Aarti Drugs to buy back 6,65,000 equity shares; stock hits 52-week high

Aarti Drugs' borad has set the buyback price at Rs 900 per equity share.

)

Shares of Aarti Drugs, the domestic pharmaceutical company, zoomed over 12 per cent in Monday's trading session and hit a 52-week high of Rs 575 apiece on the BSE. The stock rallied after the company's board approved the buyback of 6,65,000 equity shares. The buyback price is set at Rs 900 per equity share.

At around 10:15 AM, shares of Aarti Drugs were trading 12.45 per cent higher at Rs 574.15 apiece on the BSE. The market capitalisation of the company stood at Rs 5,299.96 crore.

Aarti Drugs buyback details

The buyback amount stands at Rs 59.9 crore; the buyback will be at a 76.3 per cent premium from the current price of Rs 510.6 apiece. It will be done through a tender route, and the record date is fixed as August 4, 2023.

Aarti Drugs Q1 results

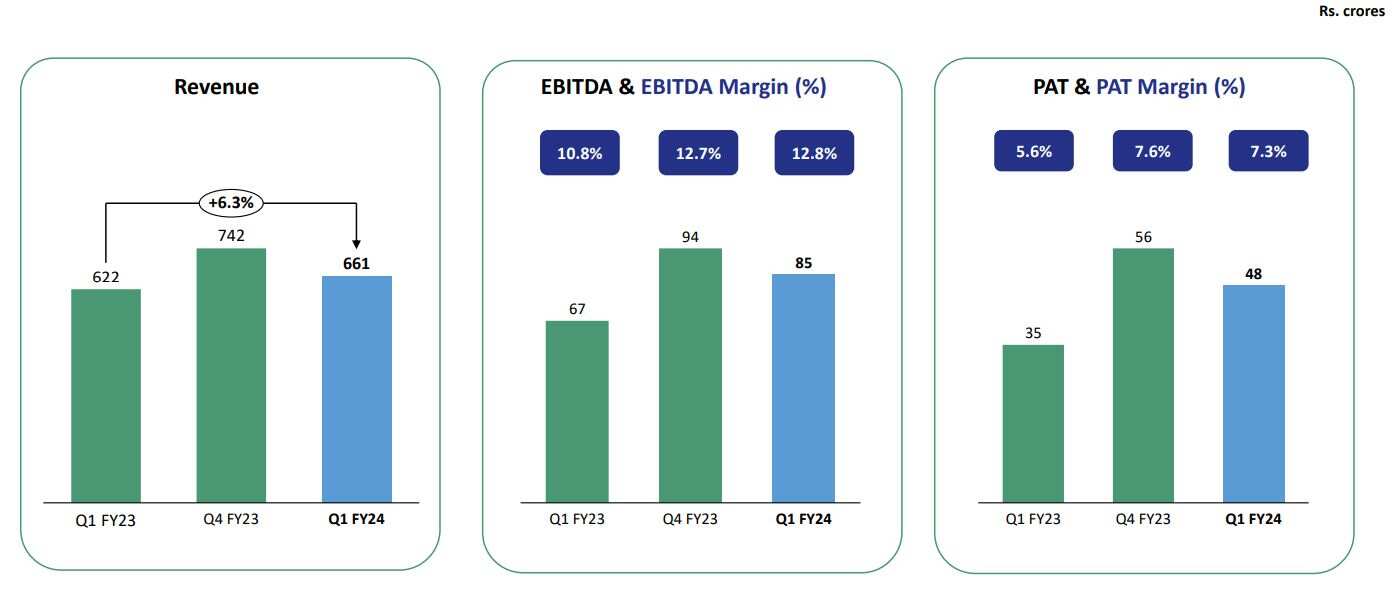

The Indian pharmaceutical company reported a 37.14 per cent increase in profit after tax (PAT) at Rs 48 crore in the June quarter of 2023, compared to Rs 35 crore logged in the corresponding quarter of the previous year. The company logged revenue of Rs 661 crore against Rs 622 crore, up 6.3 per cent.

Margins, a key measure of profitability, for the company stood at 12.7 per cent in the June quarter, compared to 10.8 per cent a year ago. The earnings before interest, taxes, depreciation, and amortisation, or EBITDA, of the company stood at Rs 84 crore against 67.18 crore, up 25 per cent in the year-ago period.

What do analysts suggest?

What do analysts suggest?

"The stock has performed well since pharma stocks started an upward trend. One should definitely participate in the buyback, as it is being done at a premium," said Zee Business panellist Sandeep Jain.

Aarti Drugs share price: Past performance

So far in 2023, shares of Aarti Drugs have gained over 28 per cent against the headline index's rise of over 8 per cent.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

11:11 AM IST

Aarti Drugs share price rises 11% amid buzz over anti-dumping duty on Ofloxacin imports from China

Aarti Drugs share price rises 11% amid buzz over anti-dumping duty on Ofloxacin imports from China  Breaking News With Anil Singhvi: Boost for Aarti Drugs as import duty slapped on Ciprofloxacin | share price target Rs 848

Breaking News With Anil Singhvi: Boost for Aarti Drugs as import duty slapped on Ciprofloxacin | share price target Rs 848 Aarti Drugs share price: Fresh investments, better realisations to boost profits; retaining a Buy with price target of Rs 848 says Anand Rathi

Aarti Drugs share price: Fresh investments, better realisations to boost profits; retaining a Buy with price target of Rs 848 says Anand Rathi