UBS initiates coverage on Paytm; check out what the brokerage recommends

Giving an outlook on Paytm, the brokerage said regulatory issues have passed for payments and the company is expected to benefit from a 24 per cent CAGR in the payment player fee pool in FY23-28E.

)

Global brokerage UBS sees over 20 per cent upside in One 97 Communications, the parent company of Paytm, compared to Tuesday's closing price. The brokerage has a positive view as it reckons a strong top-line compound annual growth rate (CAGR) of 54 per cent in FY21-24E, driven by its core payment business and supported by device and loan origination monetisation.

Further, the brokerage believes that fintech giant profitability dynamics have improved, with its contribution margin rising to 50 per cent of revenue and positive earnings before interest, tax, depreciation, and amortisation (EBITDA).

Giving an outlook on Paytm, the brokerage said regulatory issues have passed for payments and the company is expected to benefit from a 24 per cent CAGR in the payment player fee pool in FY23-28E.

"We like Paytm's merchant loan (ML) business, as Paytm's proprietary merchant data and daily settlement provide early delinquency indications. We forecast an overall revenue CAGR of 21 per cent in FY24-28E," the report read.

UBS expects the EBITDA margin to gradually reach 20 per cent as the company is likely to break even in terms of EBITDA in FY25, aided by operating leverage and declining ESOP costs. The brokerage believes the market is overestimating the marketing cost requirements of the business since most of Paytm's customer acquisitions have been done. It estimates FY26-28 EBITDA to be 8-14 per cent above consensus.

The brokerage has given a 'buy' call on the stock for the target price of Rs 900, which implies over 20 per cent upside from Tuesday's closing.

In terms of valuation, UBS believes that Paytm is a material discounts to global payment and Indian internet peers.

"We value Paytm's core business on discounted cash flow (DCF)... We view EBITDA break-even and EBITDA growth thereafter as a key re-rating trigger," the brokerage report read.

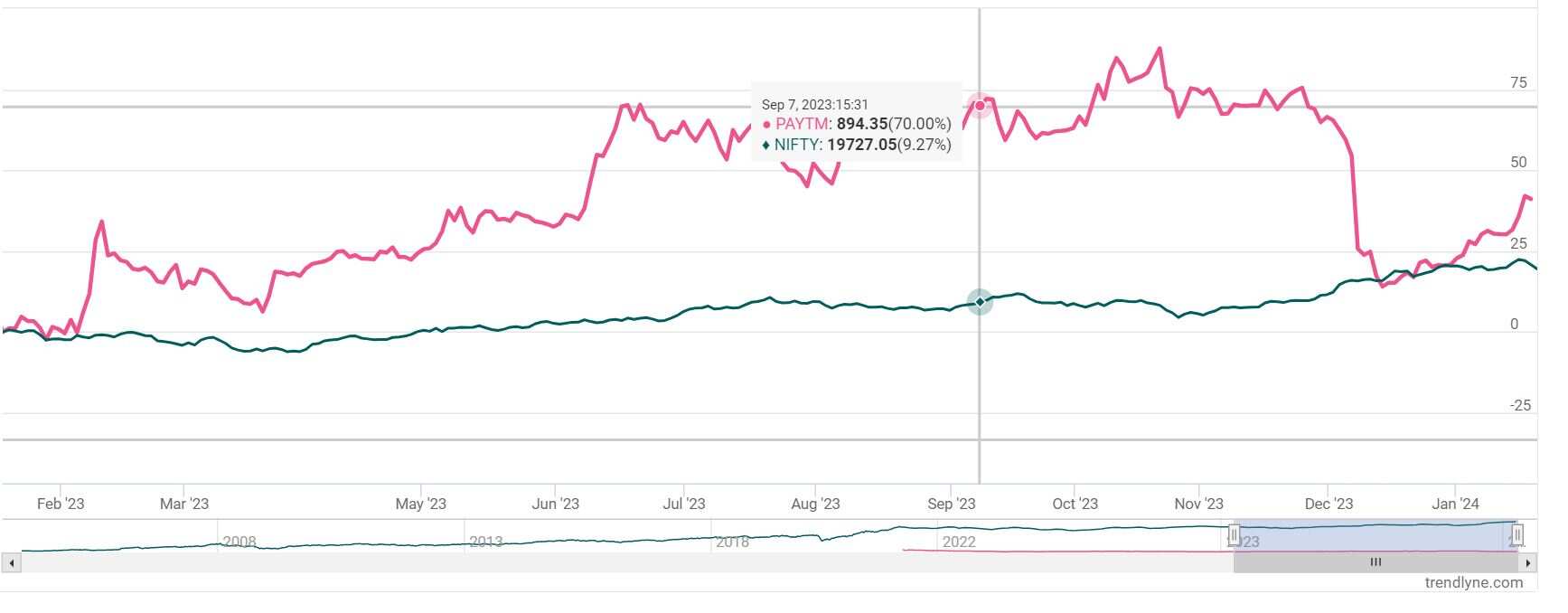

Paytm share price: Past performance

In a year, Paytm shares have gained over 41 per cent against Nifty 50's rise of over 20 per cent.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

03:11 PM IST

Paytm shares decline 5%; hit lower circuit limit

Paytm shares decline 5%; hit lower circuit limit Paytm shares fall over 15% in 2 days

Paytm shares fall over 15% in 2 days Paytm block deal: 1.4% equity changes hands via multiple block deals; stock rises

Paytm block deal: 1.4% equity changes hands via multiple block deals; stock rises Paytm shares hit lower circuit again; Anil Singhvi suggests exiting the stock

Paytm shares hit lower circuit again; Anil Singhvi suggests exiting the stock Paytm shares gain 3% ahead of its Q2 results; Jefferies initiates buy

Paytm shares gain 3% ahead of its Q2 results; Jefferies initiates buy