Buy, Sell or Hold: Zomato slides over 4%; down over 10% in 7 sessions

Technical Analyst Nilesh Jain has recommended a sell strategy on this stock on rise. He said that the current chart structure does not indicate a decisive movement trend

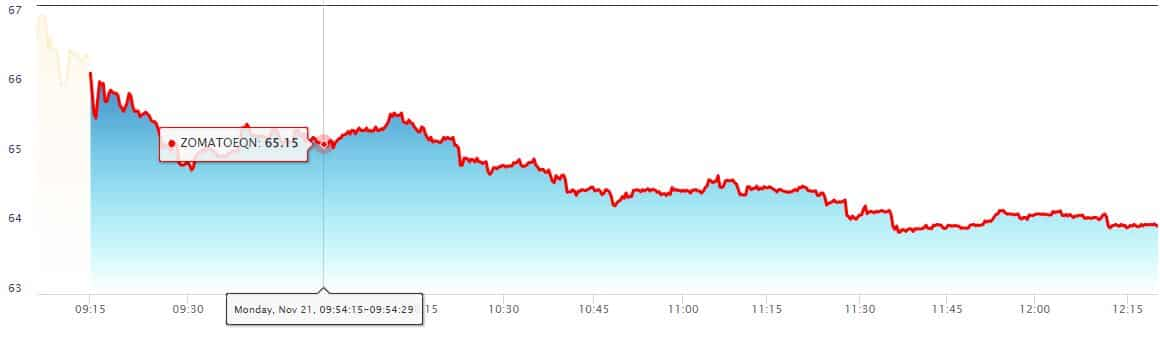

Declines in Zomato shares continued on Monday as the stock fell over 4 per cent in the intraday trade. The counter has lost nearly 11 per cent over 7 trading sessions. The stock reacted adversely to the news of its co-founder Mohit Gupta stepping down from the company. Sentiment around the stock of the food-delivery platform also turned weak amid reports of 3 per cent lay-off. Around 3800 employees are likely to lose their jobs.

Gupta stepped down on 18 November, Friday.

Technical Analyst Nilesh Jain has recommended a sell strategy on this stock on rise. He said that the current chart structure does not indicate a decisive movement trend.

Jain, who is Vice President (VP), Commodity and Currency Research at IIFL Securities said that a further downside will open till levels of Rs 58 if the stock slips below Rs 63 on a closing basis. He suggested investors is to exit their positions on pullbacks between Rs 70 and Rs 75.

At 11:30 AM, the stock was trading at Rs 64.80 on the NSE.

Brokerages Mixed on Zomato

Top brokerages have also given their recommendations on this stock. While Jefferies has remained bullish, estimating an upside of nearly 60 per cent or target of Rs 100, Macquarie has maintained a ‘Neutral’ rating with a price target of Rs 60. Morgan Stanley has given an ‘Overweight’ rating with a target of Rs 92.

The lay-off in Zomato is not a lone wolf case. Tech companies globally including Meta, Amazon and Twitter have announced to cut jobs.

Gupta’s resignation comes nearly four and half years after him remaining at the helm. He will be associated with the company as an investor. Gupta’s departure comes on the heels of two top levels resignations, weeks earlier.

Earlier, Rahul Ganju, Head of New Initiative and Siddharth Jhawar vice president of global growth put-in their papers.

The company has claimed that it will soon breakeven and turn profitable. In the quarter ended 30 September the company posted net loss of Rs 251 crore narrowing it from Rs 430 crore the company reported a year back.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Top 7 Large and Mid Cap Mutual Funds With up to 21% SIP Returns in 10 Years: Rs 11,111 monthly SIP investment in No. 1 fund has sprung to Rs 40,45,114; know about others

12:43 PM IST

Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Dmart most-valuable India co founded by self-made entrepreneur post-2000; Zomato, Swiggy next: Hurun

Dmart most-valuable India co founded by self-made entrepreneur post-2000; Zomato, Swiggy next: Hurun  Food delivery economy crucial as it generates large-scale employment: Nitin Gadkari

Food delivery economy crucial as it generates large-scale employment: Nitin Gadkari Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Amazon’s Bengaluru Blitz: 15-minute delivery shakes up QC; Swiggy, Zomato fall up to 4%

Amazon’s Bengaluru Blitz: 15-minute delivery shakes up QC; Swiggy, Zomato fall up to 4%