Top Gainers & Losers: Pharma stocks see big moves after FDA move on Cipla

In the Nifty50 universe, Divi’s Labs, UltraTech Cement and Tech Mahindra emerged the top gainers whereas Adani Enterprises, Cipla and Britannia were the top laggards.

Indian equity benchmarks Sensex and Nifty50 ended a volatile session in the red on Monday, extending losses to a second straight trading day, amid weakness in financial, oil & gas and FMCG shares. Globally, concerns persisted among investors over the prospect of a prolonged period of aggressive hikes in benchmark interest rates.

The Sensex settled with a cut of 311 points or 0.5 per cent at 60,691.5 and Nifty50 settled at 17,844.6, down 99 points or 0.6 per cent from its previous close.

In the Nifty50 basket, Divi’s Labs, UltraTech Cement and Tech Mahindra were the top gainers whereas Adani Enterprises, Cipla and Britannia were the top losers.

Here are some of the blue-chip stocks that made the biggest moves on February 20:

Divis Laboratories

Divi’s Labs shares gained by 2.5 per cent to end at Rs 2,902 apiece on NSE — emerging the top gainer in the Nifty50 pack for the day.

Image Source: Stockedge

This month, maor companies from the country's pharma sector missed analysts' forecasts on the earnings front.

Alankar Garude of Kotak Securities said a margin recovery is expected in the pharma space. The brokerage downgraded Divi's to ‘sell’ from ‘reduce’ with a reduced target price of Rs 2,380 apiece, saying the valuation of 40 times the company's estimated earnings per share for the year ending March 2024 is expensive.

UltraTech Cement

UltraTech Cement shares rose 1.5 per cent to end at Rs 7,415 apiece on BSE — the top Sensex gainer.

Reliance Securities analyst Arafat Saiyed said the company’s initiatives to increase the share of green power to 34 per cent by the financial year 2023-24, from the 20 per cent at present, focus on margin, and an uptick in accretive and asset-light value-added business segments will be key drivers.

The brokerage maintained a ‘buy’ rating on UltraTech with a target price of Rs 7,940 per share, valuing the cement maker at 14.5 times its embedded value-to-EBITDA estimate for the year ending March 2025.

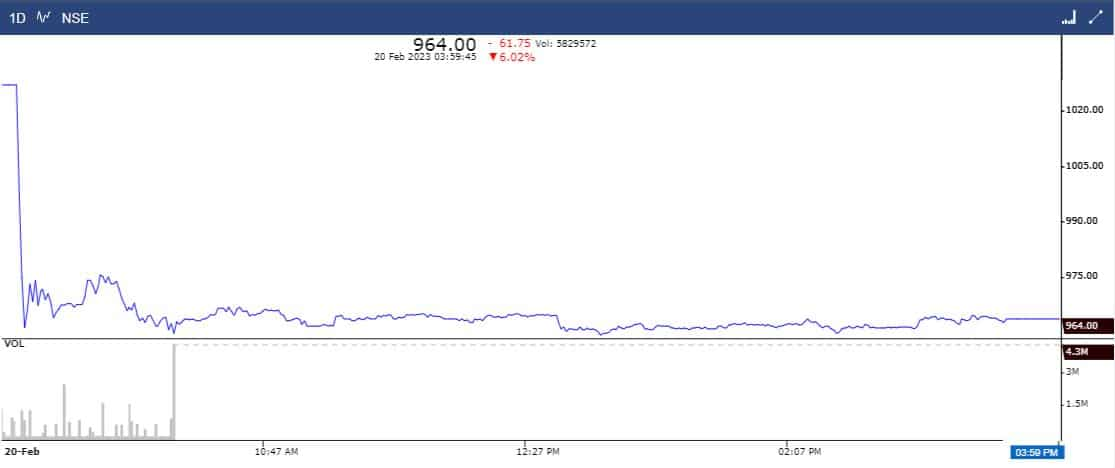

Cipla

Cipla shares declined six per cent to settle at Rs 963 apiece on NSE. On Saturday, the drug maker said it had received eight observations from US regulator FDA for its Pithampur plant in Madhya Pradesh.

Macquarie maintained an ‘outperform’ rating on Cipla with a target price of Rs 1,235 per share.

The brokerage highlighted that the Pitampur plant contributes 15 and five per cent of to the company's consolidated EBITDA and revenue respectively.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

05:54 PM IST

Promoters Samina and Rumana Hamied exit Cipla; sell 1.72% stake for Rs 2,111 crore

Promoters Samina and Rumana Hamied exit Cipla; sell 1.72% stake for Rs 2,111 crore Cipla Block Deal News: Cipla promoters offload 1.72% stake via block deals at 6% discount

Cipla Block Deal News: Cipla promoters offload 1.72% stake via block deals at 6% discount Cipla shares surge nearly 10% after positive USFDA update on Goa facility

Cipla shares surge nearly 10% after positive USFDA update on Goa facility Cipla Q2 earnings preview: Margins under pressure as US, domestic sales outlook remains modest

Cipla Q2 earnings preview: Margins under pressure as US, domestic sales outlook remains modest Cipla Vice Chairman MK Hamied steps down

Cipla Vice Chairman MK Hamied steps down