Exide Industries powers to all-time high after Morgan Stanley raises target; maintains stance

At around 10:38 a.m., shares of Exide Industries traded 3.04 per cent, or Rs 12.1, higher on BSE at 409.8 apiece. The market capitalisation of the company stood at Rs 34,833 crore at around the same time.

)

Exide Industries shares hit an all-time high in the morning deals on Monday (April 15) at Rs 423.8 apiece on BSE. The stock soared after global brokerage Morgan Stanley maintained an 'overweight' rating and raised the target to Rs 485 apiece from Rs 373 apiece.

At around 10:38 a.m., shares of Exide Industries traded 3.04 per cent, or Rs 12.1, higher on BSE at 409.8 apiece. The market capitalisation of the company stood at Rs 34,833 crore at around the same time.

Morgan Stanley believes the stock could rise significantly over the next 10 years and the company can become a leading player in battery cell localisation.

Moreover, the government's support for "Made in India" Electric Vehicles (EV), strong auto and industrial customer tie-ups, and tech tie-ups, will also favour the company's growth.

As per the report, the addressable Total addressable market (TAM) which demonstrates the entire revenue opportunity that exists within a market for a product or service, for Exide could rise sharply. The brokerage estimates the TAM at 150GWh/US $13 billion by 2030 for India's lithium battery segment.

Further, it reckons that the Hyundai and Kia contract validates capabilities and a multi-year contract is likely. In the scale-up phase, battery stocks tend to trade at 4x-6x P/B, implying Exide's price could nearly double over 12 months.

Exide offers solutions in areas of equipment selection, battery sizing, optimum room layout, installation, operation, and maintenance. Exide boasts of a distribution network and service that is continuously monitored and kept contemporary through evolving life cycles and is always ahead of the competition.

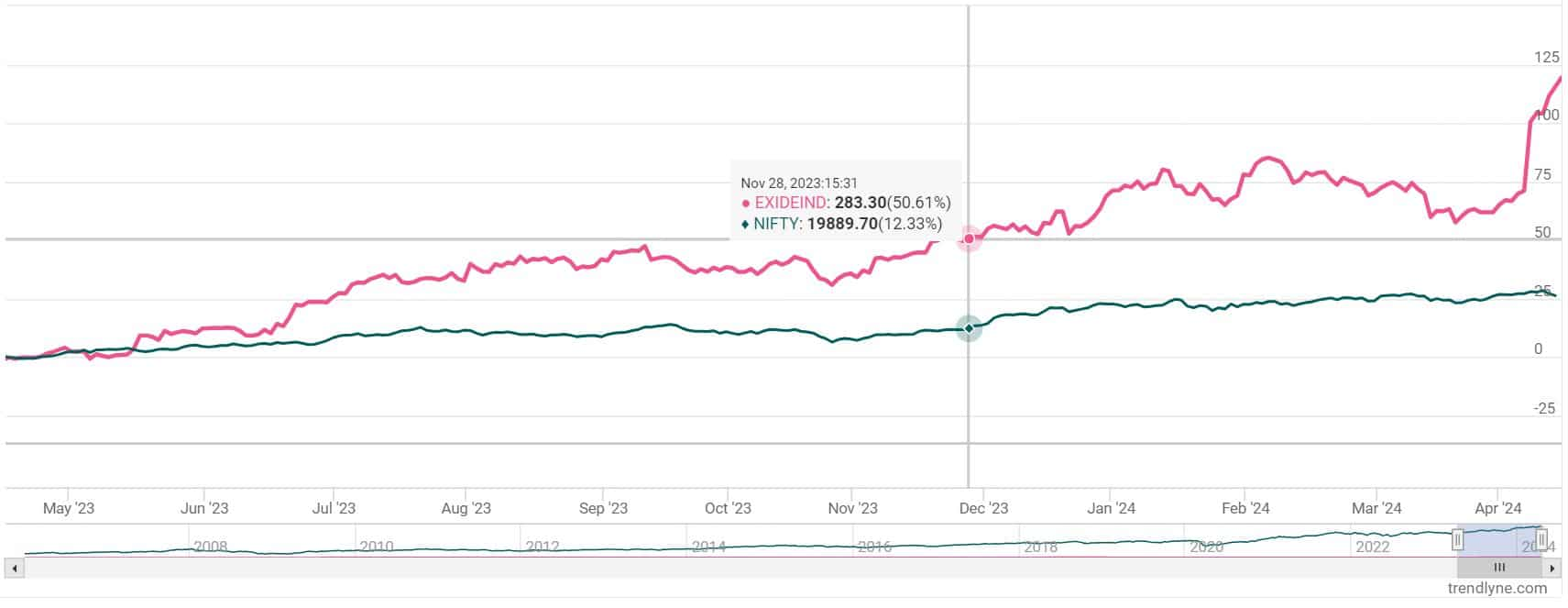

Exide Industries share price: Past performance

In a year, shares of have given a multi-bagger return of over 118 per cent against Nifty50's rise of over 26 per cent.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

11:49 AM IST

Exide Industries Q2 PAT down 13.66% at Rs 233.4 crore

Exide Industries Q2 PAT down 13.66% at Rs 233.4 crore This battery maker doubles investors money in 6 months; technicals hint at further upside

This battery maker doubles investors money in 6 months; technicals hint at further upside  Exide Industries shares climb new ATH on Q4 EBITDA and margins beat

Exide Industries shares climb new ATH on Q4 EBITDA and margins beat Exide Industries Q2 PAT up 12% at Rs 270 crore

Exide Industries Q2 PAT up 12% at Rs 270 crore Exide Industries expects to regain pre-covid margin in 1-2 years

Exide Industries expects to regain pre-covid margin in 1-2 years