Anil Singhvi strategy May 5: Important levels to track in Nifty 50, Nifty Bank

Anil Singhvi Market Strategy: Zee Business Managing Editor Anil Singhvi shares his strategy for the May 5 session on Dalal Street. Check out his take on the Indian share market, and key support and resistance levels for the Nifty and the Nifty Bank.

Anil Singhvi Market Strategy: Zee Business Managing Editor Anil Singhvi expects support for the Nifty50 benchmark at 18,125-18,175 levels and a strong buy zone at 18,050-18,100 levels on Friday, May 5. For the Nifty Bank — whose 12 constituents include HDFC Bank, SBI and Axis Bank, he sees support emerging at 43,350-43,475 levels and a strong buy zone at 43,225-43,300 levels.

Here's how Anil Singhvi sums up the market setup on May 5:

-

Global: Negative

-

FII: Positive

-

DII: Neutral

-

F&O: Cautious

-

Sentiment: Neutral

-

Trend: Positive

For the 50-scrip headline index, he expects a higher zone at 18,250-18,300 levels and a profit-booking zone at 18,350-18,425 levels. For the banking index, he sees a higher zone at 43,850-43,950 levels and a profit-booking zone at 44,050-44,150 levels.

- FII index longs at 47 per cent on Friday vs 46 per cent the previous day

- Nifty pu-call ratio (PCR) near an overbought level at 1.34 vs 1.02

- Nifty Bank PCR at 1.28 vs 1.09

- Fear index India VIX down one per cent at 11.73

ANIL SINGHVI MARKET STRATEGY

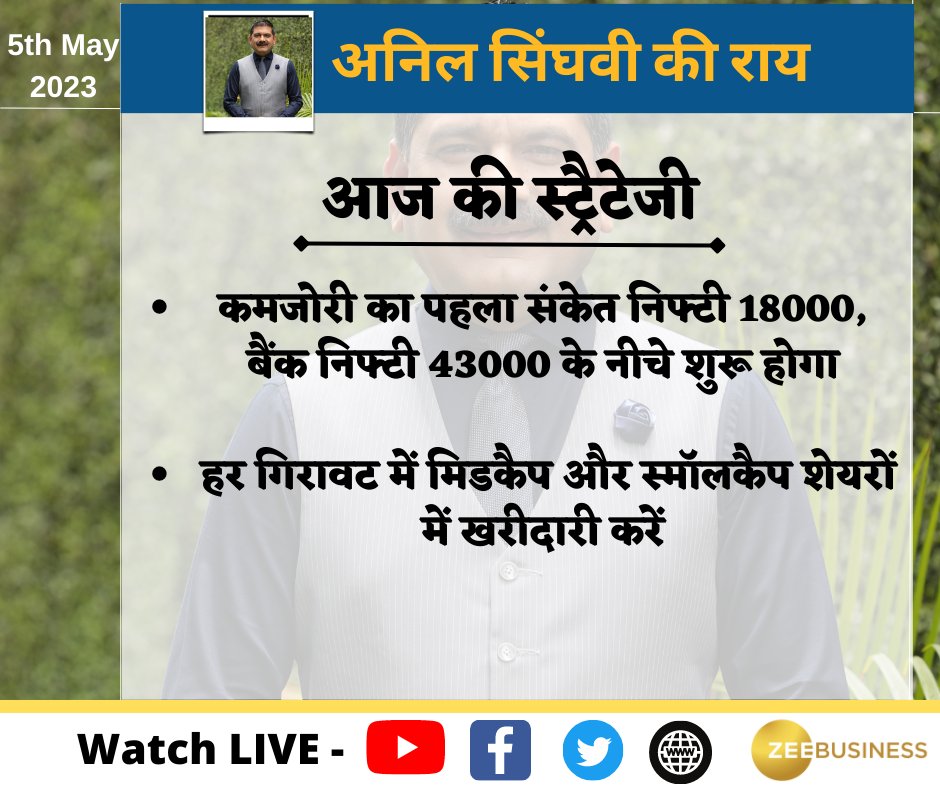

The market wizard believes a start below 18,000 for the Nifty 50 and below 43,000 for the Nifty Bank will be the first sign of weakness in the market. However, weakness should be viewed as an opportunity to buy midcap and smallcap shares, he added.

For existing long positions:

- Nifty intraday and closing stop loss at 18,300

- Nifty Bank intraday and closing stop loss at 43,750

For existing short positions:

-

Nifty intraday and closing stop loss at 18,300

-

Nifty Bank intraday and closing stop loss at 43,750

For new positions in Nifty:

-

Buy Nifty in the 18,100-18,175 range with a stop loss at 18,000 for targets of 18,200, 18,250, 18,275, 18,300 and 18,350

-

Aggressive traders can sell Nifty with a strict stop loss at 18,300 for targets of 18,200, 18,175, 18,150, 18,100 and 18,075

For new positions in Nifty Bank:

-

Buy Nifty Bank in the 43,225-43,375 range with a stop loss at 43,000 for targets of 43,475, 43,575, 43,625, 43,675 and 43,725

-

Aggressive traders can buy Nifty Bank with a strict stop loss at 43,200 for targets of 43,725, 43,850, 43,950, 44,050 and 44,150

-

Aggressive traders can sell Nifty Bank in the 43,950-44,150 range with a strict stop loss at 44,200 for targets of 43,850, 43,750, 43,700, 43,625, 43,500 and 43,375

F&O ban

- New in ban: GNFC

- Already in ban: Manappuram Finance

- Out of ban: None

Stocks of the day

Sell UBL futures with a stop loss at Rs 1,445 for targets of Rs 1,405, Rs 1,390 and Rs 1,365

- Disaster results

- Big fall in margin due to inflation

- Weak volume growth

- Big downgrades possible

Buy Hero Moto Futures with a stop loss at Rs 2,500 for targets of Rs 2,575, Rs 2,600 and Rs 2,640

- Strong revenue growth at 12 per cent

- Positive surprise in margin

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

08:17 AM IST

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today