Income Tax News: Check full circular copy on due date extension of filing ITR and audit reports; know new deadlines

Income Tax News: The due date of furnishing of returns of income for the assessment year 2021-22 has now been extended to March 15, 2022.

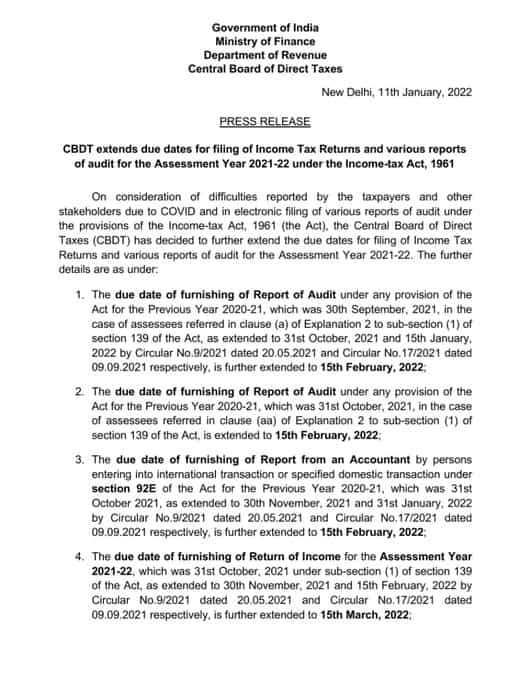

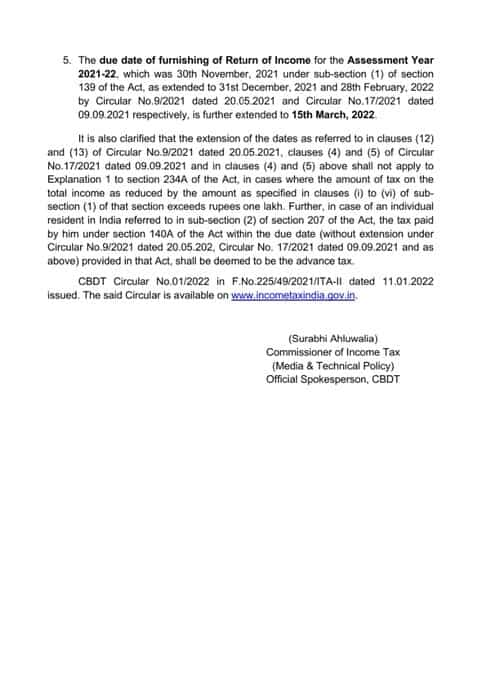

The Centre on Tuesday extended the deadlines for several compliances, including the filing of Income Tax Return (ITR) for the assessment year 2021-22.

The due date of furnishing of returns of income for the assessment year 2021-22 has now been extended to March 15, 2022.

Income Tax India @IncomeTaxIndia tweeted, "On consideration of difficulties reported by taxpayers/stakeholders due to Covid & in e-filing of Audit reports for AY 2021-22 under the IT Act, 1961, CBDT further extends due dates for filing of Audit reports & ITRs for AY 21-22. Circular No. 01/2022 dated 11.01.2022 issued."

INCOME TAX TWEET

On consideration of difficulties reported by taxpayers/stakeholders due to Covid & in e-filing of Audit reports for AY 2021-22 under the IT Act, 1961, CBDT further extends due dates for filing of Audit reports & ITRs for AY 21-22. Circular No. 01/2022 dated 11.01.2022 issued. pic.twitter.com/2Ggata8Bq3

— Income Tax India (@IncomeTaxIndia) January 11, 2022

In a statement, the Ministry of Finance said the decision has been taken after considering difficulties reported by the taxpayers and other stakeholders due to the Covid situation and in electronic filing of various reports of audit under the provisions of the Income Tax Act, 1961.

Filing of Audit reports: New due date - February 15, 2022

Notably, the Central Board of Direct Taxes (CBDT) has decided to further extend the due dates of furnishing audit report under any provision of the Act for the previous year (2020-21) to February 15, 2022.

The due date of furnishing report from an accountant by persons entering into international transactions or specified domestic transactions under Section 92E of the Act for the previous year (2020-21) is now February 15, 2022.

ITR filing: New due date - March 15, 2022

"The due date of furnishing of 'Return of Income for the Assessment Year 2021-22', which was October 31, 2021 under Sub-section (1) of Section 139 of the Act, as extended to November 30, 2021 and February 15, 2022, is further extended to March 15, 2022," the ministry said.

"The due date of furnishing of Return of Income for the Assessment Year 2021-22, which was November 30, 2021 under Sub-section (1) of Section 139 of the Act, as extended to December 31, 2021 and February 28, 2022, is further extended to March 15, 2022," it added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 90,000 and pensionable service 27 years? What can be your monthly pension in each scheme?

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

06:08 PM IST

Fact Check: Are senior citizens above 75 years old exempt from paying taxes?

Fact Check: Are senior citizens above 75 years old exempt from paying taxes? Baijayant Panda to chair Select Committee on Income-Tax Bill

Baijayant Panda to chair Select Committee on Income-Tax Bill Income Tax department activates section wise mapping of I-T Act, Tax bill

Income Tax department activates section wise mapping of I-T Act, Tax bill  New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers

New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers Budget 2025: Middle class is like a hen that lays golden eggs, Centre doesn't keep it happy, says AAP's Raghav Chadha

Budget 2025: Middle class is like a hen that lays golden eggs, Centre doesn't keep it happy, says AAP's Raghav Chadha