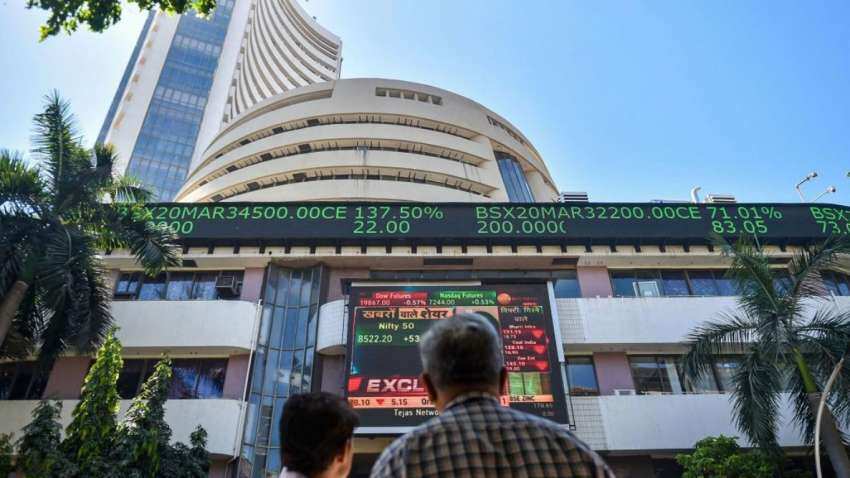

FPIs infuse over Rs 13,500 crore in Indian equities in March so far aided by Adani shares block deal

Going ahead, FPIs are likely to be cautious in their approach in the coming days as the collapse of the SVB Bank in the US has impacted sentiments in the market, V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

Foreign investors have infused over Rs 13,500 crore in the Indian equities so far this month, reversing their selling trend, primarily driven by bulk investment from US-based GQG Partners in the Adani Group companies.

This came following a net outflow of Rs 5,294 crore in February and Rs 28,852 crore in January. Prior to that, FPIs made a net investment of Rs 11,119 crore in December, data with the depositories showed.

Going ahead, FPIs are likely to be cautious in their approach in the coming days as the collapse of the SVB Bank in the US has impacted sentiments in the market, V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

Also Watch: Where Are Foreign Investors Are Investing? Watch Here

According to the data, Foreign Portfolio Investors (FPIs) invested Rs 13,536 crore in Indian equities till March 10.

"This (inflow) is inclusive of the bulk investment of Rs 15,446 crore by GQG in the four Adani stocks," Vijayakumar said.

Also, Nirav Karkera, Head of Research at Fisdom, said that a large share of the inflows is attributable to chunky block deals buying into the Adani group entities during the first week of the month itself.

Also Read: Market Next Week: Inflation data, global cues, FII flows among other top factors for Dalal Street

Excluding this, FPI activity in equities represents a strong selling undercurrent. However, the intensity of the selling has subsided.

Himanshu Srivastava, Associate Director - Manager Research at Morningstar India, attributed the latest inflows to better prospects of Indian equities over longer time frames.

Although like many other countries, India has also been going through a rate hike cycle given high inflation levels, it is still perceived to be relatively better placed with respect to macro conditions compared with other markets.

In addition, there have been enhanced focus of the government on capital expenditure and achieving higher GDP growth, which could potentially improve India's fiscal condition, he said.

Also Read: FPIs' investment value in Indian equities drops 11 per cent to $584 billion

In the calendar year 2023, FPIs have sold equities to the tune of Rs 20,606 crore.

On the other hand, FPIs pulled out Rs 2,987 crore from the debt markets during the period under review.

In terms of investing in sectors, there is no consistency in FPI activity. For instance, FPIs were buyers in financial services in the first half of February and sellers in the second half. Similarly, they were buyers in IT in the first half and sellers in the second half, Geojit Financial Services' Vijayakumar said.

With PTI Inputs

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

07:32 AM IST

FPIs return to Indian equities; infuse Rs 22,766 crore in first two weeks of December

FPIs return to Indian equities; infuse Rs 22,766 crore in first two weeks of December Markets to track inflation data, global trends, FII trading this week: Analysts

Markets to track inflation data, global trends, FII trading this week: Analysts FPIs' selling spree continues in November at Rs 21,612 crore

FPIs' selling spree continues in November at Rs 21,612 crore Foreign investors sell Rs 11,412 crore this week, Experts say Maharashtra election result may trigger inflows

Foreign investors sell Rs 11,412 crore this week, Experts say Maharashtra election result may trigger inflows Macroeconomic data, Q2 earnings, FIIs trading activity to guide markets this week: Analysts

Macroeconomic data, Q2 earnings, FIIs trading activity to guide markets this week: Analysts