SBI Reverse Mortgage Loan Scheme For Senior Citizens: Eligibility, interest rates, repayment, fee and other details

SBI Reverse Mortgage Loan Scheme For Senior Citizens: Under this scheme, the bank makes payments to the borrowers against the mortgage of their residential house property.

SBI Reverse Mortgage Loan Scheme: There are so many senior citizens who don't have an adequate source of income. According to a report, around 17 per cent of elderly people had absolutely no form of income and were dependent on others in the family to support them. In order to help them, the State Bank of India (SBI) offers a reverse mortgage loan scheme. This scheme can be beneficial for those who do not have adequate income to support themselves. Under this scheme, the bank makes payments to the borrowers against the mortgage of their residential house property.

SBI Reverse Mortgage Loan Scheme - Features

Tenure of up to 15 years: In order to help borrowers, the bank offers the loan for a maximum tenure of up to 15 years, depending on the age of the borrower.

Low Processing Fees: The processing fee is 0.50 per cent of the loan amount. However, the minimum fee that the bank will charge is Rs 2,000 and the maximum of Rs 20,000.

No Pre-Payment Penalty: There is no charges or penalty in case senior citizens prepay their reverse mortgage loan.

SBI Reverse Mortgage Loan Scheme - Eligibility

In order to avail of the benefits of an SBI Reverse Mortgage Loan, a person needs to be a resident of India.

Only those whose age is 60 years and above, in the case of a single borrower, will be eligible for this loan. In the case of joint borrowers, the spouse's age should be more than 58 years.

It is to be noted that the loan amount that can be availed under this scheme is a minimum of Rs 3 lakh and a maximum of Rs 1 crore.

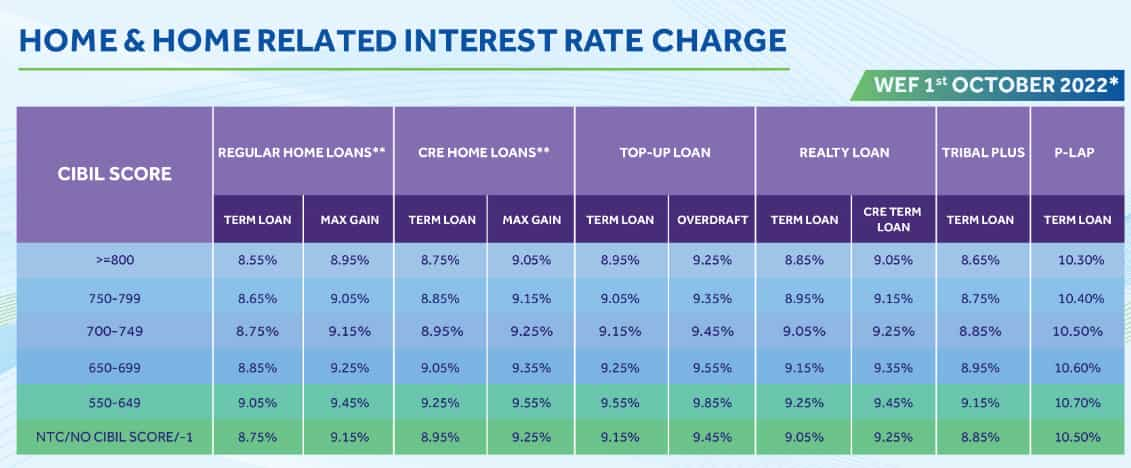

SBI Reverse Mortgage Loan Scheme: Interest Rates

SBI Reverse Mortgage Loan Scheme - Document Required

Proof of Identity, address proof, occupancy certificate, bank statement of last six months, IT returns of last three years, TDS certificate and others.

ALSO READ | SBI hikes MCLR by up to 15 bps across tenors

SBI Reverse Mortgage Loan Scheme: Key Points

The bank clearly says that "the borrower is not expected to service the loan during his lifetime."

Also, the bank does not offer loans on commercial properties under this scheme.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:53 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate