GCPL-Raymond deal: Stocks fall post the deal announcement; what do investors need to know?

Godrej Consumer (GCPL) and Raymond ltd (RCCL) shares traded in red after the acquisition announcement, should you buy, sell or hold?

Shares of Godrej Consumer and Raymond were under pressure on Friday, April 28 after Godrej Consumer (GCPL) announced the acquisition of the FMCG business of Raymond Consumer Care Limited (RCCL) worth Rs 2,825 crore.

“Godrej Consumer Products Limited (GCPL) today announced that it has entered into an agreement to acquire the FMCG business of Raymond Consumer Care Limited (RCCL), a leading player in the deodorants and sexual wellness categories in India. The RCCL FMCG business is being sold to GCPL along with the trademarks of Park Avenue (for the FMCG category), KS, KamaSutra and Premium, through a slump sale,” Godrej Consumers informed through a regulatory filing on April 27.

At the time of filing this report, shares of Godrej Consumer traded over 3 per cent lower on NSE at Rs 918.8 apiece. On BSE the stock quoted Rs 915.95 per share.

Meanwhile, shares of Raymond Ltd fell over 5 per cent on NSE and traded at Rs 1,617.4 apiece, and on BSE the scrip traded at Rs 1618 per share.

Godrej Consumer through an investor presentation said that it has acquired the FMCG business of Raymond as Raymond’s categories have a strong growth runway, strong but under-leveraged brands and significant cost synergies.

What do analysts suggest on Raymond?

Brokerage firm Systematrix Research has given a ‘buy’ call on Raymond for a target price of Rs 1,832 apiece.

According to the brokerage, the current management team looks committed and energised to aggressively drive its agenda of Go To market revamps, digital integration, cash generation, and cost rationalisation.

"Raymonds has witnessed a sharp surge during the month of April where it witnessed a perpendicular rise from Rs 1,100 to Rs 1,750. The upmove has been accompanied with a sharp rise in volume which suggests that strong hands have entered the counter. The daily momentum indicator has triggered a positive crossover from the equilibrium line indicating that it has started a new cycle on the upside," said Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas.

Gedia added considering the sharp runup in the last month a consolidation cannot be ruled out, however, the overall uptrend is still intact. The ideal strategy to trade/invest in the stock is to adopt a buy-on-dip strategy. Crucial support is placed at the Rs 1500 to Rs 1520 zone. On the upside, the stock can touch levels of Rs 2000 from a medium-term perspective.

"In the current month itself, the said counter has given a one-sided 59 per cent return. Additionally, on a daily scale, RSI is placed at 82 levels which is an extremely overbought situation, so one should wait for a dip till Rs 1540 to Rs 1550 for fresh longs," said Jigar S Patel - Senior Manager - Technical Research Analyst, Anand Rathi Shares and Stock Brokers

What do analysts suggest on Godrej Consumer?

Nuvama has recommended buying shares of Godrej Consumer for a target price of Rs 1,130 apiece. The brokerage added GCPL has been keeping up the growth momentum through continued innovation.

On the other hand, analyst believe that GCPL stock can see a further correction.

"Godrej Consumer Products was in a medium-term uptrend and has faced sharp correction from around 1000 levels. The weekly and the daily momentum indicator have a negative crossover which is a sell signal. In terms of price pattern it has broken down from a rising wedge pattern indicating a trend reversal from up to down," said Gedia.

He added, over the medium term we expect the stock to correct till levels of Rs 867 to Rs 830 which are the 38.2 per cent and 50 per cent fibonacci retracement levels of the rise from Rs 660 to Rs 995.

"At the current juncture, the said counter is in corrective mode. Moreover, multiple trendline violation is seen on a daily scale at the said counter. So one needs to wait till 860-870 for fresh longs," said Patel.

