JSW Infrastructure makes strong debut at Dalal Street, shares list at 20% premium

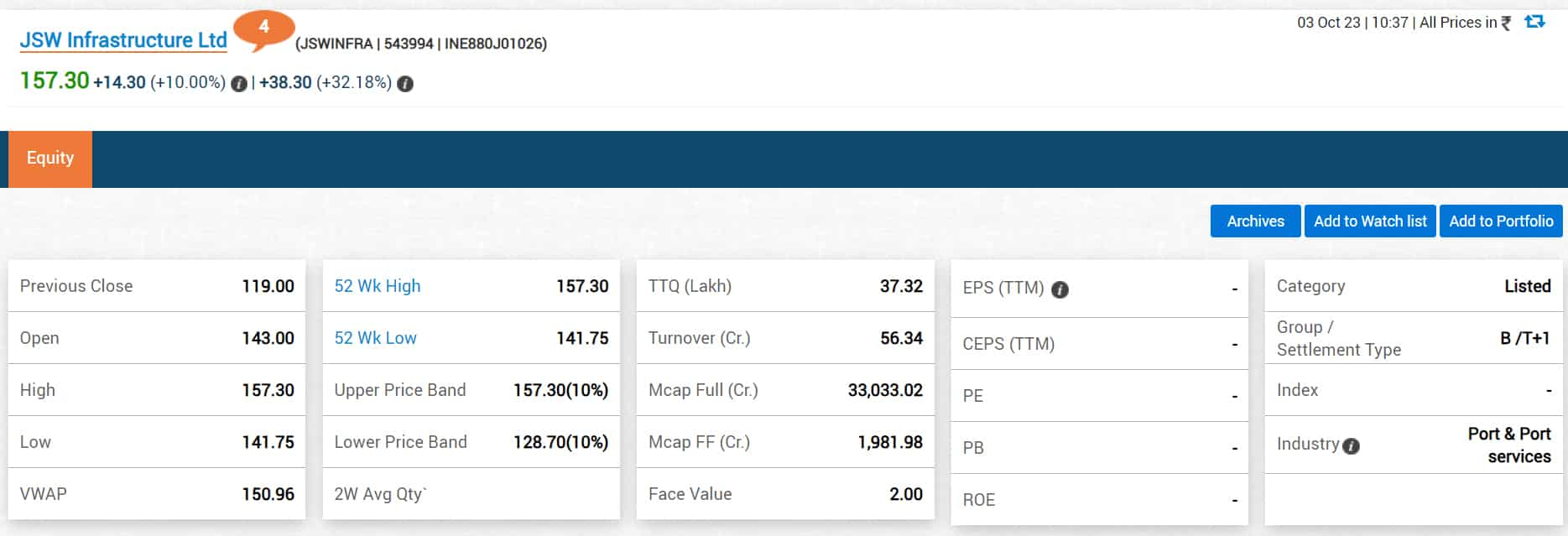

JSW Infrastructure IPO Listing, JSW Infra Share Price BSE & NSE: The shares were listed at Rs 143, a premium of over 20 per cent over the IPO issue price of Rs 119, on the Bombay Stock Exchange (BSE).

)

JSW Infrastructure IPO Listing, JSW Infra Share Price BSE & NSE: Shares of JSW Infrastructure, a part of the JSW Group, made a strong debut on Dalal Street today i.e. on October 3. The shares were listed at Rs 143, a premium of over 20 per cent over the IPO issue price of Rs 119, on the Bombay Stock Exchange (BSE). The shares were listed at the same price, i.e. Rs 143, on the National Stock Exchange (NSE).

However, shares later went on to touch the high of Rs 157.30 - a jump of 10 per cent from the opening price of Rs 143 - on the BSE. Last seen, it was trading at Rs 156.30 on the BSE and Rs 155 on the NSE.

The debut was in line with the market expectations and several experts had predicted a strong debut for JSW Infratructure. Anil Singhvi, Managing Editor, Zee Business, too had predicted a strong debut and advised investors to subscribe to the issue for reasonable listing gains and long term.

Singhvi said that the JSW Infra is a ‘must have in portfolio’ stock. “Valuations are reasonable, but the outlook for 2-3 years is very strong,” he added.

Meanwhile, the issue of JSW Infra was listed within the T+2 timeline or within two trading days after completing its Initial Public Offering (IPO) last week. Also, this marked the first IPO from the JSW Group in 13 years. The last IPO listed was of JSW Energy in 2010.

Earlier, the IPO of JSW Infrastructure was subscribed 37.37 times on the last day of bidding on Wednesday. The Rs 2,800-crore IPO had a price range of Rs 113-119 per share. The public issue was entirely a fresh issue of equity shares.

KFin Technologies was the registrar for the JSW Infrastructure Limited IPO. With this listing, the firm has substantially reduced the allotment process timelines to T+2 (IPO closing date + 2 working days).

"Trading members of the exchange are hereby informed that effective Tuesday, October 3, the equity shares of JSW Infrastructure Ltd shall be listed and admitted to dealings on the exchange in the list of 'B' group of securities," according to a BSE notice dated September 29.

Proceeds of the JSW Infrastructure issue to the tune of Rs 880 crore will be used to repay debt, Rs 865.75 crore to finance capital expenditure requirements for an LPG terminal project, Rs 59.4 crore for setting up an electric sub-station, as per a circular.

Further, Rs 103.88 crore will be used for the purchase and installation of a dredger and Rs 151.04 crore for the proposed expansion at Mangalore Container Terminal, it said. These apart, the proceeds will also be used for general corporate purposes.

JSW Infrastructure, a port-related infrastructure company, provides maritime-related services, including cargo handling, storage solutions, logistics services, and other value-added services to its customers.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:56 PM IST

JSW Infrastructure hits all-time high after firm gets contract from Chidambaranar Port Authority

JSW Infrastructure hits all-time high after firm gets contract from Chidambaranar Port Authority  JSW Infrastructure Q2 Results: Profit rises 85% to Rs 256 crore

JSW Infrastructure Q2 Results: Profit rises 85% to Rs 256 crore  JSW Infrastructure has huge potential to grow its business: Sajjan Jindal

JSW Infrastructure has huge potential to grow its business: Sajjan Jindal JSW Infrastructure IPO allotment status: Step-by-step guide to check application status; listing date on NSE, BSE

JSW Infrastructure IPO allotment status: Step-by-step guide to check application status; listing date on NSE, BSE JSW Infrastructure IPO fully subscribed on Day 2

JSW Infrastructure IPO fully subscribed on Day 2