What's in store for defence stocks that have given double- to triple-digit returns? Experts decode

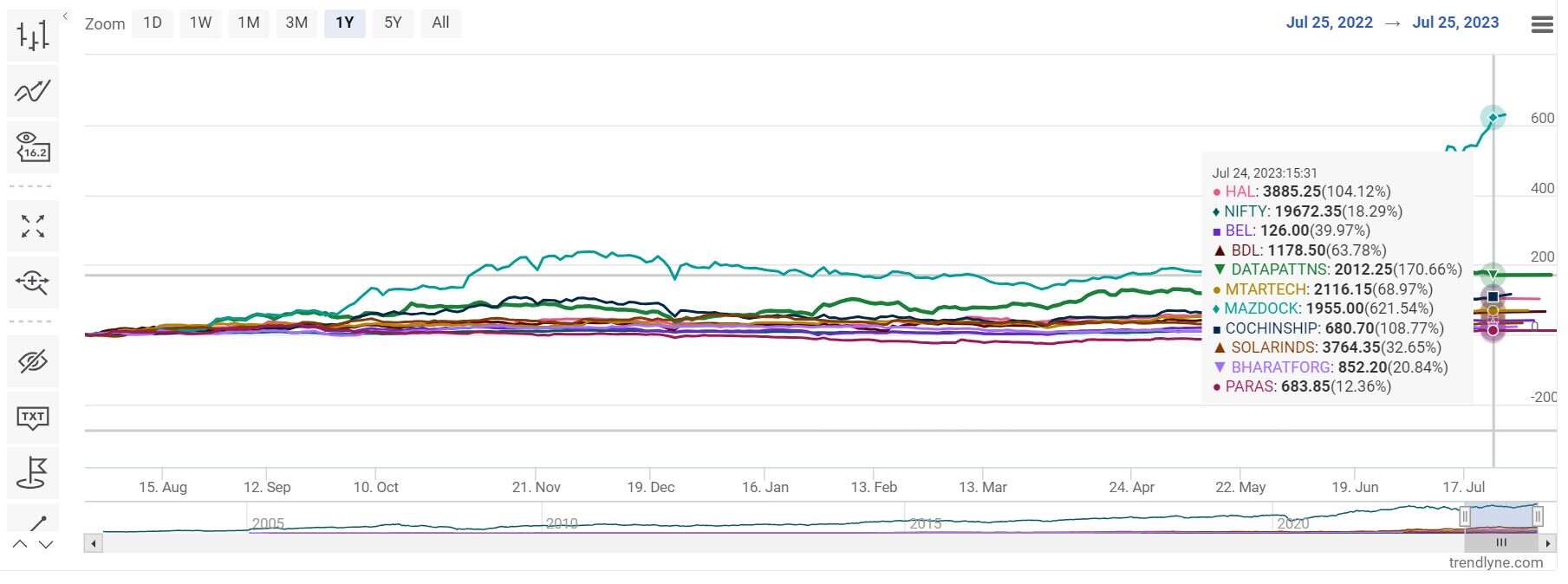

Among individual defence stocks, Mazagon Dock Shipbuilders Ltd has gained a whopping over 576 per cent in a year, followed by Data Patterns (India) Ltd which has seen a growth of over 174 per cent in a year; Hindustan Aeronautics (HAL) has rallied over 106 per cent and Cochin Shipyard Ltd has gained over 105 per cent.

)

Defence sector stocks have been on fire this year, with most scrips giving double- to triple-digit returns. The stellar rally in the stocks is mainly due to long-term execution growth visibility, a robust order book, and a healthy pipeline.

Among individual stocks, Mazagon Dock Shipbuilders Ltd has gained a whopping over 576 per cent in a year, followed by Data Patterns (India) Ltd which has seen a growth of over 174 per cent in a year; Hindustan Aeronautics (HAL) has rallied over 106 per cent and Cochin Shipyard Ltd has gained over 105 per cent.

Meanwhile, in the double-digit growth category, Bharat Electronic has gained over 40 per cent in a year, Bharat Dynamics and MTAR Technologies have risen over 63 per cent in a year, Solar Industries has climbed over 30 per cent, Bharat Forge has risen over 20 per cent and Paras Defence and Space Technologies Ltd has climbed nearly 10 per cent.

What's boosting the rally in defence stocks?

As per analysts, countries across the world are increasing their defence budgets by monitoring the Russia-Ukraine war crisis. Hence, Indian defence-related companies are witnessing solid orders. Talking about India itself, the Ministry of Defence has allocated a total budget of Rs 5.9 trillion in FY23-24, which is 13 per cent of the total budget, with capital allocations pertaining to modernisation and infrastructure development of the defence services. These apart, 'Make in India' and 'Atma Nirbhar Bharat' initiatives, have ensured domestic growth, analysts at PhillipCapital note.

Apart from these, there is a substantial cost advantage over global peers due to a large skilled workforce, which allows global original equipment manufacturers, or OEMs, to use India as a base for production and exports, they note.

Further, it must be noted that the Ministry of Defence (MoD) plans to procure Rs 8 trillion worth of platforms and weapon systems over the long term from domestic manufacturers.

Hence, these factors are likely to keep defence stocks on an upward trajectory.

But take note of the challenges too!

As per Narendra Solanki, Head of Fundamental Research at Investment Services, Anand Rathi Shares, and Stock Brokers, the following are the challenges for the defence sector that one must keep in mind while investing their money in stocks:

-Companies' dependence on foreign OEMs for the supply of critical components;

-Requirement of a highly skilled workforce and dependency on government approvals, which usually take a long time.

Stocks to buy

ICICI Securities is bullish on Bharat Electronics (BEL), the company's order book is likely to be boosted by long-term fuse orders from the Indian Army.

The brokerage also expects progress on Smart Anti-Airfield Weapon (SAAW), Project Zorawar, and the development of an air-launched variant of Amogha-III ATGM, benefiting Bharat Dynamics (BDL).

Further, according to the brokerage, Astra Microwave is likely to experience trickle-down benefits from the orders to BEL and BDL.

Phillip Capital is bullish on the defence sector as a whole and prefers to bet on Bharat Electronics (BEL), Bharat Dynamics, Solar Industries, and MTAR Technologies.

Anand Rathi recommends buying shares of Hindustan Aeronautics Limited (HAL).

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports, and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

02:09 PM IST

Bharat Electronics, Hindustan Aeronautics, Bharat Dynamics and other defence stocks in focus: Here's why

Bharat Electronics, Hindustan Aeronautics, Bharat Dynamics and other defence stocks in focus: Here's why HAL, Bharat Dynamics and other PSU defence stocks gain up to 4%: Here's why

HAL, Bharat Dynamics and other PSU defence stocks gain up to 4%: Here's why Defence stocks in focus as defence ministry to consider and approve projects worth Rs 1 lakh crore; Mazagon Dock, HAL, Bharat Dynamics gain up to 5%

Defence stocks in focus as defence ministry to consider and approve projects worth Rs 1 lakh crore; Mazagon Dock, HAL, Bharat Dynamics gain up to 5% HAL may receive Rs 21,000 crore order for fighter jets? Multibagger PSU stock rises

HAL may receive Rs 21,000 crore order for fighter jets? Multibagger PSU stock rises Budget 2024: Government increases defence budget to Rs 6.21 lakh crore for 2024-25; Rajnath Singh thanks Finance Minister

Budget 2024: Government increases defence budget to Rs 6.21 lakh crore for 2024-25; Rajnath Singh thanks Finance Minister