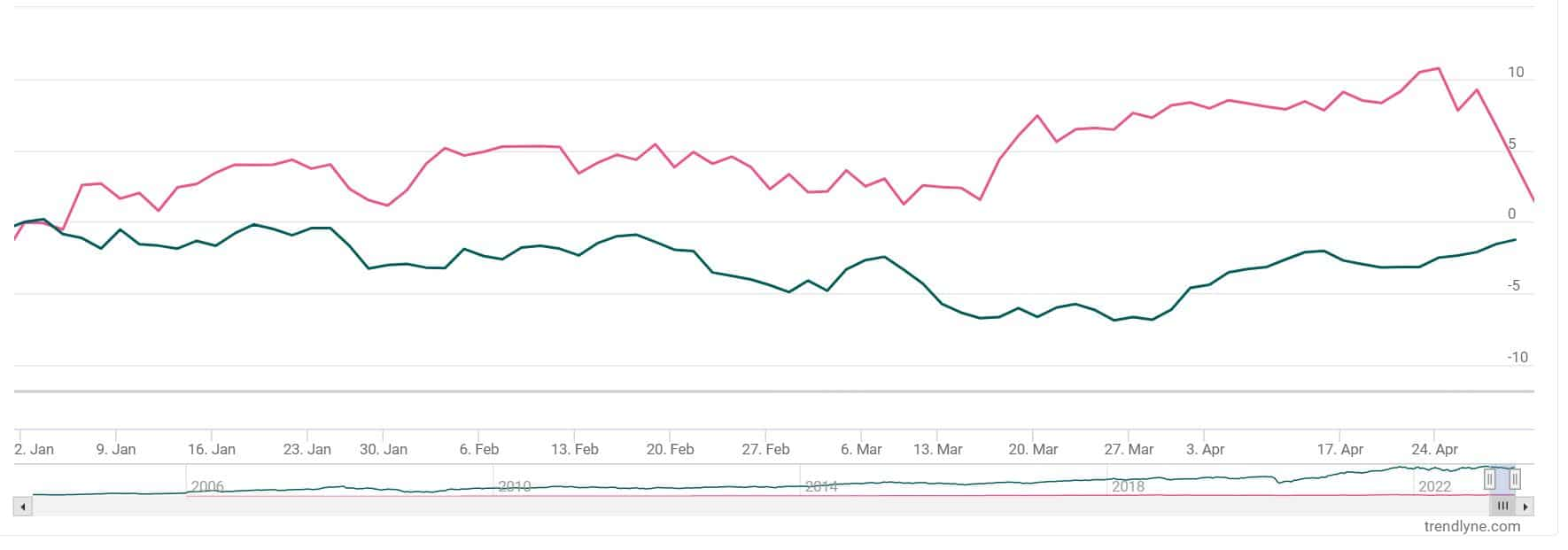

Godrej Consumer share price history

On a year-to-date (YTD) basis, the shares of Godrej Consumer rose over 2 per cent as compared to Nifty50’s dip of over 1 per cent

In the past six months, the stock rose over 4 per cent as compared to the headline index’s rise of nearly 1 per cent.

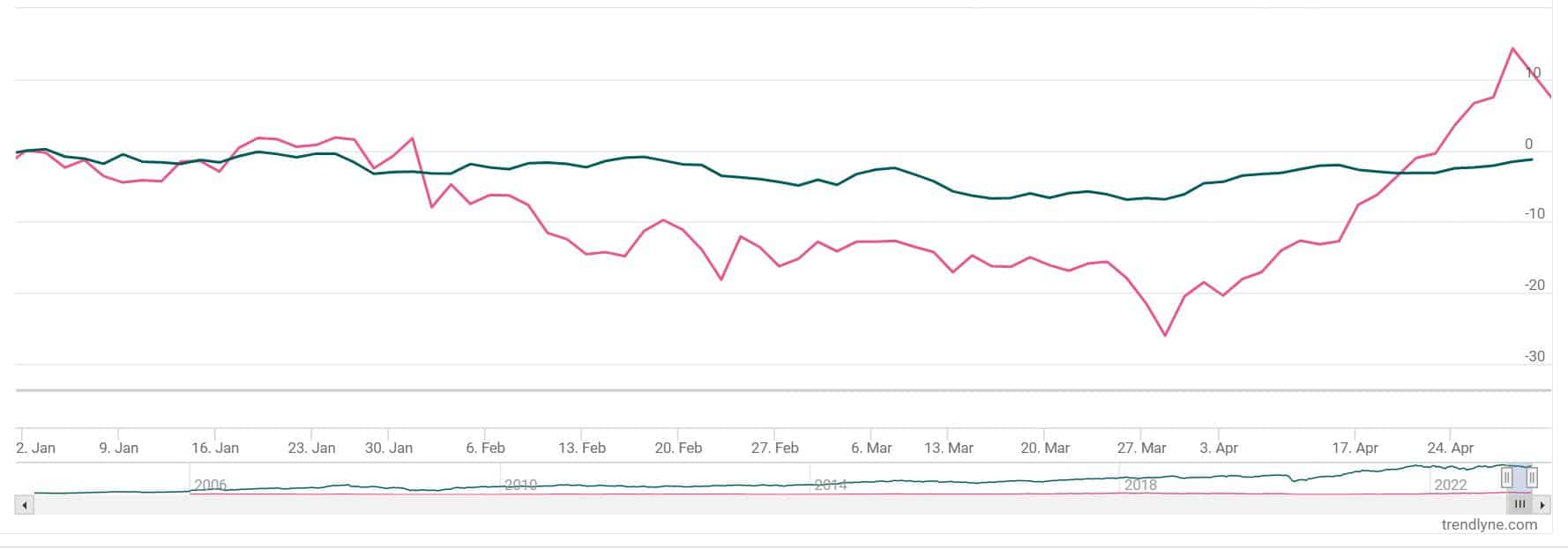

Raymond's share price history

On a year-to-date (YTD) basis, the shares of Raymond have surged nearly 8 per cent as compared to Nifty50’s dip of over 1 per cent.

In the past six months, the stock has seen over a 39 per cent rise against the headline index’s rise of nearly 1 per cent.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

01:30 PM IST

Nisaba Godrej resigns from VIP Industries board citing differences on accountability, succession

Nisaba Godrej resigns from VIP Industries board citing differences on accountability, succession Godrej Consumer Products Q3 Results Preview: Firm expected to report strong operational performance in December quarter

Godrej Consumer Products Q3 Results Preview: Firm expected to report strong operational performance in December quarter Godrej Consumer Products Interim Dividend: FMCG announces 500% interim dividend in its Q2 results

Godrej Consumer Products Interim Dividend: FMCG announces 500% interim dividend in its Q2 results Godrej Consumer appoints Aasif Malbari as CFO

Godrej Consumer appoints Aasif Malbari as CFO Should you buy, sell or hold Dr Reddy’s, L&T, Godrej Consumer, Gujarat Gas, other stocks today?

Should you buy, sell or hold Dr Reddy’s, L&T, Godrej Consumer, Gujarat Gas, other stocks today?