SIP returns: How long will it take to reach the Rs 5 crore goal?

SIP returns: According to experts, the key to getting the most out of mutual fund SIP is to stay invested for a long time.

SIP returns: Mutual fund is one of the preferred methods of investment today and a systematic investment plan (SIP) is one of the convenient facilities to invest in mutual funds. While investing in mutual funds, it is necessary for investors to have a specific goal in mind as it helps in better financial planning for the future.

According to experts, the key to getting the most out of mutual fund SIP is to stay invested for a long time. While choosing a decent fund is dependent on a variety of criteria, for which you should seek professional guidance, this article examines how long it will take for an investor to reach Rs 5 crore using SIP (assuming 12 per cent annualised returns).

According to Vivek Sharma- Director (strategy) and head of investments at Gulaq, a part of the Estee group, "One can create a corpus of Rs 5 crore in 20 years if they invest Rs 10,000 per month in equity markets. However, if they increase their SIP to Rs 20,000, they can reach this milestone in 15 years."

The below chart shows the time it takes to get to Rs 5 crore corpus when we invest with fixed SIPs. We have also shown the impact of increasing our SIP by 6 per cent per annum. The growth rate assumes is 12 per cent.

“In order to follow this plan, we must learn to avoid the short-term noise in the markets,” said Sharma.

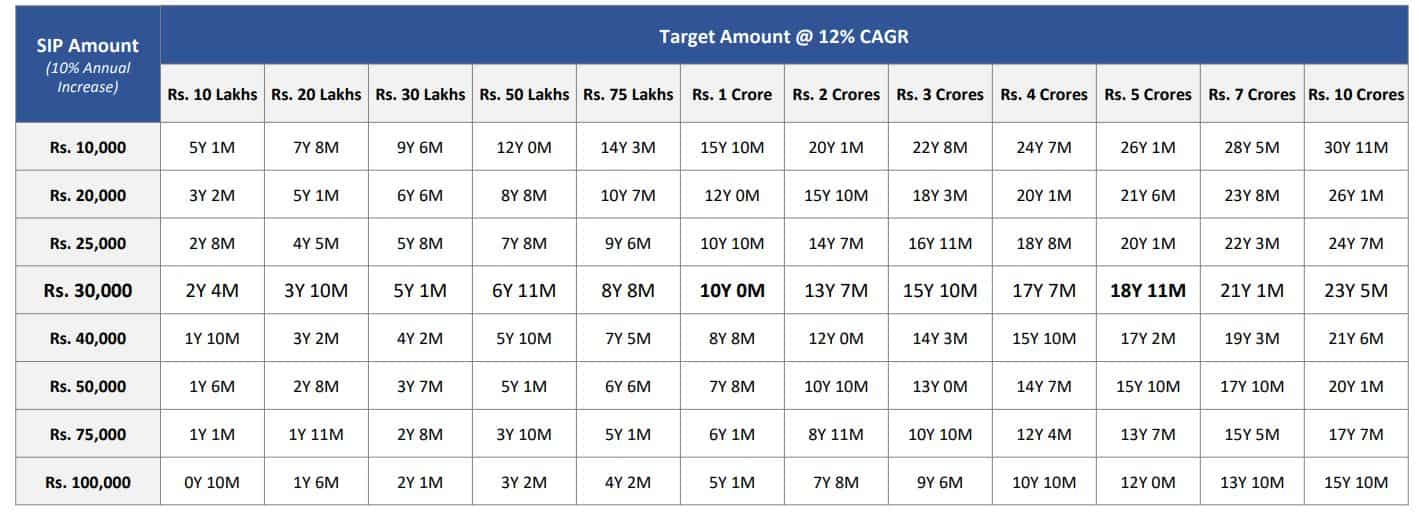

Here is a chart by FundsIndia Wealth conversation report for May 2023, which shows how investors can reach the Rs 5 crore goal if he/she invests Rs 10,000 to Rs 1 lakh per month.

What mistakes to avoid while investing through SIP?

According to experts, there are two common mistakes that investors make during the investing journey.

-One is during the bear phase when there is pessimism all around, they stop their SIPs. This has a negative impact because we get a higher number of shares/units when we invest at lower prices.

-Another common mistake is during the bull phase when they redeem their investments, fearing that the markets would correct.

Note: One should always remember that with time their earning and saving capacity increases. Hence, they should always ensure that the growth in their savings is more than the growth in their earnings.

Catch the latest stock market updates here. For more news on sports, politics follow Zee Business

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:09 PM IST

Torrent Power Rs 3,500 crore qualified institutional placement QIP oversubscribed 4 times

Torrent Power Rs 3,500 crore qualified institutional placement QIP oversubscribed 4 times MarketsMojo unveils MOJOMF distribution service platform

MarketsMojo unveils MOJOMF distribution service platform 5 top investment plans for youngsters with limited funds

5 top investment plans for youngsters with limited funds Two entities exit Sansera Engg; sell 11.66% stake for Rs 750 crore

Two entities exit Sansera Engg; sell 11.66% stake for Rs 750 crore BSE denies technical glitch as investors lost money in mutual fund investments on June 4

BSE denies technical glitch as investors lost money in mutual fund investments on June 4