Facebook parent company Meta's stock tanks over 20% as Q3 numbers spook investors

If Meta's after-hours stock rout is matched in Thursday's trading session, it will have been its deepest one-day loss since Feb. 2, when the company last issued a dismal forecast.

Facebook parent Meta Platforms Inc on Wednesday forecast a weak holiday quarter and significantly more costs next year, sending shares down nearly 20% as investors voiced skepticism about the company's pricey metaverse bets.

The forecast knocked about $67 billion off Meta's stock market value in extended trade, adding to the more than half a trillion dollars in value already lost this year.

If Meta's after-hours stock rout is matched in Thursday's trading session, it will have been its deepest one-day loss since Feb. 2, when the company last issued a dismal forecast.

The disappointing outlook comes as Meta is contending with slowing global economic growth, competition from TikTok, privacy changes from Apple, concerns about massive spending on the metaverse and the ever-present threat of regulation.

Executives announced plans to consolidate offices and said Meta would keep headcount flat through the end of 2023.

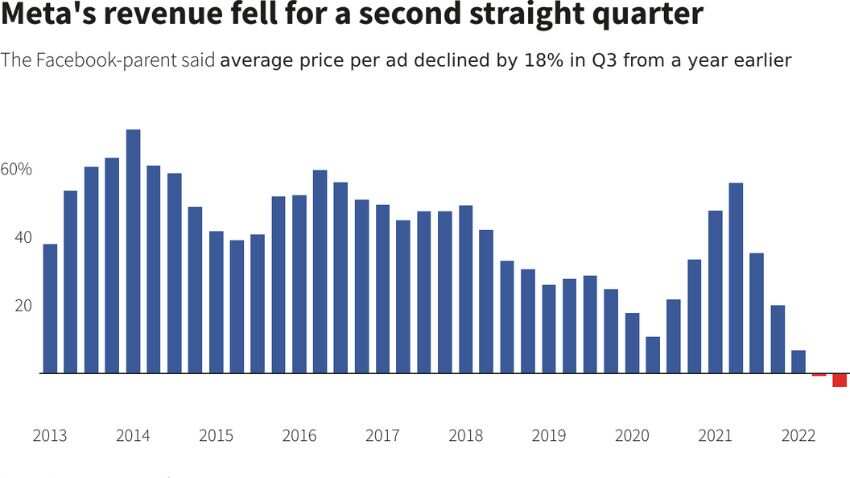

Revenue fell 4% in the third quarter ended Sept. 30. That deepened a revenue decline begun the previous quarter, when the company posted a first-ever revenue drop of 0.9%, although it was less steep than the 5.6% decline Wall Street had expected, according to IBES data from Refinitiv.

More troubling was the company's estimate that fourth-quarter revenue would be in the range of $30 billion to $32.5 billion, mostly under analysts' estimates of $32.2 billion, according to the Refinitiv data.

Meta also forecast that its full-year 2023 total expenses would be $96 billion to $101 billion, significantly higher than a revised estimate for 2022 total expenses of $85 billion to $87 billion.

That includes an estimated $2.9 billion in charges over the course of both 2022 and 2023 from the office downsizing.

It also forecast that operating losses associated with the Reality Labs unit responsible for its metaverse investments would grow in 2023 and pledged to "pace" investments after that.

Total costs for the third quarter came in above estimates at $22.1 billion, compared with $18.6 billion the year prior.

Meta is carrying out several overhauls of its apps and ads products to keep its core business pumping out profits, while also investing $10 billion a year in a bet on metaverse hardware and software.

Chief Executive Mark Zuckerberg has said he expects the metaverse investments to take about a decade to bear fruit. In the meantime, he has had to freeze hiring, shutter projects and reorganize teams to trim costs.

An analyst on the investor call told Zuckerberg investors were worried that the company had taken on "just too many experimental bets" and asked the chief executive why he believed his gambles would pay off.

Meta executives defended the spending, saying most of the company's expenses were still going toward the core business, including investments in more expensive AI-related servers, infrastructure and data centers.

Zuckerberg added that he expected the metaverse work to provide returns over time.

"I appreciate the patience," he said. "And I think that those who are patient and invest with us will end up being rewarded."

Zuckerberg said plays of Meta's TikTok-like short-video product Reels now number more than 140 billion across Facebook and Instagram each day, up 50% from six months ago, and its revenue run rates are now $3 billion annually.

He believes Reels is gaining against rival TikTok, he added, with Reels being reshared more than 1 billion times a day.

Meta also posted user growth figures roughly in line with expectations, including a year-over-year increase of monthly active users on flagship app Facebook.

"The worry for Meta is that this pain is likely to continue into 2023 as cost headwinds remain a real challenge and the strong dollar impacts on overseas earnings," said Ben Barringer, equity research analyst at Quilter Cheviot.

"Given revenues were down at a time when costs have grown significantly, modest user growth and impressions simply isn't going to bail you out."

Net income in the third quarter fell to $4.40 billion, or $1.64 per share, from $9.19 billion, or $3.22 per share, a year earlier, its worst showing since 2019 and the fourth straight quarter of profit decline.

Analysts had expected a profit of $1.86 per share.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

09:39 AM IST

WhatsApp Voice Message Transcripts: Here's how this feature works - Check details

WhatsApp Voice Message Transcripts: Here's how this feature works - Check details  Tired of redundant recommendations on feeds? Instagram to introduce ‘manual reset’ feature - Check Details

Tired of redundant recommendations on feeds? Instagram to introduce ‘manual reset’ feature - Check Details Meta slapped with $102 million privacy-related penalty

Meta slapped with $102 million privacy-related penalty Create your own AI version: Instagram to allow users customize AI character – Check details

Create your own AI version: Instagram to allow users customize AI character – Check details EU accuses Facebook owner Meta of breaking digital rules with paid ad-free option

EU accuses Facebook owner Meta of breaking digital rules with paid ad-free option