At Rs 12,546 crore, January inflows up 72% MoM in equity mutual funds; debt sees outflows worth Rs 10,316 crore

Top performer was Small Cap Fund which received a net inflow of Rs 2,255.85 crore. It was followed by Large & Mid Cap fund and Multi Cap fund with inflows at Rs 1,901.99 crore and Rs 1,773.02 crore, respectively

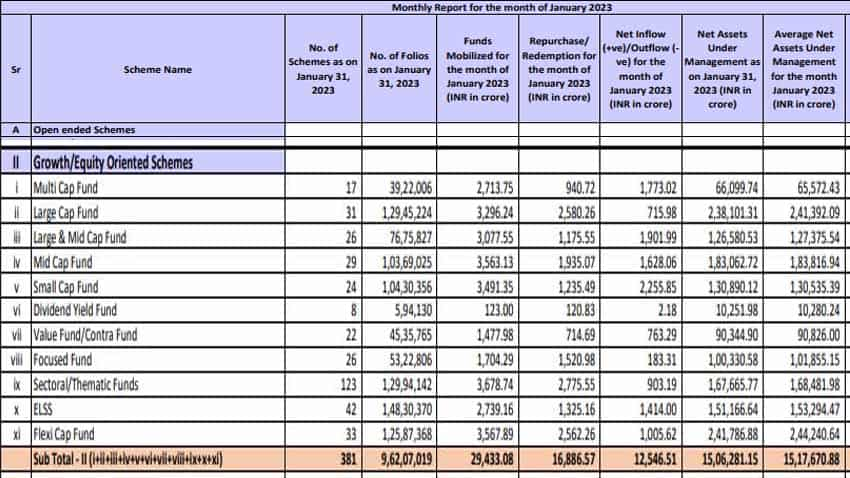

Growth or equity oriented schemes witnessed nearly 72 per cent jump in net inflows at Rs 12,546.51 crore in January 2023 as against Rs 7,303.39 crore seen in December 2022. The inflows were recorded in 381 schemes according to a data released by Amfi. Meanwhile, Income or Debt Oriented schemes saw outflows of Rs 10,316.15 crore for January 2023.

The top performer was Small Cap Fund which received a net inflow of Rs 2,255.85 crore. It was followed by Large & Mid Cap fund and Multi Cap fund with inflows at Rs 1,901.99 crore and Rs 1,773.02 crore, respectively.

Source: Amfi

Source: Amfi

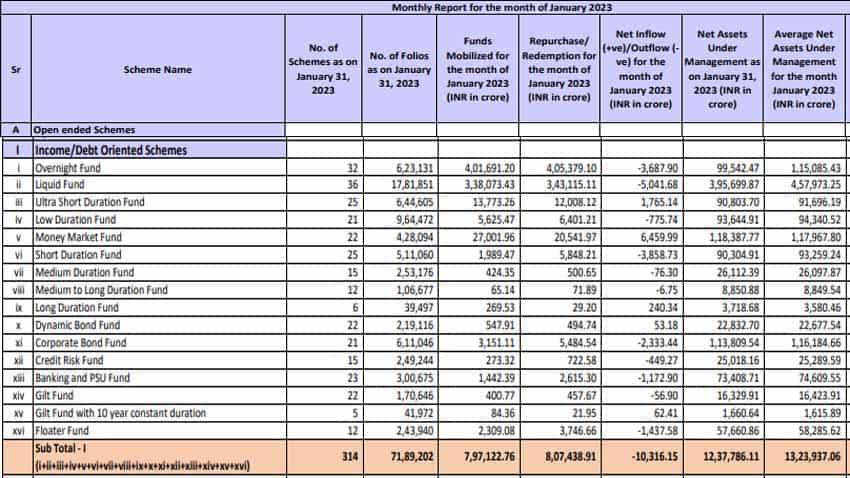

In the Debt fund category, the outliers were Money Market Fund and Ultra Short Duration Fund which saw inflow worth Rs 6,459.99 crore and Rs 1,765.14 crore, respectively. The worst performing schemes were Liquid Fund, Short Duration Fund and Overnight Fund with outflows worth Rs 5,041.68 crore, 3,858.73 core and 3,687.90 crore, respectively.

