FIRST TRADE | Sensex gains nearly 350 points, Nifty eyes 18,700 amid buying across sectors; NTPC, Axis Bank hit 52-week highs

Indian equity benchmarks began Tuesday's session in the green tracking positive moves across other major markets around the globe, ahead of a key US inflation reading and the onset of two-day deliberations at the Fed's rate-deciding panel later in the day.

)

Indian equity benchmarks began Tuesday's session in the green tracking positive moves across other major markets around the globe, ahead of a key US inflation reading and the onset of two-day deliberations at the Fed's rate-deciding panel later in the day. Both headline indices gained around half a per cent each in early deals, with the Sensex rising as much as 348.2 points to 63,072.86 and the Nifty50 climbing to as high as 18,698.4, up 96.9 points from its previous close.

At 9:30 am, the 30-scrip blue-chip index held on to the green firmly, with a gain of 329.7 points at 63,054.4 and the 50-scrip headline index stood at 18,696.

ITC, Asian Paints, Titan, Hindustan Unilever and Axis Bank rose the most among the 43 gainers in the Nifty basket, rising around 1-2 per cent each. On the other hand, Hero MotoCorp, Adani Ports, Kotak Mahindra Bank and Bajaj Auto — down around half a per cent each — were the worst hit. ITC, Axis Bank, Asian Paints and Reliance were the biggest contributors to the rise in both main gauges.

Four stocks in the Sensex basket scaled 52-week peaks: Axis Bank, IndusInd Bank, NTPC and UltraTech.

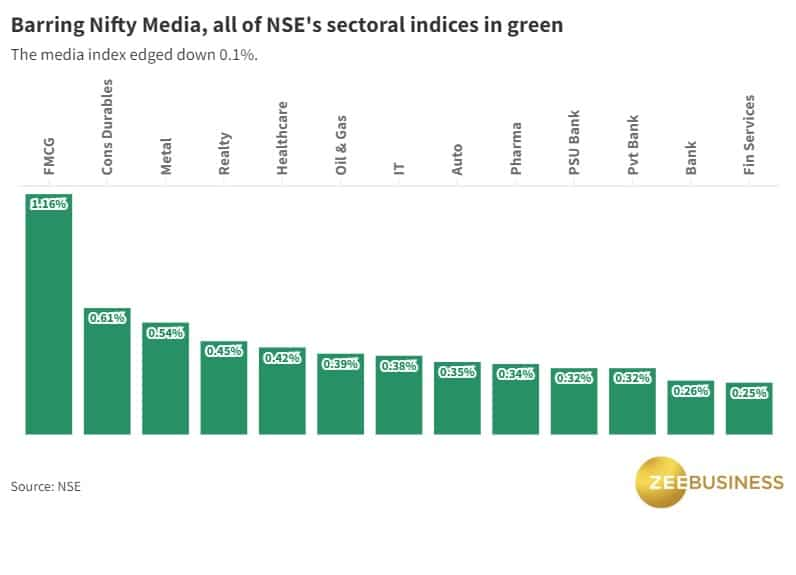

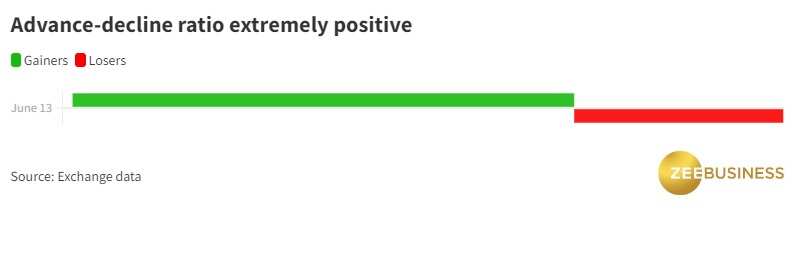

Overall market breadth favoured the bulls, with an advance-decline ratio of 12:5 as 2,157 stocks rose and 899 fell in early trade on BSE, whose broadest index — the BSE 500 — climbed up 0.6 per cent.

Broader indices Nifty Midcap 100 and Nifty Smallcap 100 went up 0.8 per cent and 0.6 per cent respectively.

Investors pinned hopes of an earlier-than-anticipated reduction in the repo rate — the key interest rate at which the RBI lends money to commercial banks — a day after official readings suggested consumer inflation eased to a 25-month low and factory output stayed in expansion mode in the country. The better-than-expected inflation tally comes at a time when major central banks are struggling to control sticky inflation without disrupting economic growth.

Inflation in India came in at 4.25 per cent in May, moving closer to the RBI's medium-term target of four per cent, as cost pressures on food eased. Separate data showed industrial output in the country increased 4.2 per cent on a year-on-year basis in April, also better than economists' estimates.

EDITOR'S TAKE | How Anil Singhvi views the market

Zee Business Managing Editor Anil Singhvi sees a strong buy zone in the Nifty at 18,475-18,550 levels. The market wizard believes traders need not worry as long as the Nifty and the Nifty Bank stay above 18,450 and 43,650 levels on a closing basis respectively. Read more on his strategy for the day

Global markets

Equities in other major Asian markets began the day on a strong note, with MSCI's broadest index of Asia Pacific shares outside Japan trading 0.7 per cent. Japan's Nikkei 225 surged 1.9 per cent.

Overnight on Wall Street, the three main US indices — the Dow Jones, the S&P 500 and the Nasdaq Composite — finished 0.5-1.5 per cent higher, with the tech stocks-heavy gauge scaling a one-year closing high as investors awaited US inflation data and the Fed rate decision this week.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:17 AM IST

"Indian markets are indicating that they are in an expensive zone," says Sanjay Bembalkar of Union Asset Management

"Indian markets are indicating that they are in an expensive zone," says Sanjay Bembalkar of Union Asset Management Indian stock market surges by 13.8% in June quarter, outperforming global peers

Indian stock market surges by 13.8% in June quarter, outperforming global peers Brokers seek grandfathering of client FDs already submitted for margin purpose

Brokers seek grandfathering of client FDs already submitted for margin purpose Indian stock indices touch fresh all-time highs; Sensex, Nifty up over 1 %

Indian stock indices touch fresh all-time highs; Sensex, Nifty up over 1 % Bakra Eid market holiday: NSE, BSE to remain shut today

Bakra Eid market holiday: NSE, BSE to remain shut today