Investors lose Rs 10.6 lakh crore in eight days as Sensex, Nifty50 continue to fall ahead of GDP data

The Sensex and the Nifty50 finished lower for the eighth session in a row on Tuesday. Investors lost Rs 10.5 lakh crore in wealth since February 16 as the market capitalisation of BSE-listed companies reduced to Rs 257.8 lakh crore, according to provisional exchange data.

Indian equity benchmarks finished lower for the eighth day in a row on Tuesday as investors awaited an official quarterly reading of India's GDP due later in the day. India's GDP data is due at 5:30 pm. Globally, concerns about the prospect of higher-for-longer interest rates kept investors on the edge.

Both headline indices finished around half a per cent lower, with the Sensex shedding 326.2 points to settle at 58,962.1 after gyrating in a range of almost 700 points around the flatline in intraday trade. The Nifty50 lost 88.8 points or 0.5 per cent to end at 17,304, having moved broadly within the 17,250-17,450 band during the session.

Investors lost Rs 10.6 lakh crore in wealth since February 16 as the market capitalisation of BSE-listed companies reduced to Rs 257.7 lakh crore, according to provisional exchange data.

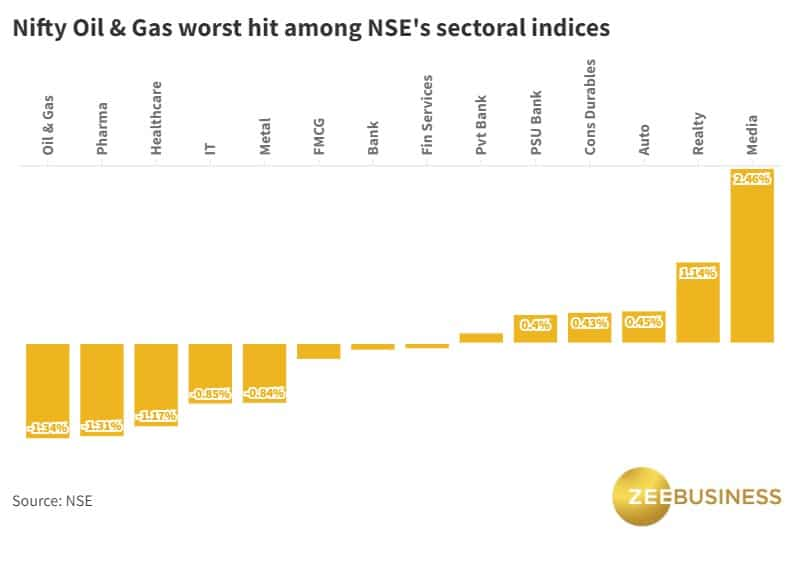

Thirty three stocks in the Nifty50 basket closed lower, with Cipla, Hindalco, Dr Reddy's, ONGC, Reliance, JSW Steel and Tata Steel — falling around 2-5 per cent for the day — being the top laggards.

Adani Enterprises was the top gainer in the blue-chip space, rising 14.9 per cent for the day. Adani Ports, Asian Paints, Britannia, Mahindra & Mahindra, PowerGrid and UltraTech were also among the stocks that rose the most among the 17 gainers in the 50-scrip universe.

Reliance, Infosys, ITC and Axis Bank posed the maximum pressure on the 30-scrip index.

The Nifty Bank inched lower at the close amid losses in Axis Bank and SBI (down one per cent) though gains in stocks such as HDFC Bank (up 0.6 per cent) kept the downside in check.

Here's how the Nifty Bank has moved over the past few days:

A majority of pharma stocks succumbed to selling pressure after drug regulator NPPA fixed retail prices of 74 formulations. Cipla, Dr Reddy's, Divi's and Sun Pharma fell between 0.7 per cent and 4.7 per cent for the day.

Overall market breadth was neutral, as 1,727 stocks rose and 1,725 fell on BSE at the close.

Analysts will track monthly sales reports by auto makers starting Wednesday for market direction.

"Global investors' interest in the equity market is weakening due to economic slowdown, led by high inflation and contractionary monetary policy. Inflows are being diverted to safe assets, and corporate earnings growth is dropping, affecting the performance of the stock market and demanding a downgrade in valuation," said Vinod Nair, Head of Research at Geojit Financial Services.

"The double whammy for India is that it is expensive compared to other emerging markets," he added.

Global markets

European markets began the day in the red after data suggested sticky inflation in France and Spain, with the pan-continent Stoxx 600 index trading down 0.4 per cent at the last count following mixed moves across Asia. Dow Jones futures eked out a gain of 0.1 per cent, suggesting a mildly positive start ahead on Wall Street.

Check out stocks to buy this week, stocks to buy in March series

Catch highlights of the February 28 session here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

07:13 PM IST

Market rally has margin trading book hitting a record Rs 54,537 crore in January

Market rally has margin trading book hitting a record Rs 54,537 crore in January How to know your risk appetite before investing in the stock market—Experts explain

How to know your risk appetite before investing in the stock market—Experts explain  Anil Singhvi strategy October 18: Important levels to track in Nifty, Nifty Bank today

Anil Singhvi strategy October 18: Important levels to track in Nifty, Nifty Bank today Anil Singhvi strategy October 17: Important levels to track in Nifty, Nifty Bank today

Anil Singhvi strategy October 17: Important levels to track in Nifty, Nifty Bank today Anil Singhvi strategy October 16: Important levels to track in Nifty, Nifty Bank today

Anil Singhvi strategy October 16: Important levels to track in Nifty, Nifty Bank today