ICICI Bank allows users to convert UPI payments into EMI: Here's how

ICICI Bank has allowed a transaction amount of above Rs 10,000 in easy installments in three, six, or nine months.

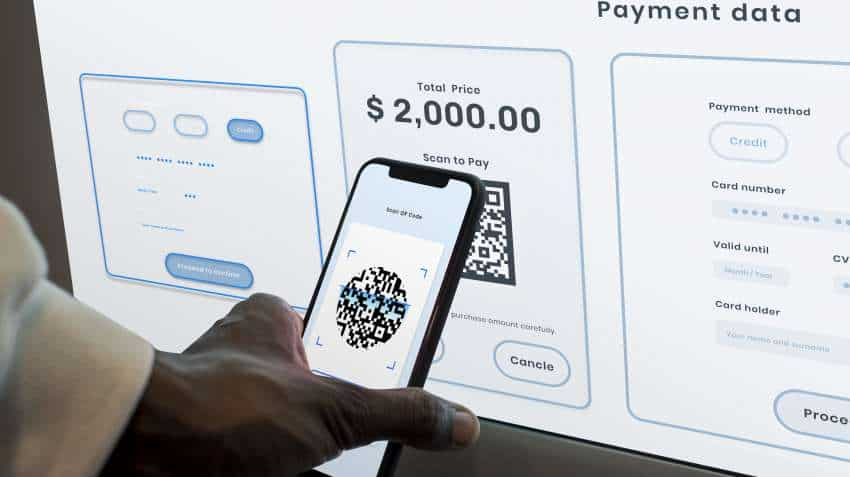

Days after the Reserve Bank of India (RBI) announced that individuals with pre-approved credit lines from banks can use them to make payments over the Unified Payments Interface (UPI), one of India's largest private banks - ICICI Bank - announced that it has introduced an EMI facility for UPI payments made by scanning QR code. Customers who opt for the bank’s ‘buy now, pay later’ service can now avail of the EMI facility for repayment, the bank stated in its release on Tuesday.

“We have seen that maximum payments these days are made through UPI. In addition, we have observed that customers are increasingly opting for UPI transactions from PayLater- the Bank’s ‘buy now, pay later’ service. Combining these two trends, we are introducing the facility of instant EMI for UPI payments done through PayLater,” added Bijith Bhaskar, Head- Digital Channels & Partnership, ICICI Bank.

Banks clarified that the facility can be availed across a host of categories such as electronics, groceries, fashion apparel, travel, and hotel bookings. As of now, the bank has allowed a transaction amount of above Rs 10,000 in easy installments in three, six, or nine months. Also, the bank has added that the EMI facility for PayLater will shortly be extended for online shopping as well.

Follow these steps to avail ICICI Bank's EMI facility through UPI

ICICI Bank has informed how the customers can avail the EMI facility on PayLater:

- Customers need to visit any physical store and choose their preferred product or service.

- To make the payment, use the iMobile Pay app, the official bank app, and choose the ‘Scan any QR’ option

- Select the PayLater EMI option if the transaction amount is Rs 10,000 or more.

- Select the tenure of repayment, it could be 3, 6, or 9 months

- Confirm the payment and the transaction is completed successfully

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

03:50 PM IST

ICICI Bank-Videocon loan case: SC notice to Chanda Kochhar, husband on CBI's plea

ICICI Bank-Videocon loan case: SC notice to Chanda Kochhar, husband on CBI's plea ICICI Bank introduces 'SmartLock'; here's how you can use this safety feature on iMobile Pay

ICICI Bank introduces 'SmartLock'; here's how you can use this safety feature on iMobile Pay ICICI Bank customers can now make payments to merchant QR code using digital rupee app

ICICI Bank customers can now make payments to merchant QR code using digital rupee app  Sandeep Bakhshi: ICICI Bank continues to make investments in technology, people, distribution, and building the brand

Sandeep Bakhshi: ICICI Bank continues to make investments in technology, people, distribution, and building the brand ICICI Prudential Life shares close over 6% higher as Anup Bagchi replaces NS Kannan as MD & CEO

ICICI Prudential Life shares close over 6% higher as Anup Bagchi replaces NS Kannan as MD & CEO