Max Financial Services hits 52-week high on strong Q1 nos, further stake purchase by Axis Bank

At the time of filing this report, around 12:45 pm, Max Financial Services stock traded at Rs 874.5 apiece, up 10.72 per cent or Rs 84.7 on the bourse.

)

Shares of Max Financial Services zoomed over 12 per cent and hit a 52-week high on the BSE at Rs 885.9 apiece in Thursday's trading session. Dalal Street showed buying interest in the stock after the company released its June quarter (Q1 FY24) numbers and informed bourses that Axis Bank will buy an additional seven per cent stake in Max Life, a material subsidiary of Max Financial Services.

At the time of filing this report, around 12:45 pm, Max Financial Services stock traded at Rs 874.5 apiece, up 10.72 per cent or Rs 84.7 on the bourse. The scrip recovered all of Wednesday's trading losses. The market capitalisation of the company stood at Rs 30,180.29 crore.

How did the company perform in Q1?

The company's consolidated profit after tax (PAT) came in at Rs 101 crore against Rs 68 crore logged in the year-ago period, up 48 per cent year-on-year (YoY), according to the regulatory filing.

Max Financial Services' margins during the quarter expanded from 21.3 per cent, a year earlier to 22.2 per cent, and the value of new business grew by 16 per cent year-on-year (YoY) to Rs 247 crore.

Assets under management (AUM) of the company grew by 20.5 per cent to Rs 129 lakh crore against Rs 1.07 lakh crore in the year-ago period.

Apart from this, the board of Max Financial Services and Max Life has approved Axis Bank's proposal to infuse Rs 1,612 crore by subscribing to 14.26 crore equity shares of Max Life at a fair market value of Rs 113.06 per share. Upon completion of the proposed infusion, Axis entities will collectively hold 19.02 per cent of the equity share capital of Max Life.

This capital infusion will help Max Life support its future growth ambitions, augment its capital position, and improve solvency margins.

Brokerages' views

Global brokerages are bullish on the company after its strong Q1 performance.

CLSA has maintained a 'buy' with a target price of Rs 1025 apiece, which implies an upside of 29.8 per cent from Wednesday's closing price.

Jefferies has also maintained a 'buy' for a target of Rs 800 apiece, which translates to an upside of 1.3 per cent from Wednesday's closing price.

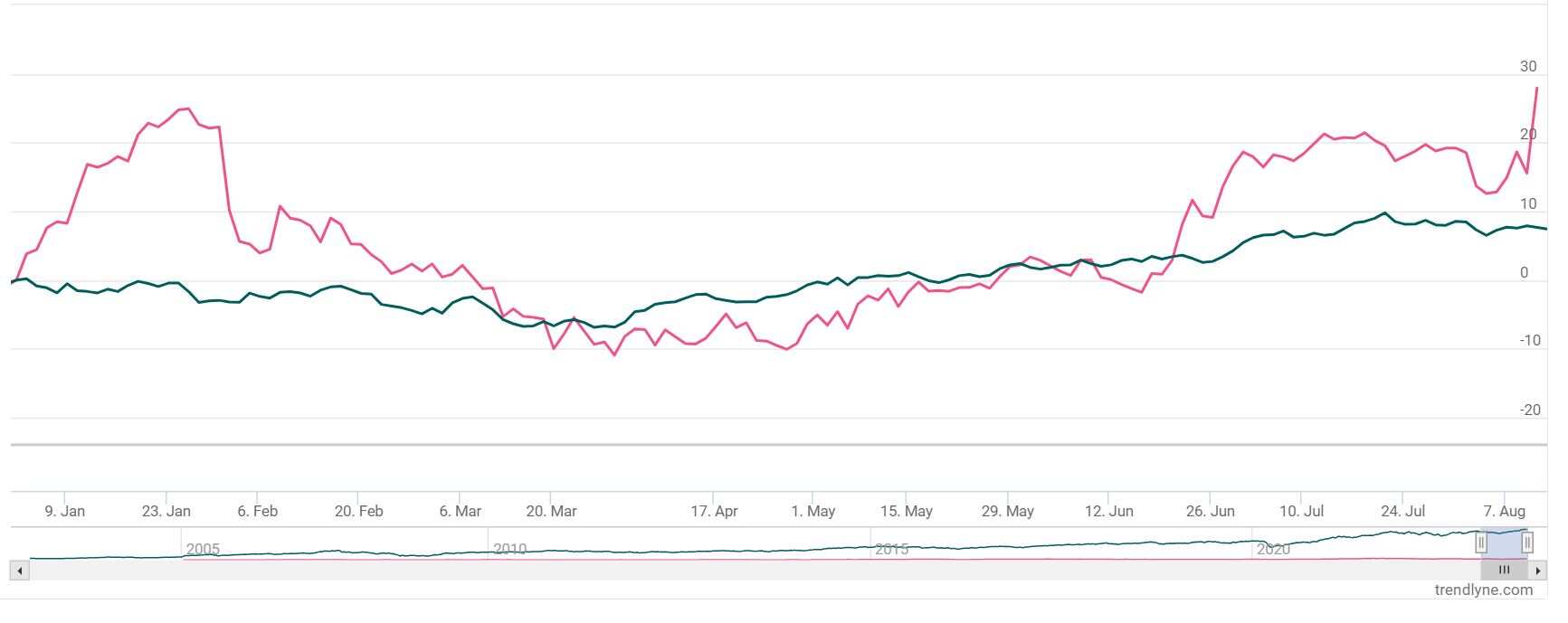

Max Financial Services share price: Past performance

The stock has gained over 27 per cent in 2023 so far, against Nifty's rise of over seven per cent.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

02:02 PM IST

Max Financial Services' promoter sells 3.18% stake for Rs 1,218 crore

Max Financial Services' promoter sells 3.18% stake for Rs 1,218 crore Axis Bank hikes stake in Max Life for Rs 336 crore

Axis Bank hikes stake in Max Life for Rs 336 crore Max Financial shares gain over 3% post Q4 earnings: Should you buy, hold or sell the stock?

Max Financial shares gain over 3% post Q4 earnings: Should you buy, hold or sell the stock? Max Financial Services soars after IRDAI approves Axis Bank-Max Life capital infusion deal

Max Financial Services soars after IRDAI approves Axis Bank-Max Life capital infusion deal Private life insurers shares in demand as CLSA upbeat on HDFC Life, SBI Life, ICICI Pru life and other stocks

Private life insurers shares in demand as CLSA upbeat on HDFC Life, SBI Life, ICICI Pru life and other stocks