Up 3x in 3 years, Ashish Dhawan-owned IT stock among analysts' long-term favourites

Ace investor Ashish Dhawan held 27,64,615 equity shares -- equivalent to 1.01 per cent of Birlasoft equity shares -- at the end of December 2022, according to shareholding data from the bourses

Birlasoft, a multibagger stock owned by ace investor Ashish Dhawan, has the potential to give returns to the rune of 38 per cent in the long term. That's what analysts feel about the smallcap IT stock, which has taken a breather after growing more than three times in value in just three years.

What analysts recommend on Birlasoft shares

| Brokerage | Rating | Target price |

| Religare Broking | Buy | Rs 341 |

| Sharekhan | Buy | Rs 340-380 |

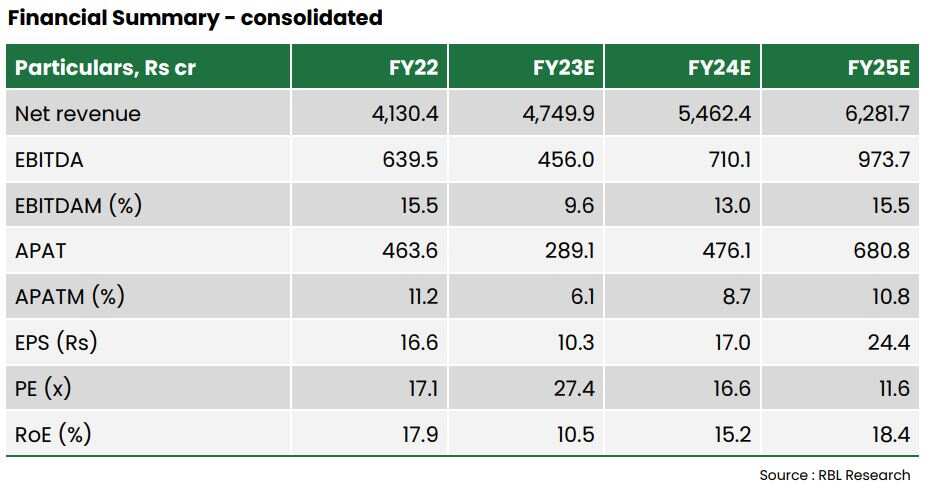

Birlasoft's revenue growth is expected to be driven by improvement in its deal pipeline in the Cloud and technology business, and sustained momentum in the BFSI unit, according to Nirvi Ashar, an analyst at Religare Broking.

Religare has a 'buy' rating on Birlasoft with a target price of Rs 341 apiece -- implying an upside potential of 24 per cent in the stock from its closing price on Tuesday.

The brokerage also expects the following to aid the IT company's growth:

- A pickup in demand from manufacturing

- An uptick in deals from Europe and America

- Focus on managing costs that will support in operating performance

Sharekhan also has a 'buy' call on Birlasoft, with a target price of Rs 340-380 per share. The brokerage's target suggests an upside of 38 per cent in the stock.

Birlasoft share price: Historical performance

Birlasoft is a multibagger, having surged from Rs 90 apiece to Rs 275 per share over a period of 3 years.

However, the stock has declined more than 34 per cent in the last one year, a period in which the Sensex headline index has risen six per cent.

Also Read: Stocks to buy: These 5 IT shares may give bumper returns in 3-4 weeks - check price targets

Birlasoft is a debt-free company with a healthy double-digit return ratio and a return on capital employed (RoCE) of over 19 per cent, according to ICICI Direct.

Birlasoft, part of Ashish Dhawan's portfolio

Dhawan held 27,64,615 equity shares -- equivalent to 1.01 per cent of the company's equity -- at the end of December 2022, according to shareholding data from the bourses.

The renowned stock market investor publicly holds 13 stocks in his portfolio, with a net worth of over Rs 2,187 crore, as of February 28, 2023, according to stock analysis website Trendlyne.

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

01:13 PM IST

Birlasoft shares slip over 2% after Q4 results; is it a buying opportunity?

Birlasoft shares slip over 2% after Q4 results; is it a buying opportunity? Birlasoft hits a 52-week high after firm's strong Q3 results; here's what brokerages say

Birlasoft hits a 52-week high after firm's strong Q3 results; here's what brokerages say IRCTC, Lupin, GE Shipping and CAMS: Stocks to watch out for on Wednesday

IRCTC, Lupin, GE Shipping and CAMS: Stocks to watch out for on Wednesday  Birlasoft Q2 PAT grows 26% to Rs 145 crore

Birlasoft Q2 PAT grows 26% to Rs 145 crore Birlasoft hits fresh 52-week high after Nomura sees nearly 30% upside, forecasts strong growth

Birlasoft hits fresh 52-week high after Nomura sees nearly 30% upside, forecasts strong growth