Federal Bank shares jump as lender eyes deposit-driven growth – what else is driving shares

Federal Bank's management at the Analyst Day meeting said, “Deposits have grown faster than Advances providing significant headroom for future growth.” In reaction, Federal Bank shares were in demand on Tuesday.

Federal Bank shares were in demand during Wednesday’s trading session on the exchanges. The stock quoted a day’s high level of Rs 133.05 per share, up around 3 per cent from Tuesday’s closing of Rs 129.1 per share on the BSE today.

At around 01:05 PM, the scrip was up around 3 per cent to Rs 132.95 per share versus a 0.61 per cent rise in the Sensex.

The stock witnessed a buying sentiment on positive management commentary at the Analyst Day meet on Tuesday. The management said “Deposits have grown faster than Advances providing significant headroom for future growth.”

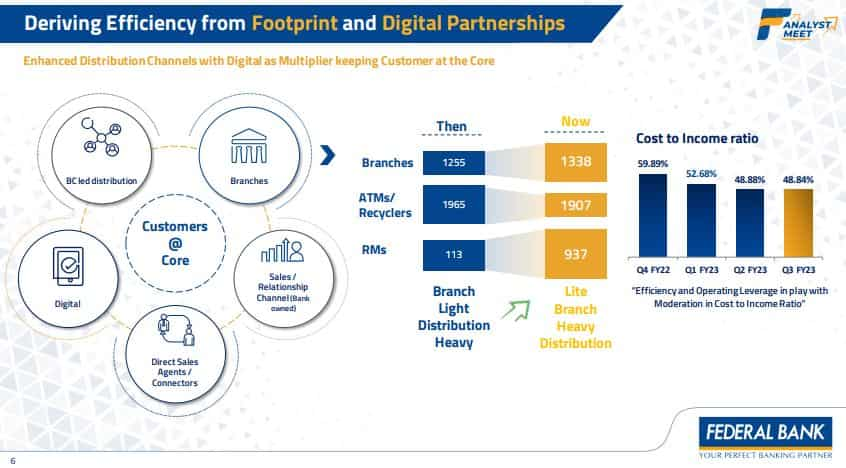

The bank’s management aims to grow the loan book in the high teens, driven by digital and fintech partnerships, and continue to focus on growing its high-margin products by leveraging data analytics.

Besides, a rating agency India Ratings has rated Federal Bank’s additional limits of Basel III Tier 2 Bonds and affirmed existing bonds at ‘IND AA’ with a positive outlook, the private lender said in a separate release on February 28, 2023.

Also Read: Federal Bank Q3 Results: Profit, NII jump to record highs as asset quality improves

“The positive outlook reflects the consistent strengthening of bank’s credit profile as reflected in its progressing liability franchise, improving diversification of its loan portfolio, reasonably well-managed asset quality and stable credit costs,” India Ratings in its comment on Federal Bank.

Most global brokerages are upbeat on the bank after positive commentary by management and see up to 36 per cent upside potential in the stock. Morgan Stanley maintains an ‘overweight’ rating, while UBS has a ‘neutral’ call and CITI retained a ‘buy’ stance on the bank.

| Brokerages | Rating | Price Target |

| Morgan Stanley | Overweight | Rs 175 |

| UBS | Neutral | Rs 155 |

| CITI | Buy | Rs 165 |

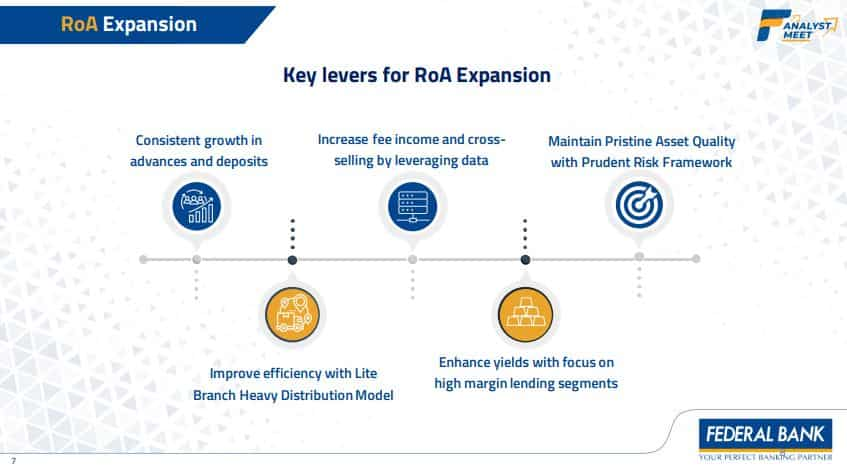

Morgan Stanley said that improving the loan mix towards higher-margin assets will be the key focus over the next 3 years for Federal Bank. While UBS said that the management is optimistic about key business drivers as well as reaffirmed net interest margin (NIM) and return on asset (ROA) guidance.

Even domestic brokerage firm Motilal Oswal has a ‘buy’ rating on Federal Bank with a target of Rs 170 per share as it believes the lender is well placed to deliver RoA expansion, led by controlled credit costs and a rise in the mix of high-yielding segments.

Federal Bank share price: Historical performance

Federal Bank share price has given decent returns to its investors in the last one year as the stock gained around 38 per cent during the said period as compared to a nearly seven per cent rise in the S&B BSE Sensex.

The stock in the last six months grew around 12 per cent against almost 1 per cent rise in the benchmark index during the same period.

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:05 PM IST

Federal Bank shares surge 8% after September quarter earnings announcement

Federal Bank shares surge 8% after September quarter earnings announcement Federal Bank rallies over 7% on strong Q2 performance; brokerages upbeat

Federal Bank rallies over 7% on strong Q2 performance; brokerages upbeat Federal Bank hits new high for the second session on Q1 result beat

Federal Bank hits new high for the second session on Q1 result beat This private sector bank up 48% in 1 year hits all-time high price: Check the trigger

This private sector bank up 48% in 1 year hits all-time high price: Check the trigger Federal Bank rolls out UPI-enabled RuPay Wave credit card; here's how to apply

Federal Bank rolls out UPI-enabled RuPay Wave credit card; here's how to apply