Income tax exemption on property - here is how to avail it

Income tax on property: Here are some deductions that can be applied while filing the income tax which will reduce the tax liability

Income tax on property: Having a house that you own is desire that many people hold. Not just that investing in real estate is also one of the preferred options today. But it is not as easy as it looks. Property ownership and rental income come under the purview of income tax and the owner is liable to pay income tax on their property as per Section 24, titled “Deduction From Income from House Property”.

So how can one save tax on income from property? Here are some deductions that can be applied while filing the income tax which will reduce the tax liability

Income tax on property: What is taxable?

To understand the deductions, one needs to first know what comes under section 24 of the Income Tax Act.

-Giving one’s house on rent comes under income tax as the rent obtained is considered as income

-if an individual owns more than one house then the Net Annual Value of those houses, except the one the owner is living in, is considered as income.

Only the property that the owner lives in will not invite any tax.

Also Read: 4 tips to repay your Credit Card debt faster

Income tax on property: Deductions to save tax

Property owners can enjoy the benefit of the following deductions which if applied accurately can help save tax:

1.Standard Deduction:

Property owners can avail 30 per cent of Net Annual Value of the house property as deduction if property is let-out that is rented for the whole or a part of the year during the previous year. This is not applicable in case the owners are residing on that property.

2.Interest on Loan:

Self occupied residential house property owners can claim Rs 2 lakhs on their home loan interest. The same applies if the house is vacant. If the owner has rented out the property, the entire interest on the home loan is allowed as a deduction. The deduction on interest is limited to Rs.30,000 if the owner fails to meet any of the below given conditions for the Rs 2 lakh rebate.-

-One must take home loan to buy and construct the property;

-The loan must be taken on or after 1 April 1999;

-The purchase or construction must be completed within 5 years from the end of the financial year in which the loan was taken

3. Section 80C

A newly bought property can get the benefit of section 80C deduction. Property owner can claim up to 10 per cent deduction on stamp duty and registration. The maximum amount that can be deducted under Section 80C is Rs 1.5 lakh. Owners can also claim the dedications for the costs incurred during the transfer of a newly constructed house.

4. Municipal Taxes

Owner can claim deduction on the taxes levied by local authority with respect of house property under these two conditions

1.Taxes are borne by the owner; and

2. Taxes are actually paid by them during the year.

Income tax on property: Calculation

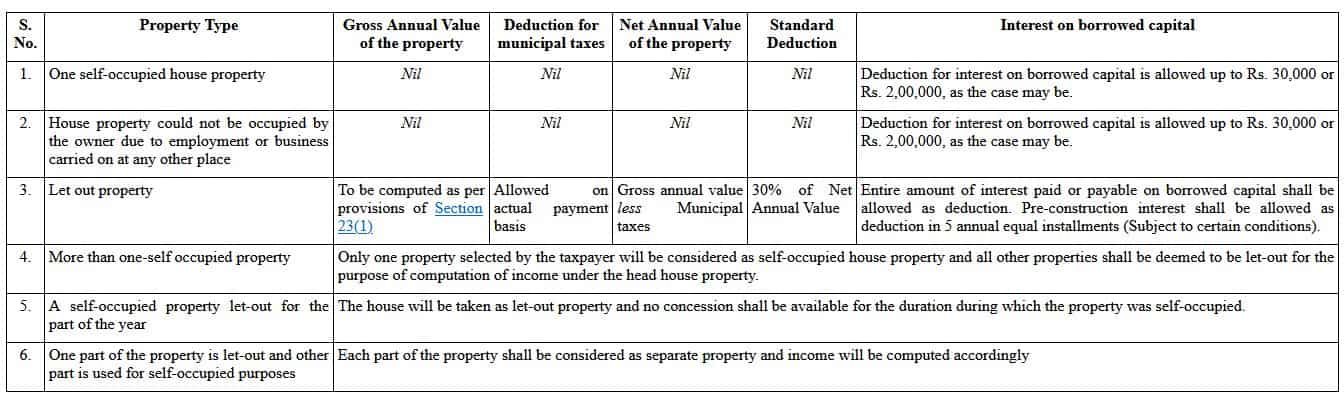

Income tax on property: Exemptions Under Section 24

Owners can be exempted from section 24 under following circumstances:

-If the property is not self occupied and the owner has taken a loan for it then they can be exempted from the entire interest with no upper limit on the exemption.

-In the case where the house is not self occupied as the owner is living in a different city for employment or business, and they have purchased or rented a house there, they can claim exemption on the interest but only up to Rs. 2 lakh

- Within 3 years of taking a loan the property owner needs to complete the construction of their houses to claim the maximum exemption of Rs. 2 lakh. In case they fail to complete the construction in three years, they can only claim an exemption of Rs 30,000.

House owners should have the interest certificate for the loans that they have taken to submit as proof of the loan during the calculation of tax deductions.

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 90,000 and pensionable service 27 years? What can be your monthly pension in each scheme?

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

09:59 AM IST

Post Office FD: Rs 15 lakh investment in this small savings scheme gives Rs 6.75 interest and tax benefits

Post Office FD: Rs 15 lakh investment in this small savings scheme gives Rs 6.75 interest and tax benefits How NPS investment can help you pay zero tax on Rs 10 lakh salary; examples included

How NPS investment can help you pay zero tax on Rs 10 lakh salary; examples included  NPS, PPF, ELSS: These 7 investment schemes will surely help you save income tax

NPS, PPF, ELSS: These 7 investment schemes will surely help you save income tax Income tax: What are the 6 common tax-saving mistakes that can be avoided

Income tax: What are the 6 common tax-saving mistakes that can be avoided New Income Tax slabs FY 2023-24 and deductions allowed - check here

New Income Tax slabs FY 2023-24 and deductions allowed - check here