Share Market HIGHLIGHTS: Sensex ends 354 pts lower, Nifty gives up 21,800; UPL slumps 11%, Paytm remains in tailspin

Share Market HIGHLIGHTS: Domestic equity benchmarks Nifty50 and Sensex finished yet another session characterised by see-saw moves lower on Monday (February 5), with weakness in financial shares outweighing gains in auto counters, amid mixed signals from global markets.

Investors awaited more earnings reports from India Inc for domestic cues after State Bank of India staged a weak quarterly performance over the weekend following a positive earnings report from Tata Motors.

Catch all the highlights of the February 5 session on Dalal Street, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stock recommendations, and much more only on Zeebiz.com's blog:

Share Market HIGHLIGHTS: Domestic equity benchmarks Nifty50 and Sensex finished yet another session characterised by see-saw moves lower on Monday (February 5), with weakness in financial shares outweighing gains in auto counters, amid mixed signals from global markets.

Investors awaited more earnings reports from India Inc for domestic cues after State Bank of India staged a weak quarterly performance over the weekend following a positive earnings report from Tata Motors.

Catch all the highlights of the February 5 session on Dalal Street, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stock recommendations, and much more only on Zeebiz.com's blog:

Latest Updates

Thank you! That's all today on Zeebiz.com's blog on Dalal Street

For all other news related to business, politics, tech and auto, follow us on Twitter, Facebook, LinkedIn and Instagram.

Share Market Update: UPL, Bajaj Finance, Bharti Airtel, HDFC Life, Grasim worst hit among 33 Nifty losers; Tata Motors, Coal India, BPCL top gainers

Top Nifty50 losers

| Stock | Change (%) | Feb 5 close |

| UPL | -10.92 | 475.4 |

| BAJFINANCE | -3.24 | 6,626.75 |

| BHARTIARTL | -3.23 | 1,113.60 |

| HDFCLIFE | -2.68 | 563.3 |

| GRASIM | -2.59 | 2,084.00 |

| MARUTI | -2.12 | 10,429.50 |

| BAJAJFINSV | -2.03 | 1,618.00 |

| ULTRACEMCO | -1.82 | 9,914.85 |

| HCLTECH | -1.81 | 1,555.10 |

| TITAN | -1.78 | 3,548.00 |

Top Nifty50 gainers

| Stock | Change (%) | Feb 5 close |

| TATAMOTORS | 5.8 | 929.75 |

| COALINDIA | 5.12 | 441.3 |

| BPCL | 3.14 | 575.9 |

| SUNPHARMA | 3.06 | 1,460.00 |

| CIPLA | 2.85 | 1,432.40 |

| ONGC | 2.43 | 263.5 |

| M&M | 2.36 | 1,700.00 |

| POWERGRID | 2.26 | 283.35 |

| TATASTEEL | 2.09 | 141.6 |

| EICHERMOT | 1.41 | 3,879.65 |

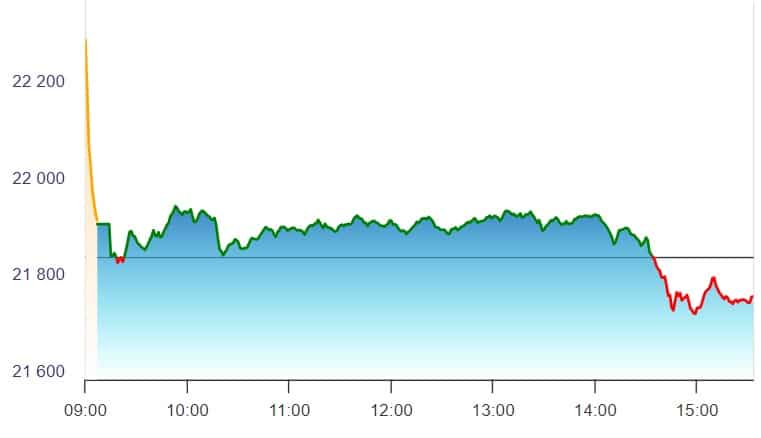

Share Market Update: Sensex ends 354 pts lower, Nifty gives up 21,800; UPL top blue-chip loser, slumps 11%; Paytm remains in tailspin

The Sensex sheds 354.2 points, or 0.5 per cent, to end at 71,731.4 and the Nifty50 settles at 21,771.7, down 82.1 points, or 0.4 per cent, from its previous close.

Nifty50

Sensex

Image: NSEIndia.com, BSEIndia.com

Share Market Today LIVE | Indian Overseas Bank shares hits 52-week high; here is why

Shares of Indian Overseas Bank (IOB) zoom as much as 17.5 per cent to hit a 52-week high of Rs 65.99 apiece on BSE. The bank's shares have risen over 41 per cent in the past three months and 113 per cent in the last six months.

A look at IOB's Q3 results

Last month, the bank shared its quarterly results for the period that ended on December 31, 2023, through a stock market disclosure. IOB reported a 30 per cent increase in its net profit to Rs 723 crore for the December quarter of 2023–24, compared to Rs 555 crore logged in the same quarter a year ago. This was mainly due to core income improvement and a decline in bad loans.

The bank further reported its total income of Rs 7,437 crore during the quarter under review, up from Rs 6,006 crore in the same period last year. Its interest income increased to Rs 6,176 crore over Rs 5,056 crore recorded for the quarter ended December 2022. Read more

Nifty Today LIVE | Tata Motors, Coal India, Sun Pharma, TCS among top movers

Tata Motors, Coal India, Sun Pharma, TCS and M&M are the top movers in the Nifty baskets at this hour. On the contrary, Bharti Airtel, Bajaj Finance, Kotak Bank and UPL are among the top drags.

Here's a look at the heatmap in the 50-scrip universe by weight:

Source: NSE

IPO Update | Apeejay Surrendra Park Hotels IPO subscribed 1.67 times so far on Day 1

On Monday (Day 1), Apeejay Surrendra Park Hotels' share sale has received bids for 5,81,12,160 shares against 3,47,61,903 shares on offer. Overall, the public issue has been subscribed 1.67 times so far on Day 1 of the bidding process. Read more

| Category | Subscription (No. of times the equity reserved) |

| Qualified institutional buyers | 1.15 |

| Non-institutional investors | 1.42 |

| Retail investors | 3.76 |

| Overall | 1.67 |

| Source: Exchange data | |

Share Market Today LIVE | UPL slips to a 52-week low after agri tech firm reports weak Q3 numbers; what Jefferies says about it

The stock of UPL dips to a 52-week low of Rs 482 after the sustainable agriculture technology firm reported weak December quarter results. The shares of UPL trade 9.3 per cent, or Rs 49.6 lower at Rs 483.9 each on BSE. The shares are in dire straits after the company slipped from profit to deficit in the December quarter.

The company suffered a loss of Rs 1217 crore in the quarter under review against a profit of Rs 1087 crore in the same quarter last year. Not just PAT, its revenue from operations were also down by 27.7 per cent. The adjusted margin for the company in the December quarter was 4.2 per cent against 22.2 per cent Year-on-Year (YoY).

What Jefferies says about UPL?

After the lackluster Q3 results of the company, Jefferies has maintained a buy call on the firm, cutting the target to Rs 635 from Rs 675. Read more

Share Market Today LIVE | LIC stock achieves Rs 1,000 milestone; hits an all-time high on BSE

The stock of Life Insurance Corporation India (LIC) crosses the barrier of Rs 1,000 for the first time since its listing on BSE as it surged to an all-time high of Rs 1,027.95 on BSE. The counter trades 6.97 per cent higher at Rs 1,010.45 on BSE.

Tata Chemicals Q3 Results Preview | Net profit likely to fall 33% with margin shrinking 260 bps

Tata Chemicals (TATACHEM) shares were under pressure on Monday as investors awaited the Tata group chemical manufacturer’s quarterly numbers due later in the day. The stock of Mumbai-based Tata Chemicals declined by as much as Rs 12.8, or 1.3 per cent, to Rs 985 apiece on BSE, falling for the third session in a row. Analysts widely expect the Tata group firm to stage a weak financial performance for the fiscal third quarter on account of a fall in European and Kenyan revenue and higher supplies from China.

According to Zee Business research, Tata Chemicals is estimated to report a consolidated net profit of Rs 265 crore for the quarter ended December 31, 2023 (Q3 FY24), translating into a 33.4 per cent fall compared with the corresponding period a year ago. The analysts estimate its revenue for the fiscal third quarter at Rs 3,820 crore, down 7.9 per cent on a year-on-year basis. Read more

Traders' Diary: Buy, sell or hold strategy on Mankind, Eicher Motors, Cochin Shipyard, MOIL, over a dozen other stocks today

In this edition of Traders' Diary, the Zee Business research team shares exclusive research on 20 stocks that investors and traders can track on Monday, February 5. Check out the complete list of stocks on analysts Kushal Gupta and Varun Dubey's radar.

Here's the complete list of investment and trading ideas for the day:

Kushal Gupta

- Buy MOIL shares in the cash segment for a target of Rs 366 with a stop loss at Rs 350

- Buy Tata Motors futures for a target of Rs 920 with a stop loss at Rs 875

- Buy the Rs 535 put option of UPL at Rs 21 for a target of Rs 40 with a stop loss at Rs 12

- Technical pick: Buy InterGlobe Aviation (IndiGo) shares for a target price of Rs 3,264 with a stop loss at Rs 3,120

- Fundamental pick: Buy Olectra Greentech shares for a one-year target of Rs 2,100

- Investment idea: Buy Amber Enterprises India shares for a one-year target of Rs 5,200

- News-based pick: Buy Aurobindo Pharma shares for a target of Rs 1,040 with a stop loss at Rs 1,085. Read more

Share Market Today LIVE | IndiGo hits an all-time high after its profit jumps 15 times in Dec quarter

InterGlobe Aviation, the parent company of IndiGo, soars to an all-time high of Rs 3,301.40 on BSE on Monday (February 5, 2024) after the company reported strong December quarter numbers. The stock of the company is soaring higher by 4.45 per cent, or Rs 139.15, at Rs 3,266.15 on BSE.

The aviation company's profit after tax skyrocketed by 15 times to Rs 2,998 crore in the December quarter, while its revenue was also up by 30.1 per cent in the same duration. Brokerage Morgan Stanley has maintained an overweight rating on the stock and raised the target to Rs 4,145 from Rs 3,745 after the aviation company posted its December quarter results. Read more

Share Market Today LIVE | SBI stock edges lower post mixed December quarter results

The stock of India's biggest public lender, State Bank of India, gives up initial gains to trade 0.35 per cent lower at Rs 648.15 on BSE after reporting mixed December quarter results. SBI's net interest income (NII) rose by 4.6 per cent in the December quarter, while its profit after tax was down by 35.5 per cent to Rs 9164 crore in the quarter under review.

What SBI said in its post-result concall and interview to Zee Business

- The bank has made AIF provision of Rs 240 crore.

- Its total exposure to AIF is Rs 1000 crore.

- The lender has no concerns on slippages.

- Its around Rs 13000 crore provision is for wage and pension.

- The bank says that it made Rs 7100 crore towards pension and Rs 6100 crore provision for wages (the difference between November 2022 to December 2023). Read more

Share Market Today LIVE | LIC Housing Finance hits a 52-week high after NBFC clocks mixed Q3 numbers

LIC Housing Finance hits a 52-week high of Rs 645.8 in morning deals on BSE after the non-banking finance company reported mixed results in the December quarter. LIC Housing Finance's net interest income (NII) jumped by 31.3 per cent, while its profit was up by 2.4 times to Rs 1063 crore in the December quarter.

Gross Non-Performing Assets were up by 4.26 per cent while its NIM slipped from 3.04 per cent to 3 per cent in the quarter under review. Read more

Share Market Today LIVE | Paytm shares hit lower circuit again; Anil Singhvi suggests exiting the stock

Shares of One 97 Communications, the parent company of Paytm hit the 10 per cent lower circuit on BSE at Rs 438.35 apiece on BSE.

The stock has hit the lower circuit for the third session in a row. The stock has been in a free fall since the Reserve Bank of India's (RBI) order to its payments bank subsidiary to stop accepting fresh deposits in its accounts or popular wallets from March onwards.

Zee Business Managing Editor Anil Singhvi recommended selling shares of Paytm even at a loss. He advised not to keep "such a risky stock in the portfolio" and instead suggested buying other quality names.

Paytm बेचकर निकल जाएं

Paytm का भाव देखकर ललचाएं नहीं

बिलकुल भी ना खरीदें #Paytm से जुड़े सवाल फटाफट भेजिए #AnilSinghvi पर#PaytmPaymentsBank #PayTMCrisis #One97Communications #PaytmKaro pic.twitter.com/TwO7RJRRTI

— CA Anil Singhvi Zee Business (@AnilSinghvi_) February 5, 2024

What led to a meltdown in Paytm?

The Reserve Bank of India (RBI) last week ordered Paytm Payments Bank Ltd (PPBL), a restricted bank that can take deposits but cannot lend, to not take any further deposits, conduct credit transactions, or carry out top-ups on any customers' accounts, prepaid instruments, wallets, or cards for paying road tolls after February 29. Read more