Anil Singhvi strategy for February 22: Important market triggers, key levels to track in Nifty50, Nifty Bank today

Zee Business Managing Editor Anil Singhvi shares his strategy for the February 22 session on Dalal Street. Check out his take on key support and resistance levels for the Nifty and the Nifty Bank, and how he views the market.

Zee Business Managing Editor Anil Singhvi expects support for the Nifty50 benchmark at 17,700-17,775 levels on Wednesday, February 22, and a strong buy zone in the 17,600-17,650 area. For the Nifty Bank — whose 12 constituents include HDFC Bank, SBI, Bank of Baroda, Axis Bank and Kotak Mahindra Bank, he sees support emerging in the 40,350-40,400 and 40,150-40,200 bands, and a strong buy zone in the 39,425-39,500 area.

Here's how Anil Singhvi sums up the market setup on February 22:

-

Global: Negative

-

FII: Positive

-

DII: Neutral

-

F&O: Neutral

-

Sentiment: Negative

-

Trend: Neutral

Anil Singhvi is of the view that the trend will turn negative if the Nifty and the Nifty Bank indices close below the 17,600 and 40,300 levels respectively.

For the 50-scrip headline index, he expects a higher zone at 17,825-17,875 levels and a strong sell zone at 17,925-18,000 levels. For the banking index, he sees a higher zone at 40,700-40,875 and a strong sell zone in the 40,950-41,125 range.

