Share Market HIGHLIGHTS: Sensex ends 179 pts higher, Nifty reclaims 21,700 as D-Street rises for second straight day

Share Market HIGHLIGHTS: Domestic equity benchmarks Nifty50 and Sensex extended gains to a second straight session on Friday, January 5, as investors awaited the onset of the domestic corporate earnings season due next week amid subdued signals from across the globe following fresh data that raised doubts over early US rate cuts in 2024.

Catch all the highlights of the January 5 session on Dalal Street, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stock recommendations, and much more only on Zeebiz.com's blog:

Share Market HIGHLIGHTS: Domestic equity benchmarks Nifty50 and Sensex extended gains to a second straight session on Friday, January 5, as investors awaited the onset of the domestic corporate earnings season due next week amid subdued signals from across the globe following fresh data that raised doubts over early US rate cuts in 2024.

Catch all the highlights of the January 5 session on Dalal Street, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stock recommendations, and much more only on Zeebiz.com's blog:

Latest Updates

Thank you! That's all today on Zeebiz.com's blog on the January 5 session on Dalal Street

For all other news related to business, politics, tech and auto, follow us on Twitter, Facebook, LinkedIn and Instagram.

Share Market Today | Nifty IT top gainer among NSE's sectoral indices; Nifty Healthcare top laggard

| Index | Jan 5 close | Change (%) |

| NIFTY IT | 34,851.70 | 1.29 |

| NIFTY AUTO | 18,406.95 | 0.44 |

| NIFTY REALTY | 844.35 | 0.36 |

| NIFTY OIL & GAS | 9,770.30 | 0.26 |

| NIFTY CONSUMER DURABLES | 31,472.75 | 0.2 |

| NIFTY MEDIA | 2,468.00 | 0.13 |

| NIFTY FINANCIAL SERVICES | 21,514.20 | -0.01 |

| NIFTY FMCG | 57,667.35 | -0.06 |

| NIFTY BANK | 48,159.00 | -0.08 |

| NIFTY PRIVATE BANK | 24,841.55 | -0.09 |

| NIFTY METAL | 7,871.80 | -0.14 |

| NIFTY PHARMA | 17,358.60 | -0.31 |

| NIFTY PSU BANK | 5,838.45 | -0.38 |

| NIFTY HEALTHCARE INDEX | 10,935.95 | -0.65 |

Share Market Today | L&T, TCS, Infosys, HCL Tech rise most among 15 Sensex gainers

HUL, Axis Bank, ICICI Bank and Wipro are also among the top gainers in the basket. On the other hand, Nestle, Asian Paints, JSW Steel, Kotak Mahindra Bank and Sun Pharma are among the top laggards in the 30-scrip basket.

