MOFSL sees 30% upside in Zomato. Key reasons why the brokerage is bullish on stock

Zomato shares today: Zomato Gold is expected to aid the growth of the company. "Strong early signs of Gold adoption (900k in the first month itself), in our opinion, should help Zomato improve growth as order frequency should improve after declining in recent quarters," the brokerage said.

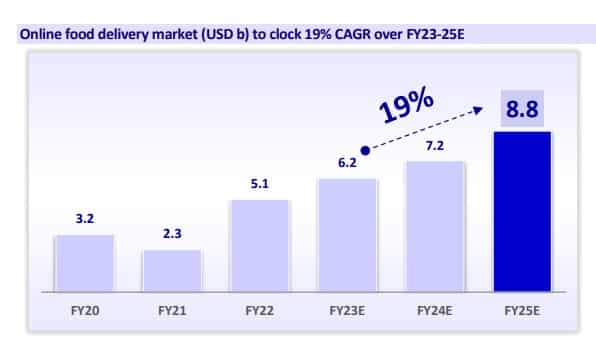

Zomato shares: India’s food delivery market, according to Motilal Oswal Financial Services, is set to clock a 19 per cent compound annual growth rate (CAGR) over FY23-25 (against slowing growth in other markets), owing to growth in the number of transacting users and order frequency. This should lead to a higher share of online food ordering - 24 per cent by FY25E from 13 per cent in FY21, the brokerage said in its latest report wherein it initiated coverage on Zomato with a target price of Rs 70.

Shares of the restaurant aggregator and food delivery company, meanwhile, were trading 0.76 per cent lower at Rs 53.42 apiece on the BSE on April 17.

The brokerage firm added that growing internet penetration, rising consumption and urbanisation have driven online delivery adoption in India. A large internet user base (1 billion by CY25E, according to Redseer) combined with the early stage of adoption – 9 per cent of the population using the internet (v/s 36% for China/50% for the US) – should ensure a long runway to growth.

With the exit of Amazon, the food delivery market is now a settled duopoly with Zomato (55% market share) and Swiggy (45%). The market has a very high moat given the significant capital required to displace the incumbents, MOFSL notes.

Catch all the live market action here

"We expect Zomato to gain from the relatively early stage of the food delivery ecosystem in India, as increased formalisation along with a growing share of platform-led delivery (currently at 7% of overall food consumption) should help boost its Food delivery gross order value (GOV) to Rs 38,400 crore in FY25 from Rs 21,300 crore in FY22.

Financials & Growth

Mukul Garg, Raj Prakash Bhanushali, and Pritesh Thakkar, research analysts at MOFSL expect Zomato to report a strong 29 per cent revenue CAGR over FY23–25 fueled by higher penetration, a higher proportion of transacting users, and increased ordering frequency. That apart, the analysts expect the company to break even by FY25. The food business of Zomato recorded a breakeven at EBITDA level in 1QFY23. MOFSL also expects gross margin to improve to 33.5 per cent in FY25 from 5.3 per cent in FY22.

Source: Motilal Oswal Financial report

Further, Zomato Gold is expected to aid the growth of the company. "Strong early signs of Gold adoption (900k in the first month itself), in our opinion, should help Zomato improve growth as order frequency should improve after declining in recent quarters," the brokerage said.

MOFSL; however, pointed out there's a limited distinction between Zomato and Swiggy’s offerings (both have food delivery, dine-in and quick commerce). A split market without a clear leader would hit margins due to the absence of efficiency gains from order bunching. The brokerage sees a contribution margin of 5.6 per cent of GOV in FY25E for Zomato v/s its medium-term target of 8 per cent.

Source: Motilal Oswal Financial report

Zomato's stock price

Shares of Zomato debuted in July 2021. The stock saw an impressive start as the scrip was listed on the National Stock Exchange (NSE) at Rs 116 per share — a 53 per cent premium on its issue price of Rs 76. However, the stock witnessed heavy selling post that. Over the past one year, the stock has tumbled over 30 per cent, BSE data show.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

12:16 PM IST

Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Dmart most-valuable India co founded by self-made entrepreneur post-2000; Zomato, Swiggy next: Hurun

Dmart most-valuable India co founded by self-made entrepreneur post-2000; Zomato, Swiggy next: Hurun  Food delivery economy crucial as it generates large-scale employment: Nitin Gadkari

Food delivery economy crucial as it generates large-scale employment: Nitin Gadkari Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Amazon’s Bengaluru Blitz: 15-minute delivery shakes up QC; Swiggy, Zomato fall up to 4%

Amazon’s Bengaluru Blitz: 15-minute delivery shakes up QC; Swiggy, Zomato fall up to 4%