Gainers and Losers: Top 10 stocks that buzzed the most today

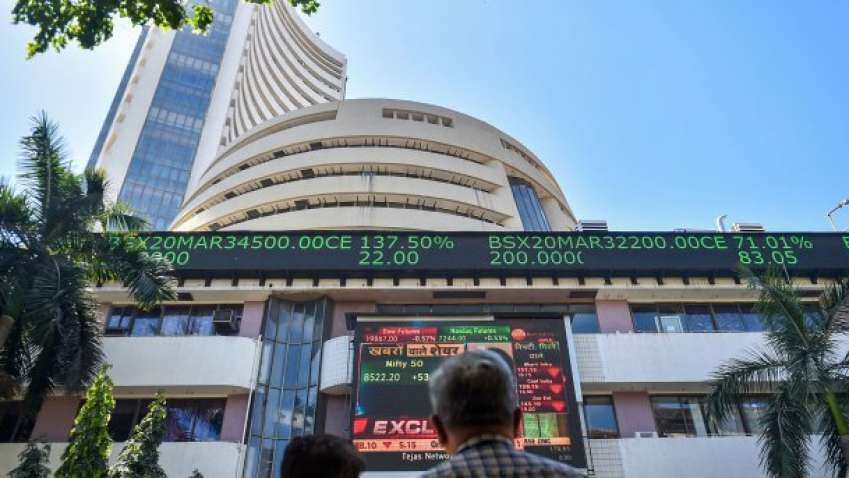

Gainers and Losers: BSE Sensex closed the session at 61,940.20, up 179 points, or 0.29 per cent. Here's what brokerages recommend.

Gainers and Losers: Indian equity benchmarks BSE Sensex and Nifty ended higher on Wednesday. BSE Sensex closed the session at 61,940.20, up 179 points, or 0.29 per cent while the NSE's Nifty ended at 18,315.10, up 49 points, or 0.27 per cent.

Among Nifty firms, IndusInd Bank, HDFC Life Insurance, Power Grid, Tata Motors, and BPCL were major winners

On the flip side, UPL, Dr Reddy’s Laboratories, Infosys, Hindalco, and Sun Pharma were the laggards.

“On the daily charts, the Nifty is still hovering around the upper boundary (18,350) of the broad trading range (18,000 – 18,350) and both bulls and bears are trying hard to defend their respective boundaries. On the way down, 18,220 – 18,200 is acting as a crucial support zone while 18,330 – 18,350 is acting as an immediate hurdle and the Nifty is witnessing volatile trade within this range. Until, we get a decisive close beyond the extremes of this range the sideways price action is likely to continue," said Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas.

Here is a list of Top 10 stocks that buzzed the most today:

1. IndusInd Bank

IndusInd shares rose over 2 per cent to end at Rs 1,172.2 apiece on NSE.

Nuvama has given a 'buy' rating on IndusInd Bank (IIB) with a target price of Rs 1,280 apiece.

“IIB continues to steadily improve on most parameters. We expect this trend to sustain going forward,” Nuvama said in its report.

2. UPL

UPL was among the top loser on Nifty50. Shares of UPL declined 2 per cent at Rs 680.5 apiece.

Nuvama has maintained a 'buy' on UPL.

“We believe the stock protects downside risk, not to mention the sustained improvement in the balance sheet,” said the brokerage.

3. HDFC Life Insurance

HDFC Life Insurance was among the top winner on Nifty50. Shares of HDFC Life rose over 1 per cent at Rs 562 apiece.

B&K Securities has maintained a 'buy' on HDFC Life with a target price of Rs 450 apiece.

“HDFC Life’s strong growth in 4QFY23, we expect growth to be slower in FY24E owing to the high base effect,” said the brokerage.

4. Dr Reddy’s Laboratories

Dr Reddy’s Laboratories was among the top loser on Nifty50. Shares of Dr Reddy’s Laboratories declined 1 per cent at Rs 4,869 apiece.

Axis Securities has given a ‘buy’ call on shares of Dr Reddy’s Laboratoriers for a target price of Rs 5,100 apiece.

“Dr Reddy’s Laboratories is planning to launch at least 30 products in the US in FY24E. As per the management, the complex drugs in the pipeline may drive double-digit revenue growth over the next 4-5 years,” said the brokerage.

5. Latent View

Latent View stock fell over 10 per cent at Rs 335.2 apiece after the company recorded weak Q4FY2023 results.

Anand Rathi has recommended buying shares of Latent View for a target price of Rs 455 apiece.

“The current PE is not a true representation as the company is sitting on Rs 10,570 million cash, which is yielding only 3-4% pre-tax. This, when utilised for an acquisition, should contribute more to the bottom line (from a cash-flow standpoint). Our target is based on 40x FY25e PE,” said brokerage,

6. DreamFolks Service

DreamFolks Services' shares rose over 8 per cent at Rs 488 apiece.

Arihant Capital has given a ‘buy’ call on shares of DreamFolks Service for a target price of Rs 500 apiece.

“DFS will be one of the biggest beneficiaries of growing air travel in India, and due to its first mover advantage and dominant position in the airport lounge access providers, the company is poised to grow exponentially in the future,” said the brokerage.

7. Hindalco

Hindalco stock ended lower by 0.52 per cent at Rs 438 apiece.

ICICI Direct has given a ‘buy’ call on shares of Hindalco for a target price of Rs 465 apiece.

“We value Hindalco at Rs 465, based on the Sum of the Parts Valuation,” said brokerage.

8. Infosys

Infosys stock declined nearly 1 per cent at Rs 1,264 apiece and ended among the top losers on NSE.

Nuvama has given a ‘buy’ call on shares of Infosys for a target price of Rs 1610 apiece.

“While Q4 results are disappointing, we view it and the lower FY24 guidance as a manifestation of the overall weak macros, which might keep Infosys – and other IT stocks – under pressure in the near term. Over the medium-to-long term though, we expect Infosys to benefit from the strong demand environment. Retain ‘BUY/SO’,” the brokerage said.

9. Tata Motors

Tata Motors was among the top winner on Nifty50. Shares of Tata Motors rose over 1 per cent at Rs 510.05 apiece.

Morgan Stanley has maintained an ‘Overweight’ rating with a target price of 513 rupees. Brokerage is bullish on Jaguar Land Rover’s expansion in the Electric Vehicle segment.

10. Sun Pharmaceutical

Sun Pharma closed marginally lower at Rs 954 apiece and ended among the top losers on NSE.

Nirmal Bang has given a ‘buy’ call on Sun Pharma for a target price of Rs 1,202 apiece.

“We remain positive on Sun Pharmaon the back of the following catalysts: (i) Ramp-up of Branded/Specialty business in the US (recently acquired Deuruxolitinib would further strengthen the Specialty pipeline) (ii) Continued growth in India business (iii) Potential inorganic opportunity due to a strong balance sheet,” said the brokerage.

Catch the latest stock market updates here. For more news on sports, politics follow Zee Business

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

06:19 PM IST

Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers— Top 10 stocks that buzzed the most today

Gainers and Losers— Top 10 stocks that buzzed the most today Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today