking money.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

LIC Saral Pension Plan: How to get Rs 64,000 annual pension on Rs 10 lakh one-time investment in this annuity scheme that everyone is talking about

Rs 1,500 Monthly SIP for 20 Years vs Rs 15,000 Monthly SIP for 5 Years: Know which one can give you higher returns in long term

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

Income Tax Calculations: What will be your tax liability if your salary is Rs 8.25 lakh, Rs 14.50 lakh, Rs 20.75 lakh, or Rs 26.10 lakh? See calculations

8th Pay Commission Pension Calculations: Can basic pension be more than Rs 2.75 lakh in new Pay Commission? See how it may be possible

SBI Revamped Gold Deposit Scheme: Do you keep your gold in bank locker? You can also earn interest on it through this SBI scheme

04:57 PM IST

As home savings take a dip, here are 7 effective ways to save more money

As home savings take a dip, here are 7 effective ways to save more money Will government revise PPF interest rate in June 2023? Check details here

Will government revise PPF interest rate in June 2023? Check details here LIC IPO: Interesting analysis - Rs 10 out of every Rs 100 saved by Indian households each year goes to LIC

LIC IPO: Interesting analysis - Rs 10 out of every Rs 100 saved by Indian households each year goes to LIC Jai Jawan, Investment Plan: Anil Singhvi celebrates Independence Day with CRPF jawans, answers their financial queries - DETAILS

Jai Jawan, Investment Plan: Anil Singhvi celebrates Independence Day with CRPF jawans, answers their financial queries - DETAILS Who moved my savings? The conundrum of declining savings post-demonetisation

Who moved my savings? The conundrum of declining savings post-demonetisation