- FII index longs at 23 per cent on Wednesday vs 22 per cent the previous day

- Nifty put-call ratio (PCR) at 0.83 vs 0.74 the previous day

- Nifty Bank PCR at 0.61 vs 0.54 the previous day

- Fear index India VIX up 4.67 per cent at 14.01

ANIL SINGHVI MARKET STRATEGY

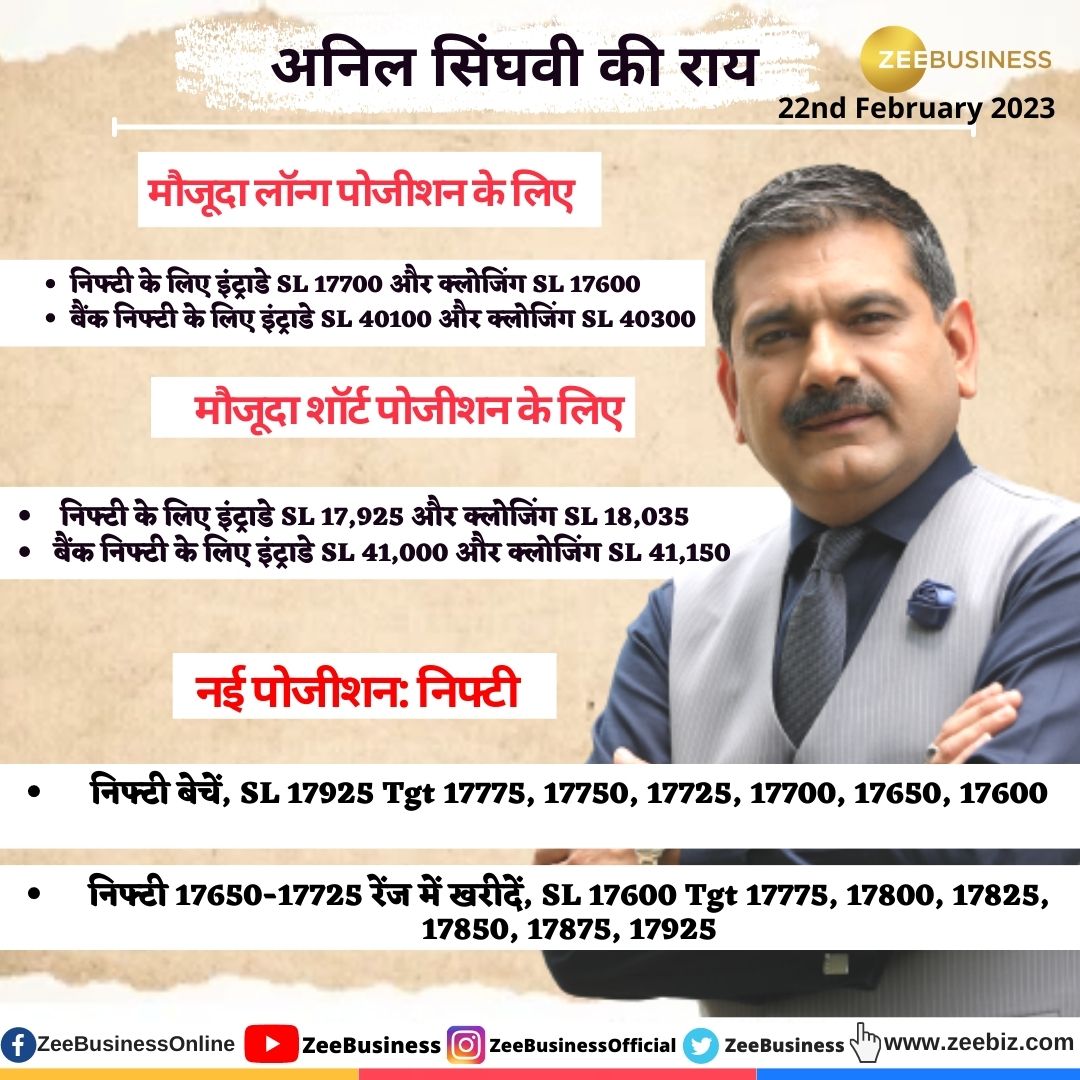

For existing long positions:

-

Nifty50 intraday stop loss at 17,700 and closing stop loss at 17,600

-

Nifty Bank intraday stop loss at 40,100 and closing stop loss at 40,300

For existing short positions:

-

Nifty intraday stop loss at 17,925 and closing stop loss at 18,035

-

Nifty Bank intraday stop loss at 41,000 and closing stop loss at 41,150

For new positions in Nifty:

-

Sell Nifty with a stop loss at 17,925 for targets of 17,775, 17,750, 17,725, 17,700, 17,650 and 17,600

-

Buy Nifty in the 17,650-17,725 range with a stop loss at 17,600 for targets of 17,775, 17,800, 17,825, 17,850, 17,875 and 17,925

For new positions in Nifty Bank:

-

Sell Nifty Bank with a strict stop loss at 41,000 for targets of 40,575, 40,500, 40,375, 40,175, 40,075 and 39,925

-

Buy Nifty Bank in the 39,425-39,500 range with a stop loss at 39,350 for targets of 39,700, 39,850, 39,925, 40,075, 40,150 and 40,350

-

Aggressive traders can buy Nifty Bank in the 40,175-40,375 range with a strict stop loss at 40,000 for targets of 40,500, 40,575, 40,675, 40,875 and 40,950

F&O ban update

-

Already in ban: None

-

New in ban: Vodafone Idea

-

Out of ban: None

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Power of Rs 8,000 SIP: In how many years you can build Rs 9 crore corpus with just Rs 8,000 monthly investment

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

8th Pay Commission: Can basic pension cross Rs 3 lakh mark in new pay commission? See calculations to know its possibility?

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

Top 7 SBI Mutual Fund MFs by One-time Investment Return: Rs 1 lakh has grown to Rs 2.85 lakh-3.48 lakh in 5 years; see list, compare SIP returns

09:02 AM IST

Anil Singhvi's Market Strategy (Feb 14): Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi's Market Strategy (Feb 14): Important levels to track in Nifty50, Nifty Bank today Anil Singhvi's Market Strategy (Feb 13): Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi's Market Strategy (Feb 13): Important levels to track in Nifty50, Nifty Bank today Anil Singhvi's Market Strategy (Feb 12): Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi's Market Strategy (Feb 12): Important levels to track in Nifty50, Nifty Bank today Anil Singhvi's Market Strategy (Feb 11): Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi's Market Strategy (Feb 11): Important levels to track in Nifty50, Nifty Bank today Anil Singhvi's Market Strategy (Feb 10): Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi's Market Strategy (Feb 10): Important levels to track in Nifty50, Nifty Bank today