Tata Steel posts better-than-estimated Q3 result; here is what brokerages suggest

Tata Steel share price: As of 10:02 a.m., shares of Tata Steel traded 0.18 per cent lower at Rs 134.9 apiece. The market capitalisation of the company stood at Rs 1,65,951.37 crore at around the same time.

)

Tata Steel share price: Tata Steel shares traded marginally higher on the BSE and touched the day's high of Rs 136.3 apiece but pared gains later. The Tata Group company posted better-than-expected Q3 FY24 results on Wednesday after market hours.

As of 10:02 a.m., shares of Tata Steel traded 0.18 per cent lower at Rs 134.9 apiece. The market capitalisation of the company stood at Rs 1,65,951.37 crore at around the same time.

On Wednesday, after market hours, the steel maker recorded a consolidated net profit of Rs 522.14 crore in the October to December quarter of the current financial year, up from a massive Rs 2,501.95 crore loss in the same quarter of the previous fiscal, as strong domestic demand offset the losses that the company is facing in Europe. The profit was estimated at Rs 630 crore by Zee Business analysts.

Steel companies benefitted from an uptick in steel prices amid strong demand fueled by heavy infrastructure spending, but higher coking coal costs weighed on the gains.

The company's earnings before interest, tax, depreciation, and amortisation, or EBITDA, stood at Rs 6,264 crore against Rs 4,048 crore logged in the year-ago period. Margins rose to 11.3 per cent against 7 per cent YoY.

On the other hand, revenue stood at Rs 55,312 crore against Rs 57,084 crore, down 3 per cent. The analysts estimated the same at Rs 59,635 crore.

Should you buy, sell, or hold Tata Steel shares?

CLSA maintained an 'outperform' rating of the stock with a target of Rs 145 apiece. Similarly, Morgan Stanley reiterated an 'equal weight' stance and gave a target price of Rs 120 apiece.

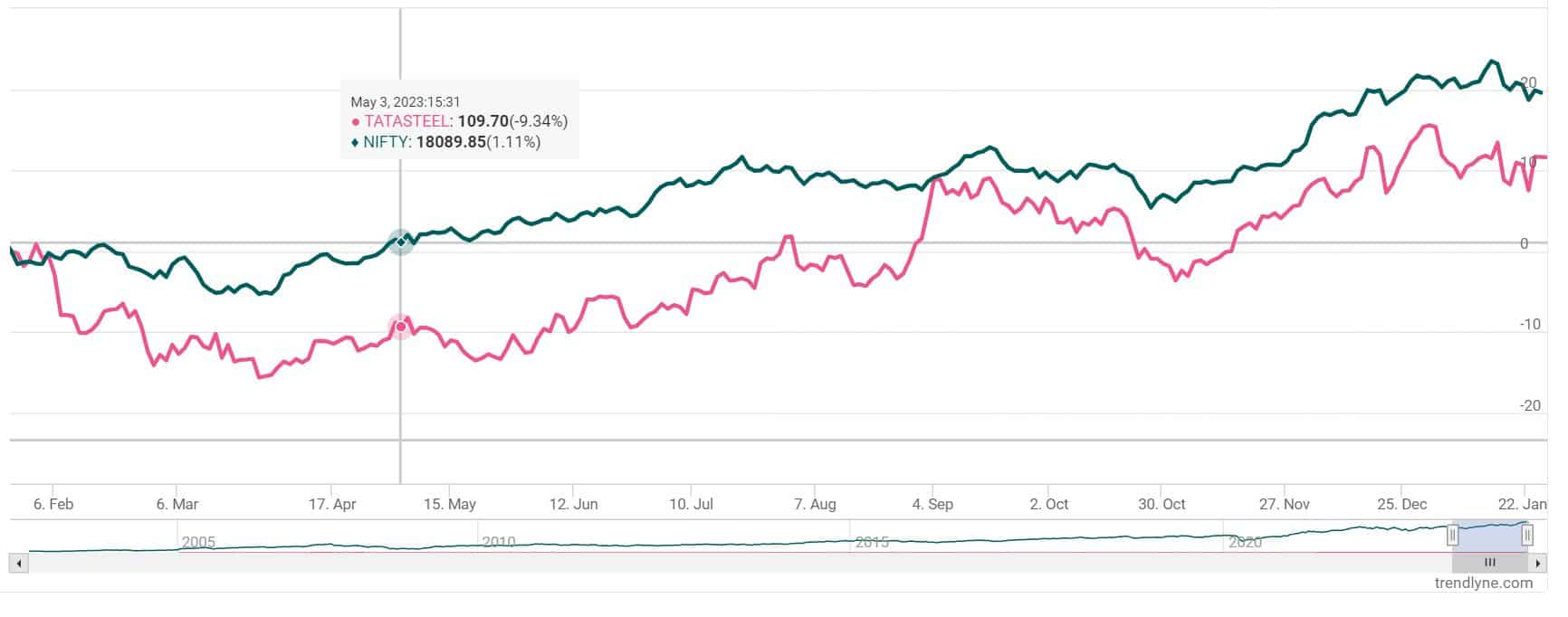

Tata Steel share price: Past performance

In a year, shares of Tata Steel have gained over 11 per cent underperforming the Nifty 50's rise of over 19 per cent.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before making any investment decisions.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Mutual Funds With Highest Returns in 3 Years: Rs 100,000 one-time investment in No. 1 scheme has swelled to Rs 2,13,588

8th Pay Commission: Can basic salary limit cross Rs 6.40 lakh mark in new pay commission? Know why it may be possible

Retirement Planning: How one-time investment of Rs 10,00,000 can create Rs 3,00,00,000 retirement corpus

Top 7 Flexi Cap Mutual Funds With Highest Returns in 1 Year: Rs 1,50,000 one-time investment in No. 1 fund is now worth Rs 1,78,740; know how others have fared

9 Stocks to Buy for Short Term: Analysts recommend largecap, midcap stocks for 2 weeks; IndusInd Bank, Coforge, MOFSL on the list

Fixed Deposit Rates for 1 Lakh Investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 3-year FD returns

11:10 AM IST

Trump’s 25% tariffs on steel shake global markets; metal stocks under pressure

Trump’s 25% tariffs on steel shake global markets; metal stocks under pressure Tata Steel expects stable realisations in India for March quarter

Tata Steel expects stable realisations in India for March quarter  Tata Steel Q3 FY25 Preview: Weak results expected with pressure on margins

Tata Steel Q3 FY25 Preview: Weak results expected with pressure on margins  Tata Steel's blast furnace in Jamshedpur achieves 50 MT production milestone

Tata Steel's blast furnace in Jamshedpur achieves 50 MT production milestone Global steel sector struggling to generate profits, demand increasing in India: Tata Steel CEO

Global steel sector struggling to generate profits, demand increasing in India: Tata Steel CEO