LIC hits 52-week high; stock has risen over 25% in a year

Stock market news, share market today: With nearly 62.58 per cent of the new business market share in FY23, Life Insurance Corporation of India (LIC), the only public sector life insurer in the country, continued to be the market leader.

)

Stock market news, share market today: Shares of Life Insurance Corporation (LIC) hit their 52-week high level of Rs 900 apiece on the BSE in the morning deals on Tuesday, January 16, 2024. The stock has risen over 25 per cent in the past 12 months.

At around 10:44 am, the stock was trading nearly 4.5 per cent higher at Rs 892.55 apiece. The market capitalisation of the company was Rs 5,64,442.79 crore at the same time. The stock ended at Rs 892.50, up 4.42 per cent.

About LIC

India Brand Equity Foundation, in its report dated August 2023, quoting the data released by the insurance regulator, the Insurance Regulatory and Development Authority of India (IRDA), notes that LIC improved its market share by 67.72 per cent as of October, a gain of 447 basis points (bps). At the end of 2021–22, private players had a 36.75 per cent share of the life insurance market, while LIC had 63.25 per cent.

With nearly 62.58 per cent of the new business market share in FY23, Life Insurance Corporation of India (LIC), the only public sector life insurer in the country, continued to be the market leader.

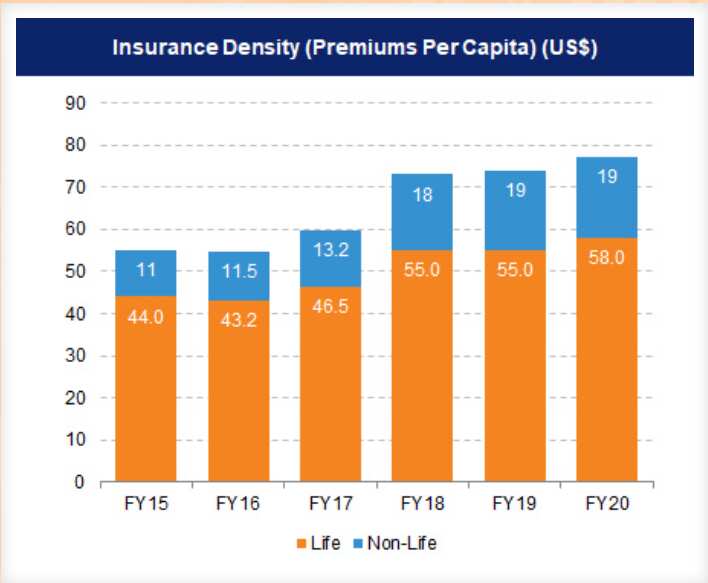

The life insurance industry was expected to increase at a CAGR of 5.3 per cent between 2019 and 2023. India’s insurance penetration was pegged at 4.2 per cent in FY21, with life insurance penetration at 3.2 per cent and non-life insurance penetration at 1 per cent. In terms of insurance density, India’s overall density stood at US$78 in FY21, notes the India Brand Equity Foundation in its report on the insurance industry.

Premiums from India’s life insurance industry are expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY31.

Market Size (Life Insurers)

The premium in March 2023 for the private life insurance industry grew at a healthy pace of 35 per cent on a year-on-year (YoY) basis and 20 per cent for FY23.

Life insurance firms collected 18 per cent more premiums in FY23 compared to the year before. Life insurers collected Rs. 3.71 lakh crore (US$ 44.85 billion) as the first-year premium in FY23 as against Rs. 3.14 lakh crore (US$ 37.96 billion) in FY22, according to the latest IRDAI data.

Debashish Panda, Chairman, IRDAI, said that the insurance industry in India became a Rs 59 crore (US$ 7.1 million) industry as of February 2023.

Source: https://www.ibef.org/industry/insurance-sector-india

LIC Q2 FY24 results

The state-owned insurer reported a 50 per cent fall in net profit at Rs 7,925 crore for the quarter ended September 30, on lower income. The country's biggest insurer had a net profit of Rs 15,952 crore in the year-ago period, LIC said in a regulatory filing. Its net premium income eased to Rs 1,07,397 crore in the second quarter of the current fiscal, from Rs 1,32,631.72 crore in the same period a year ago. READ MORE

Shares of the insurer were listed on May 17, 2022.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:28 PM IST

LIC shares rise up tp 4% on likely health insurance foray

LIC shares rise up tp 4% on likely health insurance foray LIC, HDFC Life, ICICI Pru, SBI Life: Insurance stocks surge after upbeat premium numbers in February

LIC, HDFC Life, ICICI Pru, SBI Life: Insurance stocks surge after upbeat premium numbers in February