This logistics solution provider is expected to rise 20% in next 6-12 months; take a look

Stock market news: The company serves over 400 customers via its two business segments: supply chain management (SCM), which accounts for 96 per cent of revenues, and enterprise mobility.

)

Stock market news: Mahindra Logistics, an end-to-end third-party (3PL) logistics solution provider, made its debut in the secondary market on November 10, 2017. The issue price of the scrip was Rs 429 apiece. Since then, the scrip has seen its fair share of rally as the stock hit an all-time high of Rs 819.15 on August 30, 2021. However, it failed to sustain the upside, and currently, the stock price is hovering around Rs 384 on the BSE, way below its issue price.

A quick look at the financials of the last three years shows that the company has been oscillating between losses and gains. For instance, the company reported a loss of Rs 16.64 crore in the June 2020 quarter; however, in the June 2021 quarter, the net profit came in at Rs 3.04 crore. The next year, i.e., in the June 2022 quarter, the figure stood at Rs 13.25 crore. In the June 2023 quarter, however, the firm reported a loss of Rs 8.46 crore.

However, the company's operating profit growth has been impressive. The figure stood at Rs (-) 2.22 crore in the June 2020 quarter, which increased to Rs 40.61 crore in the June 2021 quarter and Rs 65.71 crore in the June 2022 quarter. During the June 2023 quarter, it stood at Rs 66.63 crore, according to Screener. in data.

Here are the key figures (Source: Screener.in)

ICICI Securities has placed the stock on its 'High Conviction Idea' list. The brokerage believes that the company's profitability turnaround is about to begin, as expected losses on the B2B front are lowering.

Mahindra Logistics serves over 400 customers via its two business segments: supply chain management (SCM), which accounts for 96 per cent of revenues, and enterprise mobility. Revenues from Mahindra comprise 54 per cent of SCM revenues, while the rest is contributed by non-Mahindra.

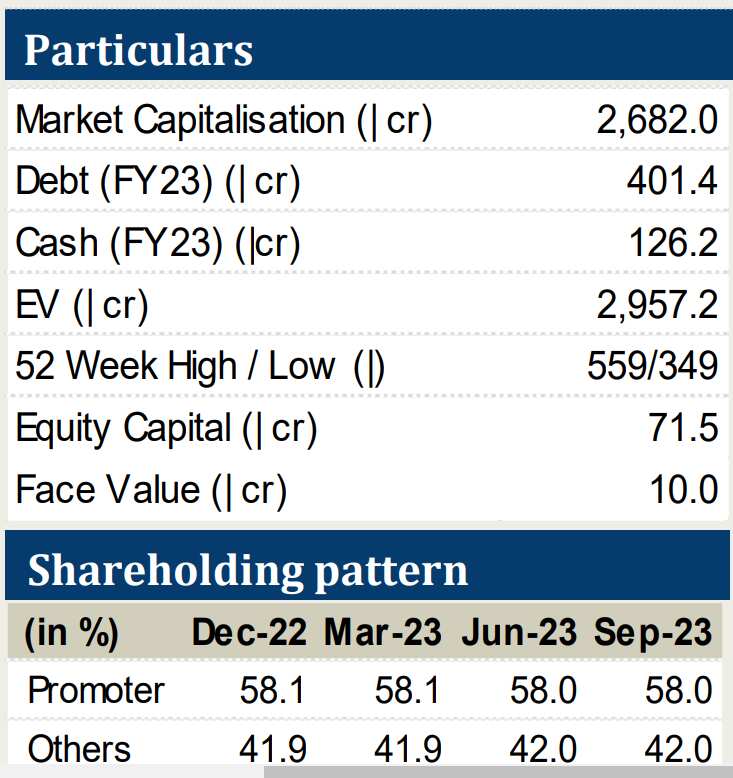

Mahindra Logistics' particulars

Source: ICICI Securities

Why the brokerage is bullish on Mahindra Logistics

Harshal Mehta, a research analyst with ICICI Securities, notes that Mahindra Logistics saw a volume drop in Q1 (25-30 per cent), due to ongoing integration with the Rivigo vertical (integration began in Q4FY23 FY23). However, synergies such as transportation cost reduction and consolidation of facilities and infrastructure are on track, while the management is actively clawing back lost volumes and expects Q3 to witness positive traction.

Secondly, as per the Redseer report, the festive season has begun with a strong sales figure (up 16 per cent)."Although these are initial trends (higher premiumisation seen), they reinforce belief in the normalisation of positive Indian consumption story. E-commerce typically utilises higher warehousing components and hence is beneficial on both volumes and margins front," the brokerage said in its latest report.

The third reason why the brokerage has a 'buy' call on the stock is the company's asset-light business model, with a target of over 15 per cent return on equity (RoE) in FY25.

"The management has targeted an ROE of 18 per cent by FY26 and expects mid-teen growth each year in the 3PL business, and other businesses (Last Mile, MESPL, etc) are also expected to follow suit and provide differentiated services. MLL's range of services, along with its integrated, tailored services to clients, would help it capture a larger wallet share of its customers, the report said further," the report adds.

Given these rationales, the brokerage has given a 'buy' call on the stock with a target price of Rs 450 in the next 6-12 months.

The stock on Monday ended at Rs 391.85 on the BSE, up 5.46 per cent.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Large and Mid Cap Mutual Funds With up to 21% SIP Returns in 10 Years: Rs 11,111 monthly SIP investment in No. 1 fund has sprung to Rs 40,45,114; know about others

Want to use market crash as a buying opportunity? Analysts suggest buying Bharti Airtel, HDFC Life and 3 more shares for up to 39% gains

08:55 AM IST

FIRST TRADE: Indices open higher; Nifty at 23,981, Sensex gains 205 points

FIRST TRADE: Indices open higher; Nifty at 23,981, Sensex gains 205 points Traders' Diary: Buy, sell or hold strategy on ITC, BHEL, L&T, Colgate Palmolive, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on ITC, BHEL, L&T, Colgate Palmolive, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on Infosys, Tata Motors, HPCL, NTPC, SBI Card, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Infosys, Tata Motors, HPCL, NTPC, SBI Card, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on HAL, BEL, HPCL, Marico, Premier Energies, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on HAL, BEL, HPCL, Marico, Premier Energies, over a dozen other stocks today Zomato to join BSE Sensex, replacing JSW Steel from December 23

Zomato to join BSE Sensex, replacing JSW Steel from December 23