International Gemmological Institute Listing Day: Shares inch lower after strong debut on BSE & NSE

International Gemmological Institute (India) Ltd Listing Day: International Gemmological Institute shares made a decent listing on the bourses today. Here are key updates and other essential details to know about the company's recently concluded IPO.

International Gemmological Institute (India) Ltd Listing Day: Shares of International Gemmological Institute India shares gave up some of their initial gains after staging a strong secondary-market debut in an otherwise weak market on Friday. In late morning deals, the stock was last seen trading at Rs 498 apiece on BSE and Rs 498.8 apiece and NSE, marking a premium of 19-20 per cent respectively. Earlier in the day, the stock listed at Rs 504.9 and Rs 510 on BSE and NSE, a premium of 21-22 per cent.

The initial public offer (IPO) of International Gemmological Institute (India), a company that specialises in the certification and grading of diamonds, was available for subscription for three trading sessions till December 17 wherein shares were available for bidding in a price band of Rs 397-417 apiece in multiples of 35.

Here are key things to know about the upcoming listing and recently concluded IPO of International Gemmological Institute (India) Ltd.

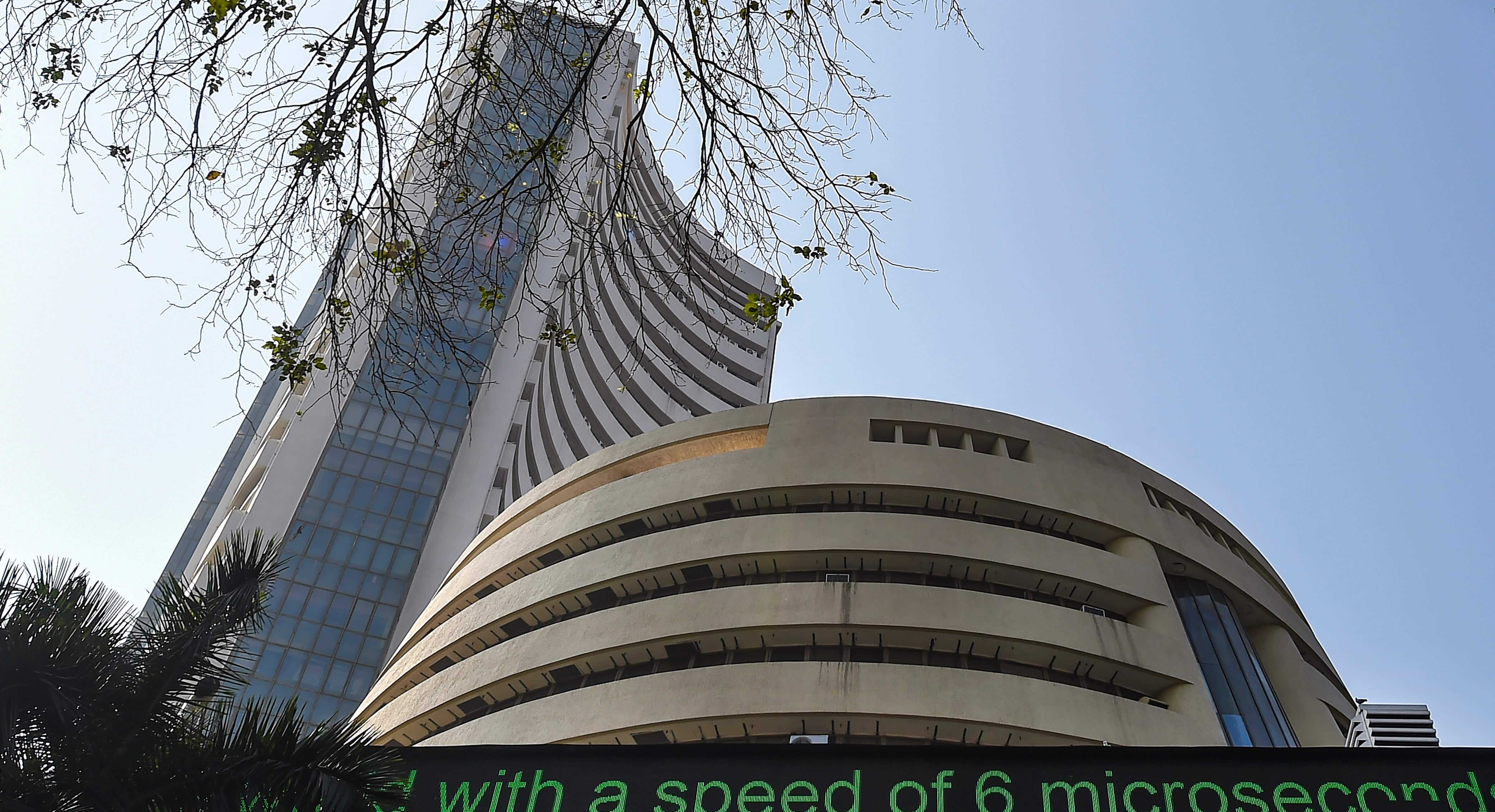

Images: PTI, Pexels, igi.org

What market wizard Anil Singhvi thinks

The listing failed to meet market guru Anil Singhvi's expectations. Zee Business Managing Editor Anil Singhvi, who had suggested applying for the IPO from a long-term perspective, expected the stock to list in the 550-575 range earlier on Friday.

He suggested investors keep holding the stock with a trailing stop loss at Rs 525.

International Gemmological Institute (India) IPO Subscription

International Gemmological Institute (India) IPO

International Gemmological Institute (India) IPO Subscription

The International Gemmological Institute (India) IPO received strong demand from across various types of investors.

While the portion reserved for qualified institutional buyers (QIBs) was subscribed 45.8 times, that meant for non-institutional investors (NIIs)—also known as high net-worth individuals—was booked 24.8 times the equity.

Retail individual investors also responded strongly to the IPO, with the category security a subscription of 11.2 times.

Blackstone-backed International Gemmological Institute (India)

What is International Gemmological Institute (India) and what does it do?

International Gemmological Institute (India) claims to be one of the biggest independent grading and accreditation service providers globally.

It operates 31 laboratories around the world grading finished jewellery, natural diamonds, lab-grown diamonds and gemstones, along with 18 schools of gemology graduating thousands of students annually, according to its website.