Mahindra CIE zooms 9% on stellar March quarter numbers

At the time of writing this report, the stock traded over 7 per cent higher at Rs 383.90 on the BSE as against a 0.06 per cent decline in the benchmark index, Sensex at 60,092.61 points. Here's what analysts suggest

Shares of Mahindra CIE Automotive jumped over 9 per cent to hit a high of Rs 392.70 on the BSE in early morning deals on April 26 after the firm, on Tuesday, reported a nearly 73 per cent surge in its net profit for the March quarter. The profit surged on the back of strong domestic and European demand.

At the time of writing this report, the stock traded over 7 per cent higher at Rs 383.90 on the BSE as against a 0.06 per cent decline in the benchmark index, Sensex at 60,092.61 points.

Mahindra CIE's consolidated profit came in at Rs 279 crore for the quarter ended March 31, up from Rs 161 crore a year ago.

Lower commodity costs and pent-up demand boosted sales in India's auto industry last year. Vehicle pre-purchases ahead of the April 1 adoption of new fuel emission standards, as well as robust demand throughout the festival season, propelled sales, the company said. The revenue from the India segment rose 13.3 per cent to Rs 1,468 crore.

The automotive company, which counts Maruti, Tata- Jaguar Land Rover (JLR) and Renault among its customers, reported revenue at Rs 2,440 crore in the March quarter, up from Rs 2,061 crore reported a year earlier, while expenses jumped 16.7 per cent.

The Board of Directors have also finalised a dividend of Rs 2. 50 per Equity Share of Rs 10 each fully paid up for the financial year ending December 31, 2022.

What do analysts suggest on Mahindra CIE?

Brokerage firm Axis Securities has given a ‘buy’ call on shares of Mahindra CIE Automotive with a target price of Rs 475 apiece which is an upside of 24 per cent from Tuesday's closing price. The brokerage is bullish on the company because of its market share gains in India and Europe, management’s focus on improving margin trends, and its capability to generate strong operating cash flows.

"Mahindra CIE's Indian business is in good shape supported by a healthy order book and the operating performance in European business has started showing improvement in reduction in energy cost. The hiving off of its German forging business would further strengthen its operating performance," said Abhishek Gaoshinde, Deputy Vice President Research at Sharekhan by BNP Paribas

He added that the sustainable volume growth and an uptick in EBITDA margin trajectory would turn into a re-rating of the stock.

Anand Rathi has given a 'buy' call on Mahindra CIE, "Recently, the said counter has taken out its previous swing high of 378.50 on the daily scale along with Daily RSI rebounding from 45 levels which are looking lucrative 'buy'. One can buy in the zone of 372-377 with an upside target of 415 and a stop-loss would be 355 on a daily close basis," said Jigar S Patel - Senior Manager - Technical Research Analyst, Anand Rathi Shares and Stock Brokers.

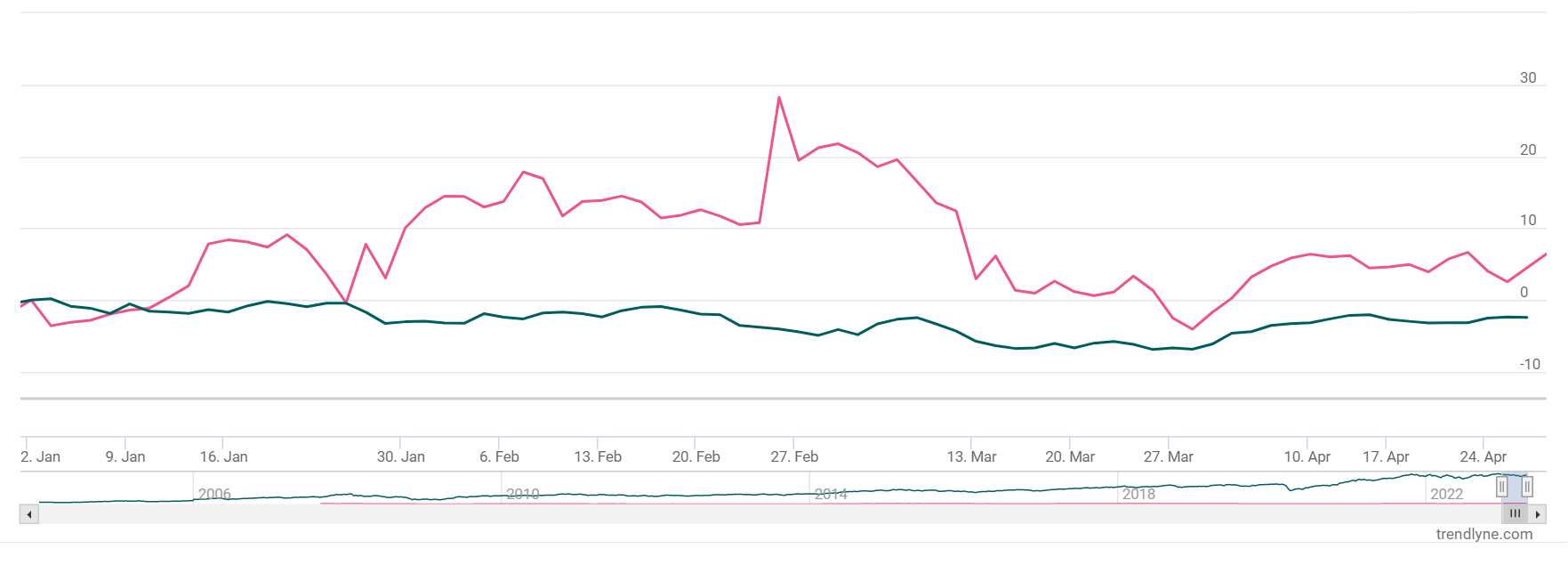

Mahindra CIE share price history

On a year-to-date (YTD) basis, the shares of Mahindra CIE have surged over 11 per cent as compared to Nifty50’s dip of over 2.64 per cent. In the past six months, the stock has gained over 30 per cent, a sharp rise as compared to the headline index’s decline of 0.11 per cent.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

03:10 PM IST

Traders' Dairy: Buy, sell or hold strategy on Bajaj Auto, Tata Consumer, Mahindra CIE, Mphasis, GNFC, 15 other stocks

Traders' Dairy: Buy, sell or hold strategy on Bajaj Auto, Tata Consumer, Mahindra CIE, Mphasis, GNFC, 15 other stocks Auto Q3 Results Preview: ICICI Securities expects passenger car, two-wheeler margins to stay flat, tractors to shine

Auto Q3 Results Preview: ICICI Securities expects passenger car, two-wheeler margins to stay flat, tractors to shine Christmas Special: Buy THESE 9 stocks to for bumper returns | Santa Stocks on Zee Business

Christmas Special: Buy THESE 9 stocks to for bumper returns | Santa Stocks on Zee Business