Image: BSEIndia.com

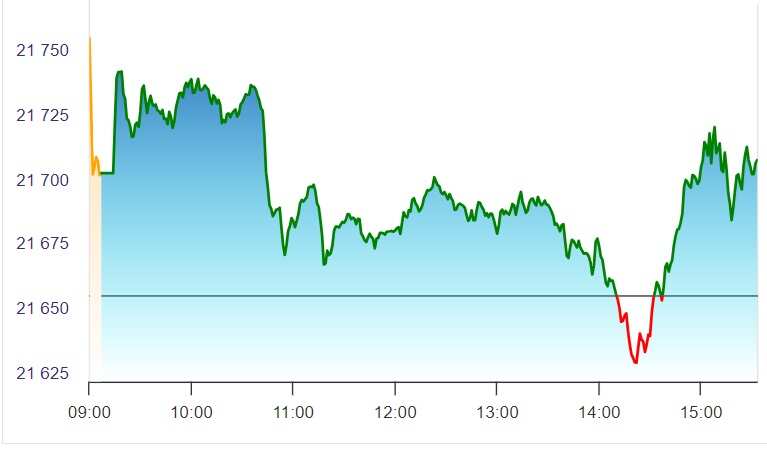

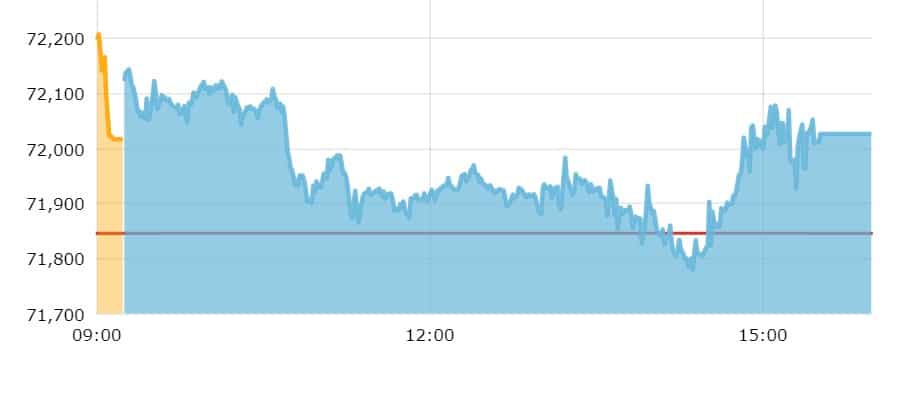

Closing Bell | Sensex up 179 pts, Nifty reclaims 21,700 as D-Street extends gains to second straight day

Both headline indices finish the day about a quarter of a per cent higher. The Sensex rises 178.6 points to end at 72,026.2 and the Nifty50 adds 52.2 points for the day to settle at 21,710.8.

Nifty50

Sensex

Images: NSEIndia.com, BSEIndia.com

Read more on the closing bell here

Share Market Tips LIVE | Buy Ion Exchange, Kfin Tech shares, says Vikas Sethi

Vikas Sethi of Sethi Finmart recommends buying Ion Exchange, shares for a target of Rs 605 with a stop loss at Rs 560. Besides, recommends buying Kfin Tech shares for a target of Rs 535 with a stop loss at Rs 495.

Share Market Today LIVE | Kaveri Seed board approves Rs 325-crore buyback plan at Rs 725/share

Agricultural products maker Kaveri Seed Company's board on Friday approved a share buyback plan worth Rs 325 crore through the tender offer route. Kaveri Seed (KSCL) shares built on the day's gains after the earnings announcement, rising by as much as Rs 20.1, or 3.1 per cent, to Rs 675 apiece on BSE.

The stock comes within Rs 16.5 of a 52-week high touched in October last year. The board set the price at Rs 725 per share, translating into a premium of 10.7 per cent over the previous close. Read more

HDFC Bank Q3 business update | Lender's gross advances jump 62.4%, retail loans zoom 111%

HDFC Bank, the country's largest private sector bank, has released its FY24 third-quarter business update on Friday, January 5. The lender's gross advances zoomed to approximately Rs 24,69,500 crore in Q3 that ended on December 31, 2023, a growth of around 62.4 per cent from 15,20,500 crore in the previous year and a growth of around 4.9 per cent over Rs 23,54,600 crore on a sequential basis.

Grossing up for transfers through inter-bank participation certificates and bills rediscounted, the bank’s advances grew by around 60.7 per cent over December 31, 2022, and around 3.8 per cent over September 30, 2023, HDFC Bank said in a regulatory filing. Read more

Share Market Today LIVE | Stocks to buy: Bharti Airtel, Bajaj Finance, Britannia among analysts' top picks

In conversation with Zee Business Managing Editor Anil Singhvi, market experts Siddharth Sedani, Kunal Saraogi, Rajesh Palviya Sacchitanand Uttekar and Sumeet Bagadia share their top stock recommendations in this special segment, Pick of the Day. On the top analysts' 'buy' list are stocks such as Bandhan Bank, AU Small Finance Bank, Bharti Airtel, Britannia Industries and Bajaj Finance. Read more

Share Market Today LIVE | Should you buy Infosys, TCS, IGL, Petronet LNG, BPCL shares now? Here is what brokerages recommend

As Dalal Street enters the January 5 session, brokerages have a bunch of stocks on their radar. Here's what Jefferies, Morgan Stanley, Citi, CLSA and UBS make of stocks such as Infosys, TCS, Coforge, HCL Tech, ONGC, GAIL and Hindustan Aeronautics:

HCL Tech

Jefferies has a 'hold' call on HCL Technologies with a target price of Rs 1,500.

