Navratna PSU stock remains analysts' long-term favourite; brokerage's Rs 303 target implies 17% upside

Multibagger PSU Stock: Are you looking out for quality buying opportunities in the PSU space? NLC India (NLCIL) is a Navratna CPSE, under the Ministry of Coal, that operates in a range of areas including coal mining, power generation, power trading,and consultancy. Also known as NLCIL--traded with the symbol NLCINDIA on NSE and BSE, NLC India is the designated nodal agency for lignite mining in India, owing the lion's share of lignite reserves in the country. NLC India shares have already rewarded investors with a 96 per cent return in the past year.

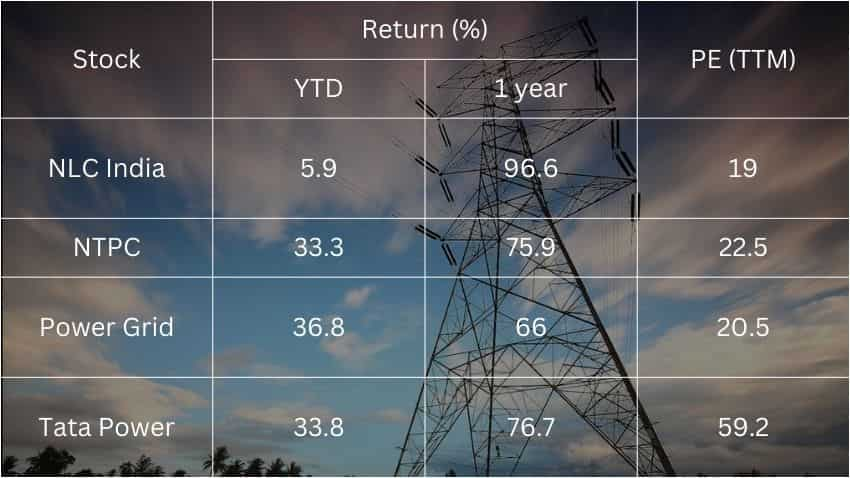

Multibagger PSU Stock to Buy: PSU stocks have been a favoured space on Dalal Street in 2024 so far thanks to the government's heavy capital expenditure (capex) commitment as part of its New India vision for the country. Many PSU shares have showered investors with phenomenal returns as reflected in Nifty PSU's almost 78 per cent rally, sharply higher than a 26 per cent surge in the headline Nifty50 index. One such stock is NLC India (NLCINDIA), which has already rule the roost within the space with a return of 96 per cent in 12 months. Many analysts remain positive on the growth prospects of NLC India, a Navratna PSU under the Ministry of Coal, due to its ambitious capacity expansion drive and focus on renewable energy.

NLC India deals in a range of areas including coal mining, power generation, power trading, and consultancy. It is also the designated nodal agency for lignite mining in the country.

Navratna PSU Stock in the Spotlight: NLCINDIA

Axis Securities has 'buy' call on NLC India

Navratna PSU stock NLC India is Axis Securities' pick of the week

Should you buy, sell or hold NLC India shares? Here's how analysts view the Navratna PSU stock

Navratna Stock in Focus: NLC India

Capacity Expansion: NLCIL plans to increase its current mining capacity from 50 MTPA to 100 MTPA by 2030, and its power generation capacity from 6 GW to around 20 GW by 2030.

These capacity additions would require a massive capex of Rs 1 lakh crore, which would drive growth in the regulated equity, analysts at Axis Securities wrote in a research report dated October 5.

Navratna PSU Stock in Focus:

NLCIL earns fixed returns on equity of 14 per cent and 15.5 per cent from its captive mining and power generation segments.

As of June 2024, NLCIL had a total regulated equity of Rs 9,529 crore (Rs 5,931 crore from power and Rs 3,598 crore from mining)

The management envisages the regulated equity to grow to Rs 11,000 crore by Q1 FY26 and to Rs 23,000 crore by FY30.

Navratna PSU in Focus: NLC India

NIRL IPO

All eyes on NLC India Q2 FY25 Results

NLC India has yet to announce the date it will release its financial results for the second quarter of FY25.

For Q1 FY25, it registered a 38.2 per cent year-on-year jump in its consolidated net profit to Rs 559.4 crore with growth of 1.8 per cent in revenue to Rs 3,375.1 crore, according to a regulatory filing.