KFintech IPO review by Anil Singhvi: Subscribe or Avoid? Check recommendation

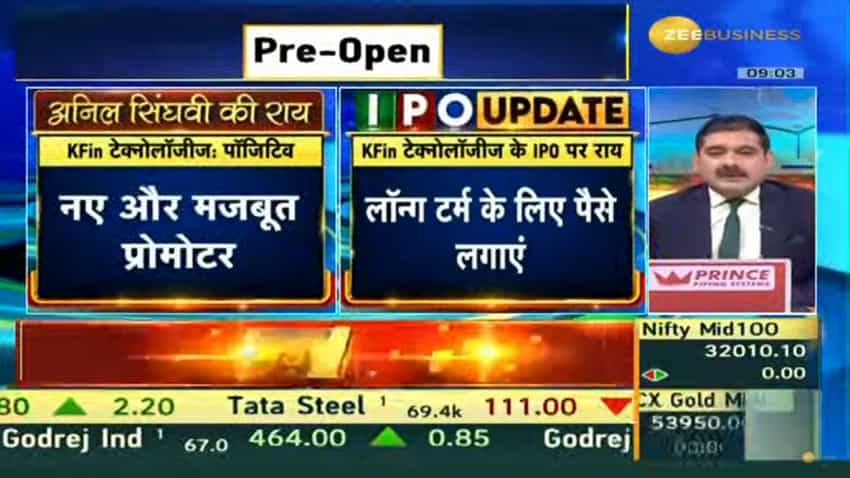

KFin Tech IPO Review By Anil Singhvi: Zee Business Managing Editor Anil Singhvi has recommended subscribing to the public issue for long term.

KFin Tech IPO Review By Anil Singhvi: The Initial Public Offering (IPO) of KFin Technologies today, December 19, opened for subscription. The subscription window will close on December 21.

Zee Business Managing Editor Anil Singhvi has recommended subscribing to the public issue for long term. He said that the company is good for investment perspective. He said that once can buy shares even after the listing.

Singhvi said that the company so far has received good anchor booking. He said that the company has 40 per cent market share and has an advantage of leadership in the industry.

Singhvi said that the mutual fund’s company has a strong growth outlook as there are new avenues that are opening up in this segment. The financials are strong and profit booking is good.

Click here to get more updates on Stock Market I Zee Business Live

Singhvi said that the revenue growth is strong and ratios are also looking good.

Mentioning the pros, he said that promoter General Atlantic is new but strong. On the flipside, Singhvi said that the promoter Karvy Group is under scrutiny for money laundering which can be a risk affair.

Singhvi said that the management of KFin Technologies has ensured that the Karvy group doesn’t have any prominent hold on the company and KFin Technologies will not take any responsibility of whatever the outcome comes out of the case.

Singhvi said that the management has said that Karvy Group has only around 14 per cent stake in the company.

According to Singhvi, valuations are reasonable but could have been more attractive.

KFin Technologies IPO Details

The IPO is worth Rs 1,500 crores and the issue price of KFin Technologies IPO is set at Rs 347-366. The company has already raised Rs 675 crore from anchor investors ahead of the IPO.

Retail investors can buy a lot of 40 shares worth Rs 14,640. Maximum 13 lots can be bought worth Rs 1,90,320. Minimum lot for High Net Worth Individual (HNI) is 14, worth Rs 2,04,960. A maximum of 69 lots can be bought by HNI, worth Rs10,10,160.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

11:17 AM IST

Deepak Builders & Engineers IPO: Check subscription dates, price range and other details

Deepak Builders & Engineers IPO: Check subscription dates, price range and other details  CDSL, BSE, CAMS, KFin Technologies and other broking stocks gain up to 2%; here’s why

CDSL, BSE, CAMS, KFin Technologies and other broking stocks gain up to 2%; here’s why This financial services stock doubles investors' wealth in less than 1.5 years

This financial services stock doubles investors' wealth in less than 1.5 years KFin Technologies slides over 6.50% amid reports of block deal

KFin Technologies slides over 6.50% amid reports of block deal D-Street Newsmakers: KFin Tech, Genus Power, other stocks that hogged limelight on Friday

D-Street Newsmakers: KFin Tech, Genus Power, other stocks that hogged limelight on Friday