Infosys

Jefferies has recommended buying Infosys shares for a target of Rs 1,720.

Wipro

Jefferies has maintained an 'underperform' rating on Wipro with a target of Rs 385.

Coforge

Jefferies has a 'buy' call on Coforge shares for a target of Rs 7,000.

TCS

Jefferies has maintained a 'hold' call on Tata Consultancy Services (TCS) with a target of Rs 4,000.

Tech Mahindra

Jefferies has maintained an 'underperform' rating on Tech Mahindra with a target of Rs 1,100.

LTIMindtree

Jefferies has a 'buy' call on LTIMindtree with a target of Rs 6,830. Read more

Share Market Today LIVE | Jefferies positive on utilities after CERC releases tariff norms for FY25–29; lists 3 top buys

Utility stocks are in focus on Friday, January 5, a day after the Central Electricity Regulatory Commission (CERC) issued the FY25–29 tariff draft regulations, wherein the regulated RoE, or return on equity, for thermal has been maintained at 15.5 per cent.

The S&P BSE Utilities index trade nearly a per cent higher at 5,045.85 levels. Global brokerage Jefferies, after the release of the tariff norms, has maintained its bullish stance on the sector, which had a stellar run in December 2023. The brokerage highlighted that the initial read of the draft regulation suggests that generation incentives/operations, and maintenance (O&M) have seen a positive tweak. Read more

Share Market Today LIVE | Macrotech Developers shares soar to record high; what has investors all excited?

Macrotech Developers (LODHA) shares zoom to a record high on Friday, January 5, after the real estate company released a strong business update for the October-December period. The stock gain by as much as Rs 100.3, or 9.1 per cent, to Rs 1,198.8 apiece on BSE, surpassing an existing peak of Rs 1,125.9 apiece registered the previous day.

In a regulatory filing, released ahead of the market hours on Friday, Macrotech Developers reported pre-sales growth of 12 per cent to Rs 3,410 crore for the third quarter of the financial year compared with the corresponding period. Read more

Share Market Today LIVE | TCS, Infosys Q3 results due next week; here is what Jefferies expects from the IT sector

Tata Consultancy Services (TCS), the country's largest IT company, is all set to kick off the corporate earnings season for India Inc on January 11. Infosys, the second largest, will also report its financial results for the October-December period on the same day. As investors await the onset of the Q3 results season, Jefferies has shared its stance on IT companies. The brokerage has maintained a 'buy' call each on Coforge and Infosys, and upgraded LTIMindtree to 'buy' from 'hold'. It has kept a 'hold' rating each on TCS and HCL Technologies, and an 'underperform' each on Wipro and Tech Mahindra.

What Jefferies makes of the IT sector now

In FY25, Jefferies expects continued focus on RoI by clients to result in a gradual pickup in growth to a year-on-year 6 per cent in constant currency. Read more

Share Market Today LIVE | OMCs announce additional incentive on maize-based ethanol; BCL Industries, Gulshan Polyols and sugar stocks jump

BCL Industries, Gulshan Polyols, and most sugar stocks edge higher in the morning trade after oil marketing companies (OMCs) announced an additional incentive of Rs 5.79 per litre (excluding goods and services tax) for ethanol sourced from maize on Thursday.

BCL Industries shares are up nearly 10 per cent, Gulshan Polyols stock is up over 4 per cent, Rajshree Sugars is up over 2 per cent, while Shree Renuka Sugars, Bajaj Hindusthan Sugar, and Mawana Sugars is trading over 1 per cent higher. Read more

Share Market Today LIVE | UBS initiates buy on this defence PSU; sees 24% potential upside

Global brokerage UBS has initiated a 'buy' rating on Hindustan Aeronautics (HAL) with a target of Rs 3,600, implying a 24 per cent upside from the last closing price. The rationale behind the global brokerage's bullish stance on the defence major is that the company has sharpened its policy focus and is working to compress the US$60 billion opportunity into 5-7 years.

The brokerage further highlighted that the new orders will result in a material step-up, with revenues rising at a 16 per cent compound annual growth rate (CAGR). Read more