Income Tax slabs, rates and exemptions for senior citizens: Know how income tax on pension is calculated

Income Tax Slabs For Senior Citizens, Income Tax Rates For Senior Citizens: Retired employees who fall between 60 and 80 years of age, have the basic exemption limit fixed at Rs 3 lakhs. In the case of super senior citizens (above 80 years), the exemption limit is set at Rs 5 Lakh.

Income Tax Slabs For Senior Citizens, Income Tax Rates For Senior Citizens: Salaried people and pensioners have to mandatorily file their Income Tax Return (ITR). However, the government in Budget 2021-22 introduced a new section in the Income Tax Act, 1961 wherein senior citizens above 75 years are no longer required to ITR if they meet certain criteria.

Here, we will tell you about the income tax slabs, rates and exemptions that senior citizens enjoy.

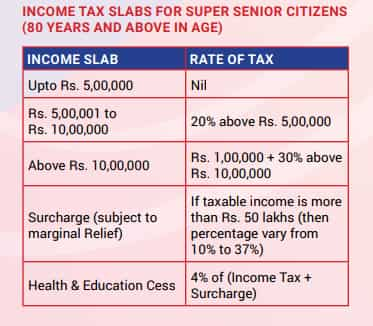

Income Tax Slabs For Senior Citizens (60 to 80 years)

(Pic: Official Website)

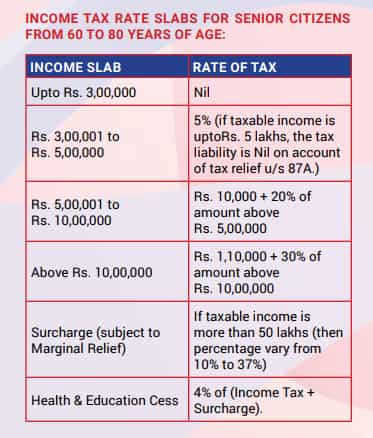

Income Tax Slabs For Senior Citizens Above 80 years

(Pic: Official Website)

Income Tax Exemption Limit For Senior Citizens

A senior citizen is an individual who is 60 or above 60 years or below 80 on the last day of the previous year. Retired employees who fall between 60 and 80 years of age, have the basic exemption limit fixed at Rs 3 lakhs. In the case of super senior citizens (above 80 years), the exemption limit is set at Rs 5 Lakh.

Is Pension Taxable In India?

Pension received by retired employees is taxable. It is taxable under the income head ‘salaries’ beyond the exemption limit.

Also read- 5 tax saving options other than 80C

Tax On Gratuity, Provident Fund For Retired Employees

The amount received from PF is tax-free for government employees. For non-government employees, PF receipts are exempted from tax if received from a recognised PF after rendering continuous service of not less than 5 years.

Gratuity received on retirement is exempt from tax for government employees.

Whereas, for non-government employees, gratuity is exempt from tax in the following cases:

- Gratuity amount of Rs 10 lakh

- 15 days' salary for each year of service

- Actual gratuity received.

Is Family Pension Taxable?

Family Pension is taxable in India. It is taxed under 'Income from Other Sources.' It is taxable after allowing a deduction of 33.33 per cent or Rs 15000, whichever is less.

Also read- Income tax return filing: What is ITR 1 Sahaj form? Check eligibility and steps to file online

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

09:14 AM IST

Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November

Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November No proposal on income tax relief for senior citizens under consideration: Centre

No proposal on income tax relief for senior citizens under consideration: Centre  Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax