Share Market HIGHLIGHTS: Sensex ends 65 pts higher, Nifty holds 17,600 as D-Street halts three-day losing streak; HCL Tech inches lower

Share Market HIGHLIGHTS: Indian equity benchmarks Nifty 50 and Sensex ended barely in the green on Thursday, but managed to halt a three-day losing streak, amid mixed moves across global markets as investors weighed optimism on a sustained pause in benchmark interest rates against mixed quarterly earnings. Among heavyweights, gains in HDFC Bank, Larsen & Toubro (L&T), Titan and Tata Motors were offset by losses in Reliance and Infosys. HCL Tech saw mild gains as investors awaited the IT major's Q4 results due later in the day.

Here's a list of headlines that were in focus on Dalal Street on Thursday:

- HCL Tech Q4 preview: Net profit likely to have contracted 6% sequentially

- What Anil Singhvi makes of ICICI Securities quarterly numbers

- Motilal Oswal initiates coverage on Paytm with 'buy' rating, expects co to turn profitable by 2024-25

- Mastek soars on strong Q4 results; board declares final dividend of Rs 12/share

Catch HIGHLIGHTS of all the action in the Indian share market on April 20, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Share Market HIGHLIGHTS: Indian equity benchmarks Nifty 50 and Sensex ended barely in the green on Thursday, but managed to halt a three-day losing streak, amid mixed moves across global markets as investors weighed optimism on a sustained pause in benchmark interest rates against mixed quarterly earnings. Among heavyweights, gains in HDFC Bank, Larsen & Toubro (L&T), Titan and Tata Motors were offset by losses in Reliance and Infosys. HCL Tech saw mild gains as investors awaited the IT major's Q4 results due later in the day.

Here's a list of headlines that were in focus on Dalal Street on Thursday:

- HCL Tech Q4 preview: Net profit likely to have contracted 6% sequentially

- What Anil Singhvi makes of ICICI Securities quarterly numbers

- Motilal Oswal initiates coverage on Paytm with 'buy' rating, expects co to turn profitable by 2024-25

- Mastek soars on strong Q4 results; board declares final dividend of Rs 12/share

Catch HIGHLIGHTS of all the action in the Indian share market on April 20, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Latest Updates

Thank you! That's all today on Zeebiz.com's stock market blog

For all other news related to business, politics, tech, sports and auto, follow us on Twitter, Facebook, LinkedIn and Instagram.

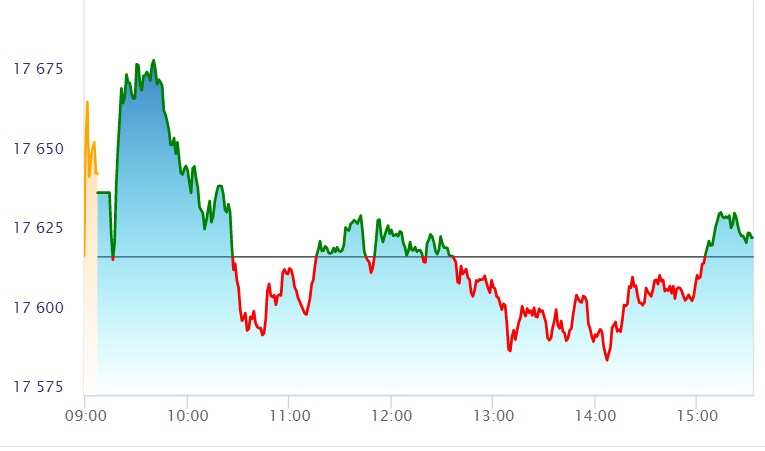

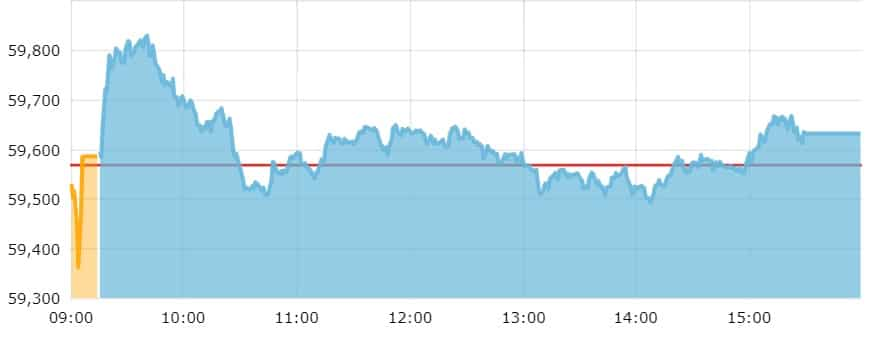

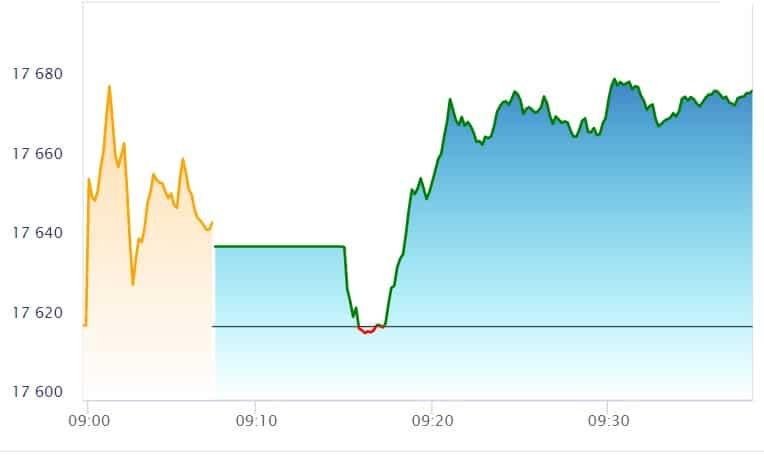

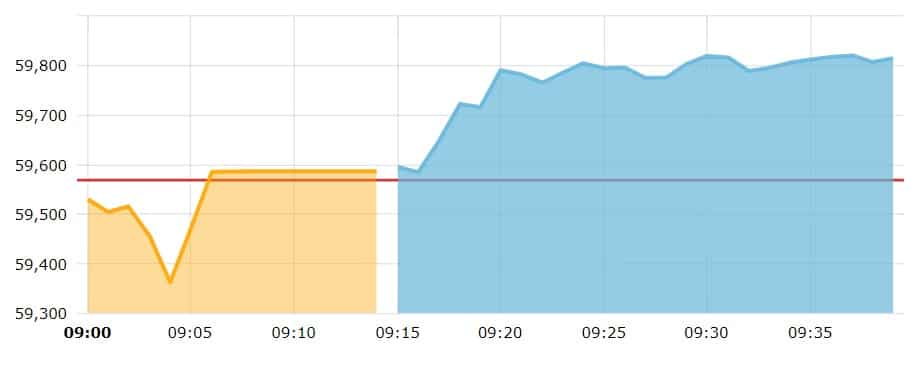

Share Market Update | Nifty 50, Sensex finish barely in the green

The Nifty 50 settles with a gain of 5.7 points at 17,624.5 and the Sensex closes at 59,632.4, up 64.6 points or 0.1 per cent for the day.

Here's how the headline indices moved through the day:

Nifty 50

Sensex

Images: NSE, BSE

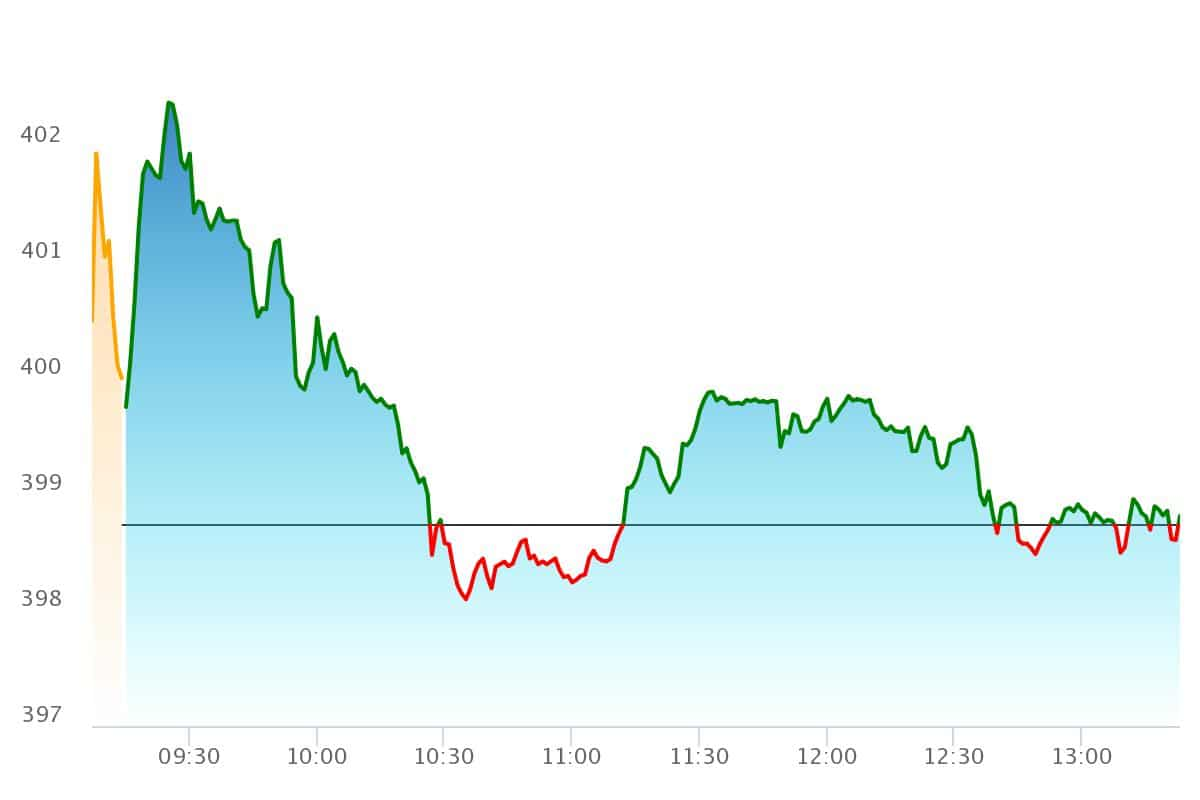

ITC hits Rs 5 trillion market cap for first time ever

ITC – cigarette-to-hotel conglomerate – has hit the market capitalisation (market cap) of Rs 5 trillion for the first time ever as the shares of FMCG major hit an all-time high of Rs 402.60 per share, after surging by a per cent on the BSE during Thursday's session.

The stock has eventually pared gains in line with the benchmark indices fall during the mid-session today. At around 01:25 PM, the counter was flat at Rs 398.70 per share, up Rs 0.30 or 0.08 per cent on the BSE.

ITC stood at eighth position in the overall market cap ranking with a market cap of Rs 5.003 trillion, according to the data from BSE today. Read More

Tata Motors shares at 8-month high

Shares Tata Motors – a Tata Group-backed cars, trucks, and buses maker – rose a per cent to touch a nearly eight-month high level of Rs 475 per share on the BSE during Thursday's session.

The surge in the stock can be attributed to the announcement of the auto company’s UK-based subsidiary Jaguar Land Rover's investment plan in the electric vehicle segment. Read More

The counter is a mere Rs 20 or 4 per cent away from its 52-week high of Rs 494.5 per share, touched on August 17, 2022.

Key Top Gainers, Losers Today

Amid a flat market today, stocks such as Tata Communication, Mastek, NMDC Steel, Sula Vineyards, and Indigo Paints among others are buzzing amid mid and small-cap segments.

While ICICI Securities shares after weak March quarter results are in the red along with Alok Industries and Divi’s Lab during Thursday's trading session.

आज बाजार में कौनसे शेयर रहे अभी तक Top Gainers & Losers? पढ़िए यहां #TopStocks #StockMarket #Nifty #Sensex pic.twitter.com/IaaTD3esZS

— Zee Business (@ZeeBusiness) April 20, 2023

Mastek, Indigo Paints, Shoppers Stop rise most among 280-odd gainers in BSE 500 universe

On the other hand, Alok Industries, Brightcom Group and Gland Pharma are the top laggards.

Here's a look at the stocks moving the most in the broadest gauge on the bourse:

Image: BSE

Share Market Tips LIVE | Aurobindo Pharma, Indian Oil, Castrol India, Polycab among analysts' recommendations

In conversation with Zee Business Managing Editor Anil Singhvi, top analysts share their intraday recommendations in this special segment, Pick of the Day.

- Vikas Sethi recommends buying Aurobindo Pharma shares for a target of Rs 605 with a stop loss at Rs 580

- Rakesh Bansal suggests buying IOC for a target of Rs 81 with a stop loss at Rs 77.5

- Sumeet Bagadia of Choice Broking recommends buying Polycab India shares for targets of Rs 3,200 and Rs 3,225 with a stop loss at Rs 3,080

Check out the full list of 'Pick of the Day' recommendations

How Motilal Oswal views Paytm

Here are some highlights of what Motilal Oswal Financial Services makes of Paytm:

- Two-pronged strategy to drive profitability for Paytm

- Paytm estimated to achieve overall EBITDA break-even by FY25

- Value stock at Rs 865 based on 18x times the EV-EBITDA ratio estimate for FY28 and discounting it to FY25

- Digital payments new face of commerce

- Total payments industry forecasted to double to $16 trillion by 2026

- Digital payments expected to surge three-fold to $10 trillion by 2026 from $3 trillion in 2021; mobile payments projected to grow even faster at five-fold to $3 trillion by 2026

- Paytm payment business posting healthy growth; revenue CAGR estimated at 21 per cent

- Paytm has reported healthy traction in growing its gross merchandise value (GMV) at 55 per cent CAGR over FY19-23

- Paytm GMV clocked 81 per cent CAGR over FY21-23

- Paytm payment revenue to clock healthy CAGR of 21 per cent over FY23-25

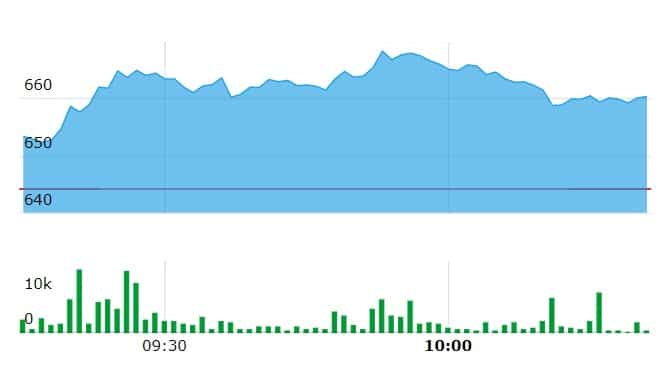

Share Market Today LIVE | Paytm shares hold on firmly to the green after Motilal Oswal initiates coverage with Rs 865 target

Paytm parent One097 Communications' shares rise by as much as Rs 24.7 or 3.8 per cent to Rs 669 apiece on BSE, after Motilal Oswal Financial Services initiates coverage on the digital payments firm with a target price of Rs 865.

Image: BSE

The brokerage estimates the company's EBITDA to break even by the year ending March 2025. It sees Paytm turning profitable by the year ending March 2025.

ITC Share Price | How brokerages rate the cigarette maker

| Brokerage | Rating | Target price |

| CLSA | Outperform | Raised by Rs 15 to Rs 430 |

| HSBC | Hold | Rs 400 |

According to CLSA, treating catalysts appear to be playing out in ITC shares as investors await corporate action. For instance, a demerger of the company's hotels business will be an important thing to watch out for, according to the brokerage.

A dividend yield of four per cent also provides support, says CLSA, which has raised its earnings estimates for ITC for the two financial years ending March 2025 by 2-4 per cent.

ITC shares @ all-time high

The stock of cigarettes-to-hotels conglomerate climbs to a record high of Rs 402.6 apiece on BSE, having risen as much as 1.1 per cent to its previous close. ITC shares have scaled a series of unprecedented levels over the past few sessions.

Share Market Today LIVE | Titan, Larsen & Toubro among top blue-chip gainers; Divi's Labs, Eicher Motors top laggards

Top Nifty 50 gainers

|

Stock

|

CMP | Change (%) |

| Adani Ports (ADANIPORTS) | 670.5 | 1.8 |

| TITAN | 2,602.7 | 1.3 |

| Larsen & Toubro (LT) | 2,243.1 | 1.1 |

| POWERGRID | 232.2 | 1 |

| Bharat Petroleum Corp (BPCL) | 344.5 | 0.7 |

Top Nifty 50 losers

|

Stock

|

CMP | Change (%) |

| Divi's Labs (DIVISLAB) | 3,235 | -3.2 |

| Eicher Motors (EICHERMOT) | 3,250.1 | -1.2 |

| Apollo Hospitals (APOLLOHOSP) | 4,274.7 | -1.1 |

| Dr Reddy's Labs (DRREDDY) | 4,875 | -0.7 |

| Nestle India (NESTLEIND) | 20,519.7 | -0.5 |

Share Market Today LIVE | Nifty 50, Sensex push higher after a listless start; ICICI Bank, HDFC Bank, L&T, ITC, TCS top movers

Both headline indices gain around half a per cent in early deals after a flat start. The Sensex adds 269 points to touch 59,836.8 at the strongest level within the first few minutes of the session. The Nifty 50 rises to as high as 17,684.5, up 65.7 points from its previous close.

Nifty 50 LIVE

Image: NSE

Sensex LIVE

Image: BSE