Source: Amfi

Source: Amfi

Gold ETF Schemes which are a type of open ended schemes witnessed outflows worth Rs 199.43 crore during the month gone by.

Open ended funds are mutual fund schemes which are open for buying and selling at any time. There is no maturity period in such funds, which means that one can remain invested in the scheme for as long as he or she wants.

In the closed ended schemes, the equity oriented schemes saw outflows of Rs 74.92 crore while debt schemes saw inflows of Rs 583.09 crore.

A closed ended mutual fund scheme is where investments are locked-in for certain duration. The issue can be subscribed only at the time of NFO or new fund offer period. Redemption of units can be made only after the expiry of lock-in period.

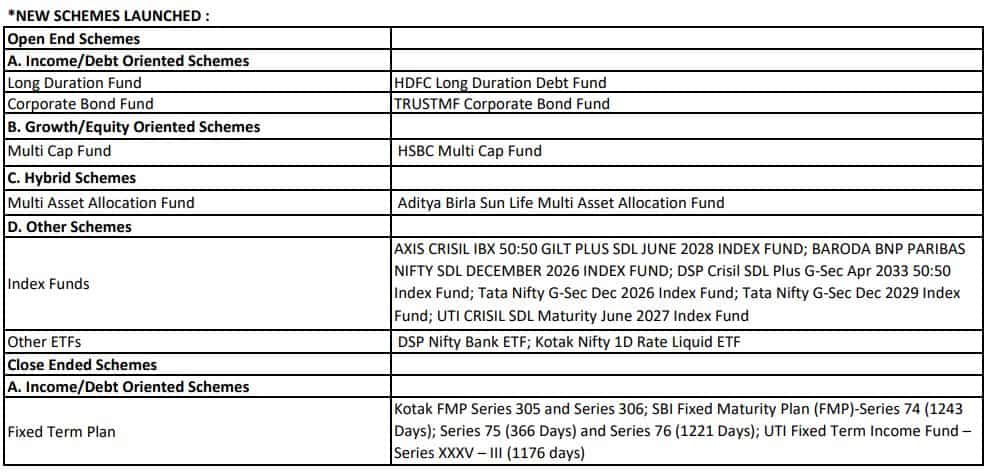

During the month, 12 new mutual fund schemes were launched which mobilised funds worth Rs 3,571 crore.

The Mutual Fund industry grew by 1 per cent on a monthly basis in Average Assets Under Management (AAUM) to 40.8 lakh crore in January 2023, Gautam Kalia, Senior Vice President and Head, Super Investor at Sharekhan by BNP Paribas said.

The Mutual Fund industry has grown by four times in less than a decade (the industry was 10 lakh crore in May 2014), he said.

“But as interest rates rise, gold prices continue higher and the equity market returns stagnate, there is a real concern that retail clients will lose patience and reallocate resources back to fixed deposits, real estate and gold. It will be interesting to see whether retail clients continue to stay invested and truly buy the long term wealth creation promise of Mutual Funds,” Kalia opined.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:54 PM IST

Monthly equity mutual fund inflow shrinks 10%, SIPs at fresh high of Rs 24,509 crore

Monthly equity mutual fund inflow shrinks 10%, SIPs at fresh high of Rs 24,509 crore Budget 2024: AMFI requests govt to permit pension-focused schemes with NPS-like tax benefits

Budget 2024: AMFI requests govt to permit pension-focused schemes with NPS-like tax benefits Mutual Fund NFO: This fund has minimum investment of Rs 100; will invest in top Nifty 500 companies. Who should invest?

Mutual Fund NFO: This fund has minimum investment of Rs 100; will invest in top Nifty 500 companies. Who should invest? Mutual fund data: Equity inflows drop nearly 16% sequentially to Rs 22,633 crore in March, off nearly two-year high

Mutual fund data: Equity inflows drop nearly 16% sequentially to Rs 22,633 crore in March, off nearly two-year high Worst performing small- and mid-cap MFs: Up to Rs 716 wiped off every Rs 10,000 invested in just 1 week in these schemes

Worst performing small- and mid-cap MFs: Up to Rs 716 wiped off every Rs 10,000 invested in just 1 week in these schemes