Going abroad? PNB World Travel Card can make your trip stress-free - Details

PNB World Travel Card Charges, Eligibility, Limit: The best thing about this card is that it does away with the need for carrying traveler cheques and currency.

PNB World Travel Card Charges, Eligibility, Limit: Holiday season is here! It is that time of the year when you will not need a reason to travel. December end is perfect for planning long holidays and this makes it the most suitable time for travelling abroad. So, for those who are planning to take an international trip across major travel destinations, including USA, UK & other European nations, Punjab National Bank (PNB) is offering a 'Prepaid PNB World Travel Card'. The best thing about this card is that it does away with the need for carrying traveler cheques and currency. Also, it has several major advantages over other types of cards.

PNB World Travel Card: Eligibility

Indian Nationals, valid PAN Card holders, desirous of visiting/travelling abroad (except Nepal and Bhutan) for any purpose as permitted by RBI.

PNB World Travel Card: Currency of Issue and Validity of Card

World Travel Cards (WTCs) are available in three currencies i.e. USD, GBP or British Pound & EURO. The Cards are issued with a pre-embossed expiry date in mm/yy format which cannot be extended further. If the validity of the card expires, a new card needs to be issued to the customer. The existing

balance in the old card, if any, may be transferred through the nodal branch of WTC.

PNB World Travel Card: Documents Required

- Application form

- Copy of PAN Card

- Copy of valid passport

- Copy of VISA

- Latest photograph

- Declaration form cum A2

PNB World Travel Card: Transaction Limit

The cash withdrawal limit per transaction on ATM is as per the limit, set by the concerned ATM provider of the country of visit with a maximum of USD 1000/Euro 800/GBP 500 per day.

PNB World Travel Card: Insurance Coverage

Those using the WTC will get insurance coverage of up to Rs 3,50,000 for any financial losses arising out of fraudulent transactions, loss of card,

loss of baggage and important documents etc,.

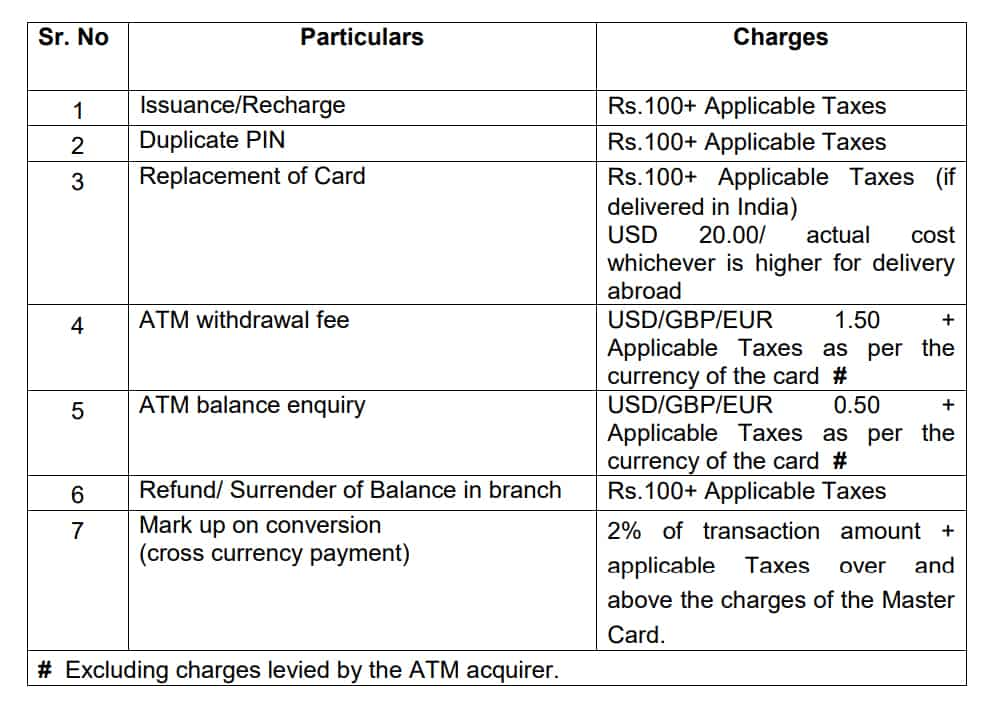

PNB World Travel Card Charges

PNB World Travel Card: Important points

- One of the most important features of this World Travel Card is that it is an “across the shelf/Over the counter” readymade product. It can be bought even on the date of the journey.

- The card can be used throughout the world except in India, Nepal & Bhutan.

- The card should not be used for paying temporary charges which are refundable also i.e, paying deposits at hotels, or on hiring cars etc.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:03 PM IST

PNB reports Rs 270.57 crore loan fraud by Gupta Power Infrastructure

PNB reports Rs 270.57 crore loan fraud by Gupta Power Infrastructure  HDFC Standard Life buys PNB Housing Finance shares worth Rs 90 crore

HDFC Standard Life buys PNB Housing Finance shares worth Rs 90 crore PNB Housing Finance jumps 11% on strong Q2 performance; broader market shows mixed trends

PNB Housing Finance jumps 11% on strong Q2 performance; broader market shows mixed trends  Eraaya Lifespaces' subsidiary secures Rs 250 million contract - Details

Eraaya Lifespaces' subsidiary secures Rs 250 million contract - Details Punjab National Bank (PNB) fixes floor price for share sale

Punjab National Bank (PNB) fixes floor price for share sale