Vedanta targets $750 crore EBITDA in 2 years; stock hits 52 week high

As of 10:27 a.m., shares of Vedanta traded over 2.57 per cent or Rs 9.7, higher at Rs 387.7 apiece on BSE. The market capitalisation of the company at around the same time stood at Rs 1,44,320.16 crore.

)

Vedanta shares clocked a 52 week high at Rs 391 apiece on BSE after Vedanta Ltd Chairman Anil Agarwal said the current financial year that started on April 1 will be a transformative year for his conglomerate Vedanta.

As of 10:27 a.m., shares of Vedanta traded over 2.57 per cent or Rs 9.7, higher at Rs 387.7 apiece on BSE. The market capitalisation of the company at around the same time stood at Rs 1,44,320.16 crore.

As per mining tycoon Agarwal, Vedanta will prioritise disciplined growth while eyeing a USD three billion deleveraging in the next three years. In a communication to shareholders, Agarwal said the group will pursue sustainable growth while maintaining a healthy balance sheet.

"These include further deleveraging (parent) Vedanta Resources by USD three billion in the next three years and achieving an annual group EBITDA of USD 7.5 billion within 2 years," he said.

"FY25 will be a transformative year for us on many fronts as we prioritise disciplined growth, operational excellence, and exploring opportunities along the value chain," Agarwal said.

Vedanta had previously stated that it will invest USD 6 billion across businesses that span from aluminium and zinc to iron ore, steel, and oil and gas, which is expected to generate incremental revenue of over USD 6 billion and boost EBITDA from an expected USD 5 billion in the fiscal year ended March 31 to USD 6 billion in 2024-25 (FY25) and up to USD 7.5 billion by FY26.

Reflecting on the operational performance in the fiscal year that ended March 31, he said Vedanta achieved the highest-ever annual aluminium production of 2.37 million tonnes of aluminum with a lower cost of production and increased margins.

Operational efficiencies led to a 15 per cent cost reduction in the last six quarters, as per Agarwal. On oil and gas, he said Vedanta has effectively countered a natural decline in production by drilling more infill wells and bringing new fields online.

Also read: FY25 to be a transformative year, says Vedanta's Anil Agarwal

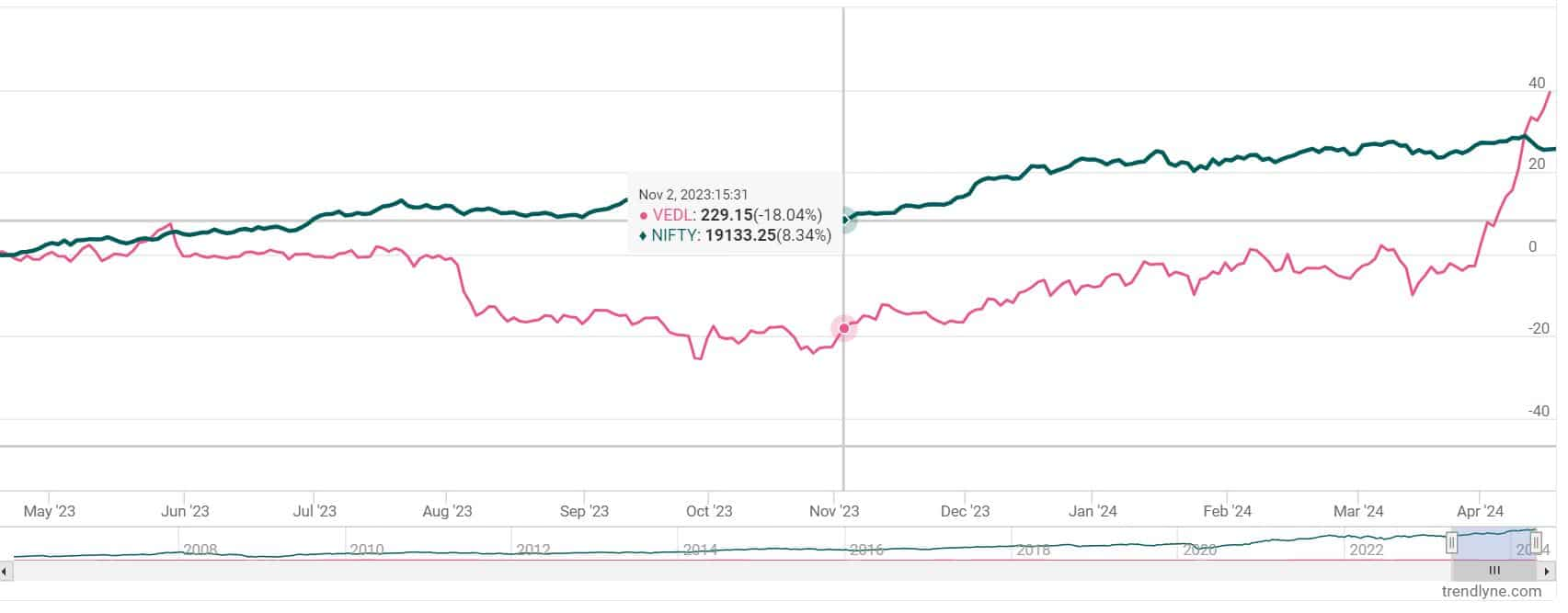

Vedanta share price: Past performance

In a year, Vedanta shares have gained over 39 per cent, against Nifty50's rise of over 25 per cent.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:46 AM IST

Vedanta reports rise in production of aluminium, iron ore, zinc in Q1

Vedanta reports rise in production of aluminium, iron ore, zinc in Q1