Aditya Birla Capital hits 52-week high after Macquire initiates coverage with ‘outperform’, expects stock to double in 3 years

At 11:50 am, Aditya Birla Capital shares held on firmly to the green with a gain of 8.3 per cent at 196.8 apiece on BSE.

)

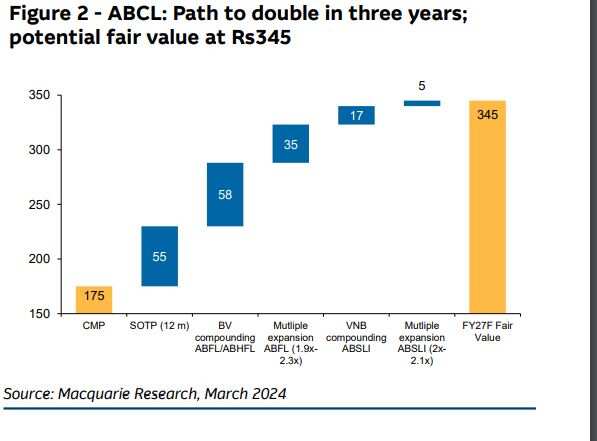

Aditya Birla Capital shares soared to a 52-week high on Tuesday after foreign brokerage Macquarie initiated coverage on the Aditya Birla group investment company. The stock of Aditya Birla Capital (ABCAPITAL) soared by as much as Rs 17.8, or 9.8 per cent, to Rs 199.6 apiece on BSE. Analysts at Macquarie believe that Aditya Birla Capital shares have the potential to double in three years.

At 11:50 am, Aditya Birla Capital shares held on firmly to the green with a gain of 8.3 per cent at 196.8 apiece on BSE.

The brokerage assigned a target of Rs 230 per share to Aditya Birla Capital, indicating a potential upside of 26.5 per cent from the previous close.

According to Macquarie, Aditya Birla Capital is poised to register strong growth in loans and earnings driven by its lending (NBFC and HFC) and savings (life insurance) businesses over the next several years, supported by:

>> Strong parentage and the ‘AAA’ rating providing access to competitive funding

>> The leveraging of the Aditya Birla Group and ABCL ecosystem for cross-selling and upselling in NBFC, insurance, and other segments

>>A diversified product suite and distribution mix avoiding concentration risk in terms of product segment dependency

>>A strong senior leadership providing confidence in underwriting and asset quality

Analysts at Macquarie also see value unlocking in the company's non-banking financial companies (NBFC) and insurance business, and expect ABFL to deliver an AUM CAGR of 28 per cent over FY23-26E with a more than 10 basis points (bps) return on asset (ROA) expansion, and 2.4 per cent in FY26E, higher than the brokerage’s expectations from other top NBFCs.

Meanwhile, Morgan Stanley remained bullish on the stock, maintaining its ‘equal-weight’ rating on the stock with a target of Rs 190, suggesting a potential upside of 4.5 per cent.

Around 85 per cent of the sum of the parts-based valuation is derived from FY25 book value multiples of 1.9 times and 1.4 times for the NBFC and HFC units, according to Morgan Stanley.

Meanwhile, Morgan Stanley also maintained an 'equalweight' rating and gave a target of Rs 190 apiece.

Aditya Birla Capital share price performance

In a year, the company's shares have gained over 29 per cent against Nifty50's rise of over 28 per cent.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:34 PM IST

Grasim Q1 profit down 12 percent to Rs 2,267.74 cr, revenue up 9 percent to Rs 33,860.75 cr

Grasim Q1 profit down 12 percent to Rs 2,267.74 cr, revenue up 9 percent to Rs 33,860.75 cr Aditya Birla Group launches retail jewellery brand INDRIYA, plans to open stories in over 10 cities in 6 months

Aditya Birla Group launches retail jewellery brand INDRIYA, plans to open stories in over 10 cities in 6 months Aditya Birla Group to invest USD 50 million in manufacturing, R&D center in Texas

Aditya Birla Group to invest USD 50 million in manufacturing, R&D center in Texas  Emoha partners with Aditya Birla Health Insurance to provide eldercare solutions

Emoha partners with Aditya Birla Health Insurance to provide eldercare solutions Aditya Birla Fashion to demerge Madura Fashion & Lifestyle business into separate listed entity

Aditya Birla Fashion to demerge Madura Fashion & Lifestyle business into separate listed entity