PF Balance Check - New Wage Code Bill: EPFO alert! Your EPF Passbook balance money will jump over 66 pct; Check these calculations

PF Calculator — New Wage Act 2021: The Narendra Modi Government is mulling to implement the New Wage Act 2021 from 1st April 2021. Finance Minister Nirmala Sitharaman has already made an announcement in this regard in her Union Budget 2021.

PF Balance Check - New Wage Code Bill: The Narendra Modi Government is mulling to implement the New Wage Act 2021 from 1st April 2021. Finance Minister Nirmala Sitharaman has already made an announcement in this regard in her Union Budget 2021. As per the New Wage Act 2021 provisions, the basic salary of an employee can't be less than 50 per cent of net monthly salary. If the new wage code gets implemented by this April, the Employees' Provident Fund Organisation (EPFO) handling the Employees Provident Fund (EPF) account of the private sector employee will have some good news to share. after the implementation of the new wage act, an EPF account holder's EPF balance at the time of retirement would shoot up dramatically.

As per the EPFO norms, entire PF withdrawal is tax exempted and hence this rise in the EPF balance due to the implementation of this new wage act in India is going to provide huge relief to the EPF account holders. How? Because their monthly EPF contribution will go up, leading to higher PF withdrawal at the time of retirement.

Speaking on the New Wage Act 2021 SEBI registered tax and investment expert Jitendra Solanki saidm, "Once the New Wage Act 2021 is implemented in India, government sector employees won't get much affected as they already have their basic salary around 45-50 per cent of their net monthly CTC. but, for the private sector employees who are EPF account holder, it will be a huge relief in terms of retirement fund accumulation." Solanki said that in the private sector, it has been found that a recruiter doesn't pay more than 30 per cent of their net CTC as their basic salary. So, after the implementation of the New Wage Act 2021, their EPF balance will leapfrog many folds.

See Zee Business Live TV Streaming Below:

PF calculation in the wake of New Wage Act

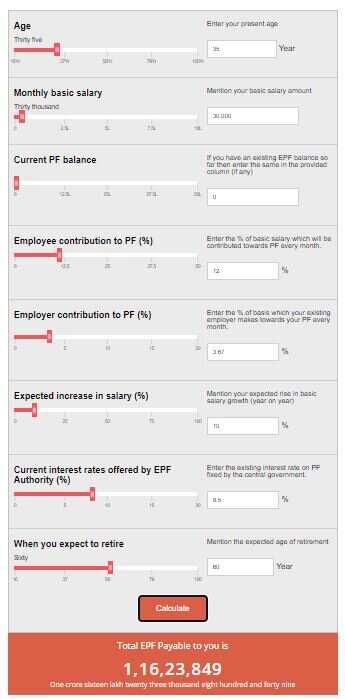

Let's assume an EPF account holder is 35 year old and monthly salary is Rs 60,000. In that case, if the monthly increment is assumed at tepid 10 per cent, keeping current 8.5 per cent PF interest rate for the coming period, then due to the new wage code implementation, one's net PF balance at the time of retirement will be Rs 1,16,23,849.

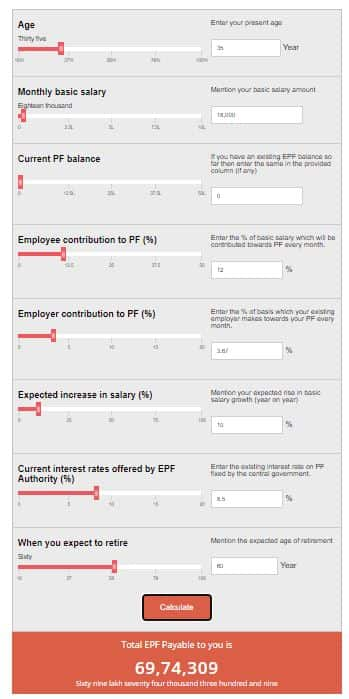

Comparing this PF balance with the current EPF contribution, which is not more than 30 per cent in majority of the EPF account holders, the PF balance post retirement of the same employee in the current circumstances will be Rs 69,74,309.

So, an EPF account holder's PF balance will shoot up by 66.67 per cent if the New Wage Code 2021 gets implemented.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:00 AM IST

EPFO, ESIC subscribers may soon use claim amounts via e-wallets: Labour Secretary

EPFO, ESIC subscribers may soon use claim amounts via e-wallets: Labour Secretary EPFO extends deadline for employers to upload pending pension applications until January 31, 2025

EPFO extends deadline for employers to upload pending pension applications until January 31, 2025 EPFO Board approves key reforms: Auto-claim limit increased to Rs 1 lakh, pension disbursement streamlined & other decisions

EPFO Board approves key reforms: Auto-claim limit increased to Rs 1 lakh, pension disbursement streamlined & other decisions Domestic youth unemployment lower than global levels: Labour Ministry

Domestic youth unemployment lower than global levels: Labour Ministry Labour Ministry asks EPFO to focus on preparations to launch ELI Scheme

Labour Ministry asks EPFO to focus on preparations to launch ELI Scheme